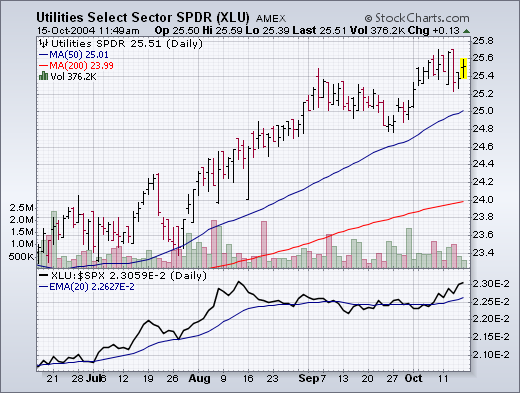

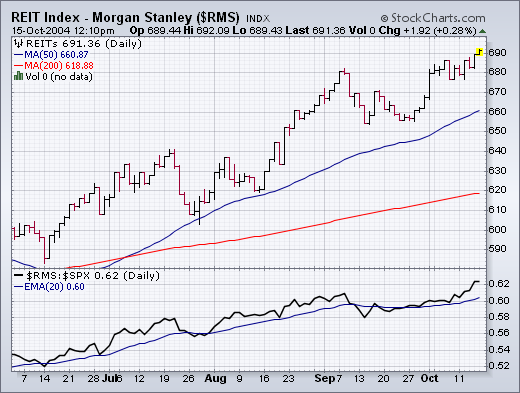

The biggest market feature of the week was the fact that Energy and Materials were the two weakest sectors. This is a reversal of recent trends. The loss of leadership by those two former leaders contributed to this week's market selling. At such times, money moving out of former leaders usually finds it's way into former laggards. We haven't seen too much of that yet. Utilities (Chart 1) and REITs (Chart 2) continue to hold up very well. That may be the result of low interest rates or, more likely, a pursuit of dividend-paying stocks. That may also explain why value stocks have done better than growth stocks. Two groups that usually attract money in this environment are consumer stocks -- either staples or retailers. Although neither group has created much excitement, there are some stocks in each group that are showing good chart action. Yesterday, I showed McDonalds hitting a new six-month high. Here are a few others.