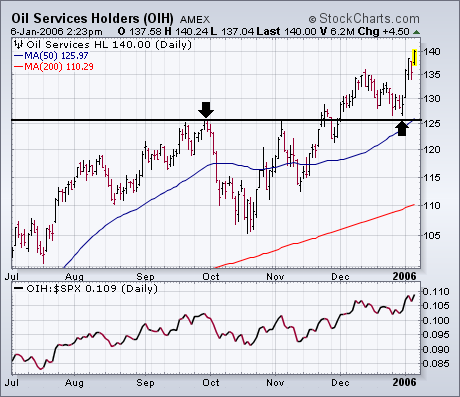

The market is starting the new year with a bang. Virtually all of the major market averages have risen to new 52-week highs. Some of that new optimism is the result of the Fed minutes released earlier in the week hinting that it might be close to ending its rate-hiking. I've expressed skepticism about the staying power of the early 2006 strength. But only time will tell if that skepticism is warranted. I've also suggested that January is traditionally the best month of the year to take some money out of the market is one is so inclined to do so. An alternative to taking money out of the market is rotating it to those market groups that are leading the market higher. It should come as no surprise that some of those early leaders are commodity-related stocks (especially gold) and foreign stocks. I've been writing about that trend for several months. I suggested earlier in the week that those same Fed minutes that sparked this week's market rally also weakened the dollar. If anything, the falling dollar has accelerated the move into commodity-related stocks and foreign markets this week. Hopefully, our readers are already aboard those moves. Energy stocks are also among early 2006 leaders as oil has climbed back over $64. Oil service stocks are the clear leaders there. Chart 1 shows the Oil Service Holders (OIH) hitting a new record on Friday. The recent pullback stopped just above its 50-day average and chart support along its late September high. That's a textbook example of what an uptrend should do. Its relative strength line is also in new high ground. Chart 2 shows the Energy Sector SPDR (XLE) nearing a challenge of its September high. It too is starting to outperform the S&P 500 again. While that may help boost the S&P over the short run, continued energy leadership is usually bad for the S&P further out in time. Early 2006 leadership is also coming from chip and internet stocks.