The TIP/TLT price relative serves as a good proxy for inflationary fears or expectations. TIP is the iShares TIPS Bond (TIP), which is based on the US Treasury's inflation indexed bonds. TLT is the iShares 20+ Year Treasury Fund (TLT), which is not hedged against inflation.

Bonds loathe inflation and would decline in the face of increasing inflationary expectations. The TIP/TLT price relative takes this one step further by measuring the performance of inflation-hedged bonds against non-hedged bonds. This price relative rises when inflation expectations rise and falls when inflation expectations decline.

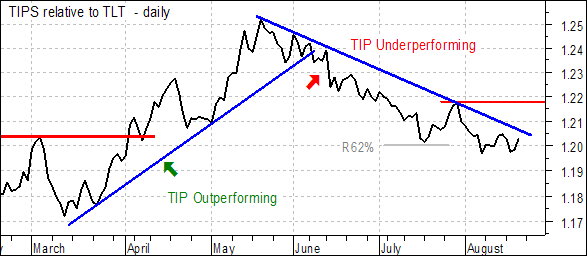

Looking at the TIP/TLT price relative for 2004, there are two distinct moves: an advance from mid March to mid May and a decline from mid May to mid August. The decline is still underway as the upper blue trendline has yet to be challenged and the price relative remains well below the late July high. As long as this downtrend continues, inflation remains at bay and bonds are unlikely to remain strong as inflation is not a concern.

Also, notice that there is a good and inverse correlation between the TIP/TLT price relative and the actual performance of TLT. When inflationary expectations rose from mid March to mid May, TLT declined from 91.48 to 80.51. When inflationary expectations subsided from mid May to mid August, TLT advanced from 80.51 to 87.