Last week saw stocks sell off rather sharply for several days, of which the catalyst was the sharp rise in bond yields as inflation and too strong growth concerns too center stage. Since bond yields are now the tail wagging the stock market dog – we think it imperative to understand perhaps where bond yields are headed given stocks are now showing a highly inverse correlation with bond yields. If bond yields are headed higher; then ostensibly stock prices are headed lower.

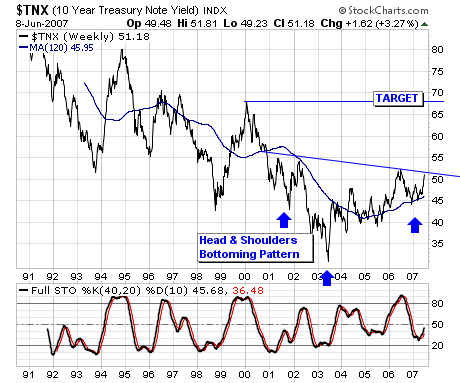

The market's focus is upon the 10-year note yield; it is clear bond yields are in a bull market given the bottom forged in 2003, with a subsequent series of higher lows and higher highs. Also, we must point out that the 120-week moving average tends to illustrate the trend rather well, and further provides support to declines. Our concern, and it should also be our clients concern – is that a technical "head & shoulders bottoming pattern" is forming, of which a breakout above 5.25% would break neckline support and lead to still higher yields... perhaps sharply higher yields towards those extant in early-2000 at 6.75%.

Market participants aren't mentally prepared for this circumstance. Can you think what the world would look like if 10-year notes were at 6.75%? What the stock market would look like? What would have to happen for this to occur? Most – including us have been conditioned on a low interest rate environment after the technology bubble burst, as well as the sub-prime implosion. We and others looked for lower interest rates; not higher interest rates. We were wrong headed; now we must contend with a world with greater risks and lower levels of liquidity... and perhaps sharply lower stock prices after a 5-year bonanza.