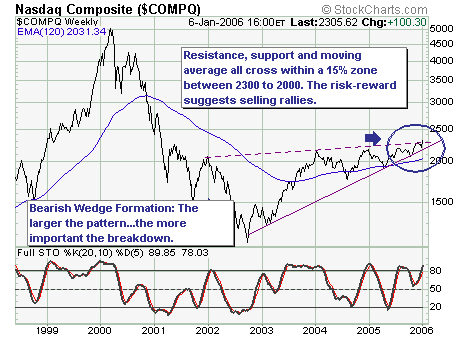

The first 4-days of US trading has shown nothing but gains; and we believe that this "euphoria" is providing an upcoming opportunity to be come short the technology sector as a whole. Allow us to explain:

Using the weekly NASDAQ Composite chart, the rally off the low has clearly traded within a well-defined bearish rising wedge pattern. In fact, it has gone further into the apex that we would have thought, which last week saw prices breakout very modestly above trendline resistance. Common technical convention notes that the further along the apex – the higher risk of "false breakouts"; we think this is just such a circumstance. Therefore, we will soon opt to begin accumulating short positions in selected technology shares such as F5 Networks (FFIV)...perhaps next week; if not...then soon.