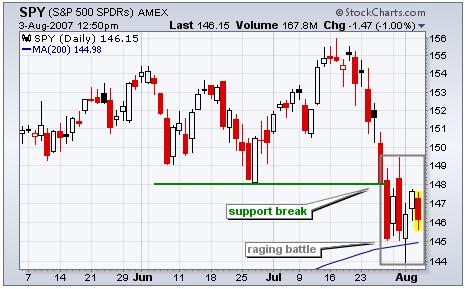

The S&P 500 ETF (SPY) firmed this week and found some support. The ETF hit support from the 40-week moving average and broken resistance. The 40-week moving average is equivalent to the 200-day moving average and this level is important to the long-term trend. Resistance stems from the February high and SPY broke this level in April. Securities often return to the their breakouts and this marks an important test as well.

A bull-bear battle raged this week as SPY shot up to 149.5 on Tuesday and fell back to 144 intraday on Wednesday. That is about a 3.5% swing high-low swing in two days. The bulls are trying to hold support and the ETF has basically consolidated this week. The boundaries of this consolidation hold the key to the next move. A break above 149.5 would be positive and revive the bulls. Conversely, a break below 144 would signal a continuation lower and decisively break support.