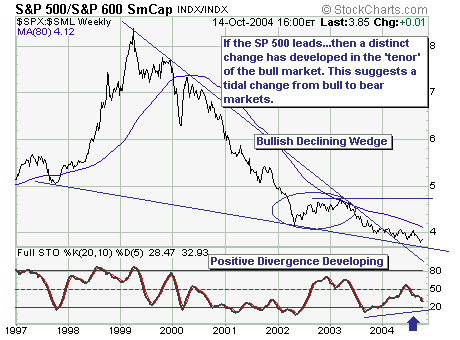

For all intents and purposes, the cyclical bull market that began in March-2003; and during the entire move to higher prices - S&P 500 Large Cap index performance 'lagged' that of the S&P 600 Small Cap index. However, the 'winds are a changin' as they say; the S&P 500/S&P 600 Ratio is showing signs of bottoming given the bullish declining wedge breakout.

If this is the case as we suspect, then subtle, but material change has taken place that will prompt the major market indices to move lower in a series of lower higher and lower lows...the definition of a downtrend.

Thus, if one is long...then one should define their risk tolerance at these levels; but if one were to be more aggressive...then short positions are warranted on all countertrend rallies.