ChartWatchers March 17, 2007 at 10:05 PM

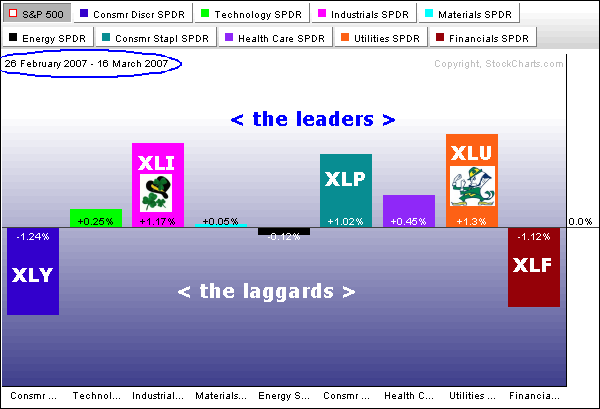

The sector rotations since 26-Feb reflect a defensive and nervous market. Things started changing on Wall Street with the sharp decline on 27-Feb and the PerfChart below shows sector performance since this decline... Read More

ChartWatchers March 17, 2007 at 10:04 PM

One of my colleagues has been harassing me (in a friendly way) for not yet having declared myself a bear. The truth is that top picking is a treacherous business, and I have given it up in favor of letting trend models make my declarations for me... Read More

ChartWatchers March 17, 2007 at 10:03 PM

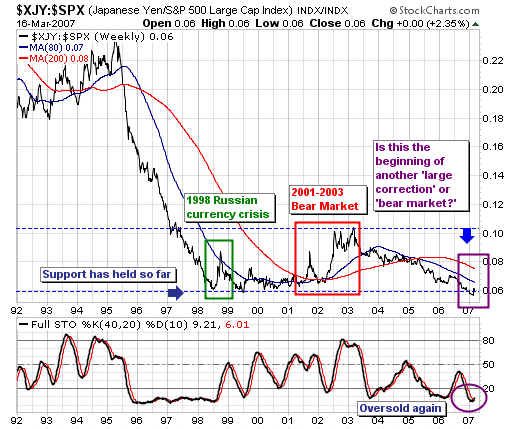

The recent focus of the equity markets is upon the "sub-prime" mortgage problem; and upon the "yen-carry trade". We think both are valid concerns; however, the question of the "yen-carry trade" is more important in our mind than the "sub-prime implosion... Read More

ChartWatchers March 17, 2007 at 10:01 PM

It's no secret that one of the main problems pulling the market down over the last month has been the fallout from subprime mortages... Read More

ChartWatchers March 17, 2007 at 10:00 PM

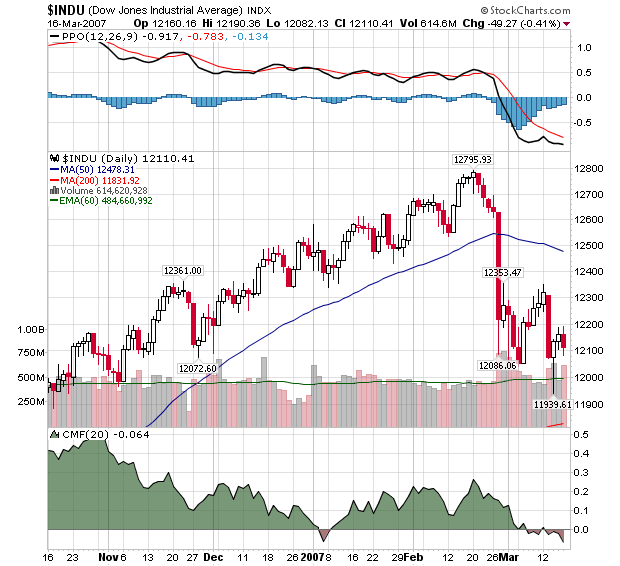

Hello Fellow Chartwatchers! Last week's recovery rally was crushed by Tuesday's big decline and while the Dow quickly rose back above 12,000, the technical damage was done. The chart below shows the important technical developments for the Dow in recent days... Read More

ChartWatchers March 04, 2007 at 11:06 PM

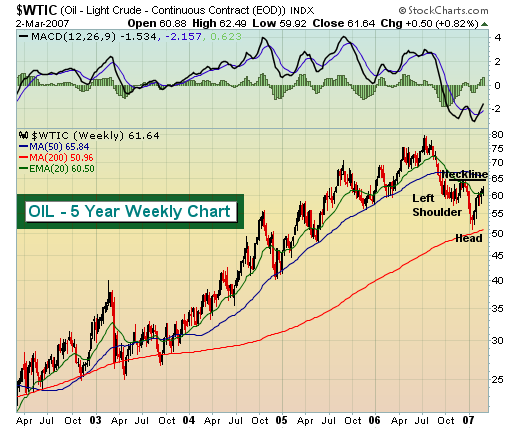

We have been in the bearish camp on energy and over the past several months and for now remain on the bearish side. But anytime you take a position on the bullish or bearish side, you need to realize patterns that could change your view... Read More

