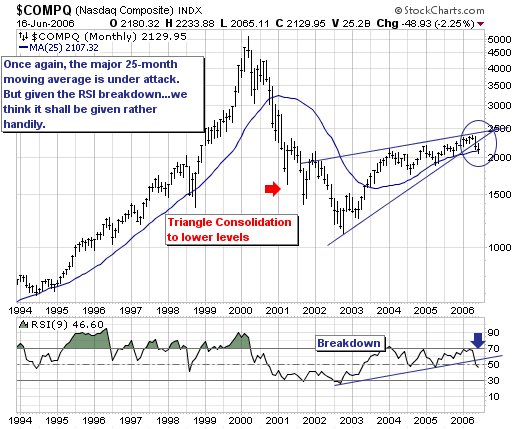

The NASDAQ Composite is now in danger embarking on an extended move lower. Quite simply, we use the 25-month month moving average to demarcate the difference between bull and bear trends; and given the Composite is trading only 22 points above this level within the context of an RSI breakdown...increases the odds that this level will indeed be violated. We don't know how to be more simple than this.

To take advantage of this decline; we are in the process of putting on short positions via semiconductor equipment-makers such as Cymer (CYMI) and Lam Research (LRCX), and also looking to put on a short position in SanDisk (SNDK) in the very near future. These issues should lead the decline; and are quite far off their representative October-2005 lows.