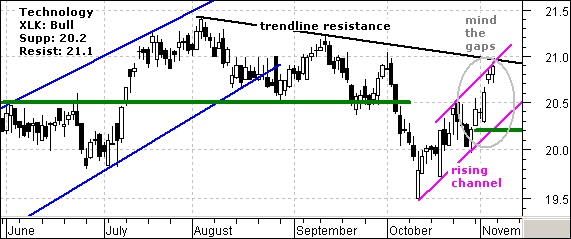

The Information Technology SPDR (XLK) broke support in early October, bottomed in mid October and surged over the last few weeks. This surge featured two gaps last week and these hold the key to recent strength. The stock gapped up on Monday and again on Thursday (gray oval). Gaps show power and both of these gaps should be considered bullish unless they are filled.

The stock is nearing resistance from the August trendline and early October high. A move above the early October high would break the August trendline and forge a higher high. This would be enough to turn the medium-term trend bullish and expect new highs over the coming months. Yes, the fabled yearend rally would be upon us.

The current advance looks like a sharp rising price channel and "rising" is the key word. The lower trendline sets the bullish tone and support from this trendline coincides with Monday's gap. Should the stock fail to break resistance, watch for a move below 20.6 to fill the second gap and signal trouble. Further weakness below the first gap (20.2) would also break the rising channel trendline and reverse the current uptrend. Such a move would target further weakness below the October low.