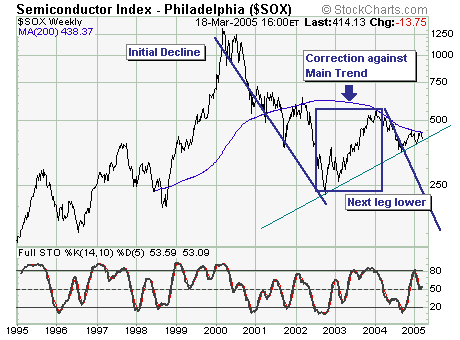

Today we expand a bit with 2 charts; with our contention that selling short the Semiconductor Index ($SOX) and several individual names has a high probability of success in the months ahead.

Looking at the $SOX, it is trading within a not yet complete' decline that began in 2000, of which the recent correction higher is complete given multiple failure' at the 200-week moving average. This absolute negative when coupled with emerging relative underperformance by the $SOX with the Nasdaq 100 ($NDX) [chart 2] indicates shares are headed lower...and for those wanting to add high beta' to their short portfolios may decide this sector warrants and overweight trading position'.

Our favorites are in the semiconductor and semi capital equipment maker industries : Xilinix (XLNX), BroadCom (BRCM), KLA Tencor (KLAC) and Novellus (NVLS).