FALLING COMMODITIES HURT CANADA ... When commodity prices started to slide several months ago, I suggested that certain global stocks markets might suffer from falling raw material prices. One of them was Canada. Chart 1 shows the Toronto 300 Index (TSE) in the process of challenging its spring high. That's not too bad unless we consider that most other global markets have moved well beyond that chart barrier. The more important line on the chart is ratio of the TSE to the Dow Jones World Stock Index (solid line). Notice that the line has been falling since May. The means that the Canadian stock market has gone from a global leader to a global laggard during 2006. The line below the chart is the CRB Index which peaked in May. You can see a close correlation between the falling CRB Index and the falling relative strength line for Canada. Canada benefited from the bull market in commodities for several years. It's now being restrained by falling commodity prices.

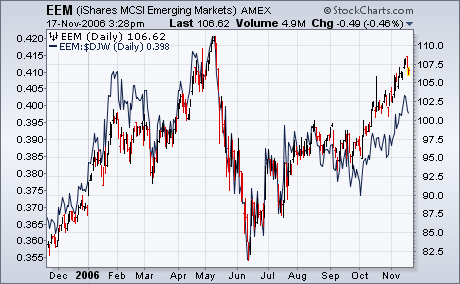

EMERGING MARKETS ARE ALSO LAGGING ... I also suggested over the summer that emerging markets might suffer from falling commodity markets. I suspect there are other forces at work including a move away from riskier assets to more established large-cap stocks in developed stock markets. Even so, emerging markets as a group have become global laggards over the last six months. Chart 2 shows the Emerging Markets Ishares (EEM) still trading below their spring peak. The solid line is a ratio of the EEM to the Dow Jones World Stock Index, and it shows global underperformance by emerging markets since May. I suspect falling commodity prices have something to do with that since many emerging markets are producers of raw materials. Global leadership appears to have shifted to Europe and Asia (ex-Japan).