ChartWatchers March 04, 2007 at 11:05 PM

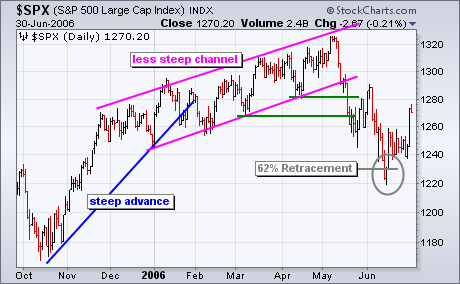

The current breakdown in the S&P 500 looks quite similar to the May-June 2006 breakdown. Let's look at the May-June 2006 break down first. The S&P 500 surged from mid October to mid December (2005) and then began a slower zigzag higher until early May (2006)... Read More

ChartWatchers March 04, 2007 at 11:04 PM

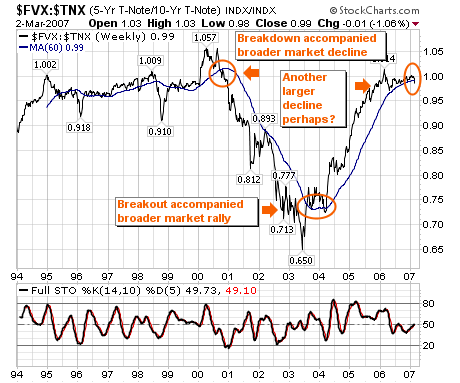

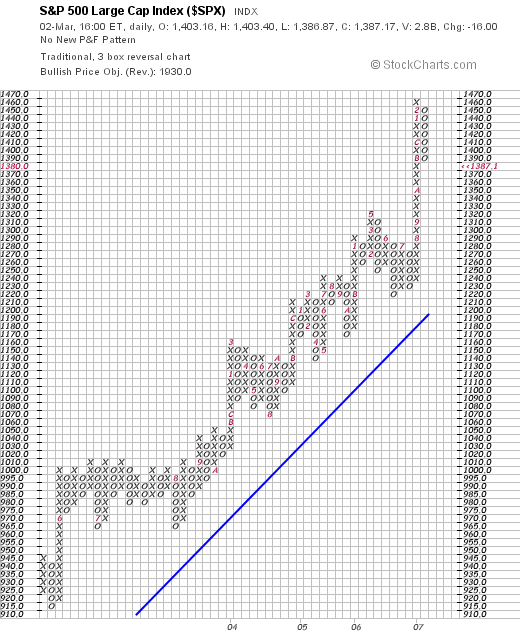

In light of this week's sharp decline (mini-crash?), the most obvious subject for discussion in this week's article is to question whether or not we are on the verge of another major crash. In my 12/8/2006 article, Crash Talk Is Premature, I stated: ". . ... Read More

ChartWatchers March 04, 2007 at 11:03 PM

Last week's market decline was quite interesting from a number of perspectives. First, the decline clearly mirrors the movement in Japanese Yen as the "carry-trade" is unwound; if one watches these closely, one will see that stock traders are cleary focused on the yen... Read More

ChartWatchers March 04, 2007 at 11:01 PM

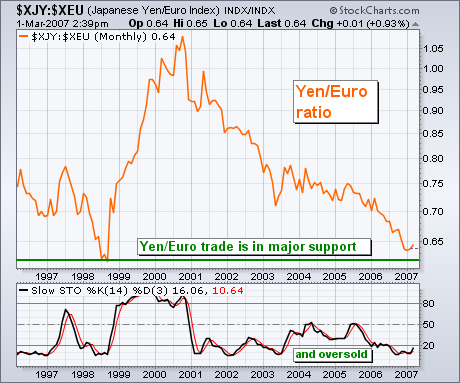

Our main concern here is the relationship between the world's strongest currencies and the Japanese yen. Since 2000, the world's strongest currency has been the Euro (followed by the Swiss Franc, Canadian and Aussie Dollars, and the British Pound... Read More

ChartWatchers March 04, 2007 at 11:00 PM

Hello Fellow Chartwatchers! This week's market gyrations have caused many people to stop and question the market's current position - sometimes quite emotionally... Read More