When I look across the European banking sector, the charts are disturbingly weak. After Jay Powell's presser, one of the things he mentioned was that they had six banks they were watching. He did not mention if they were US-based or international.

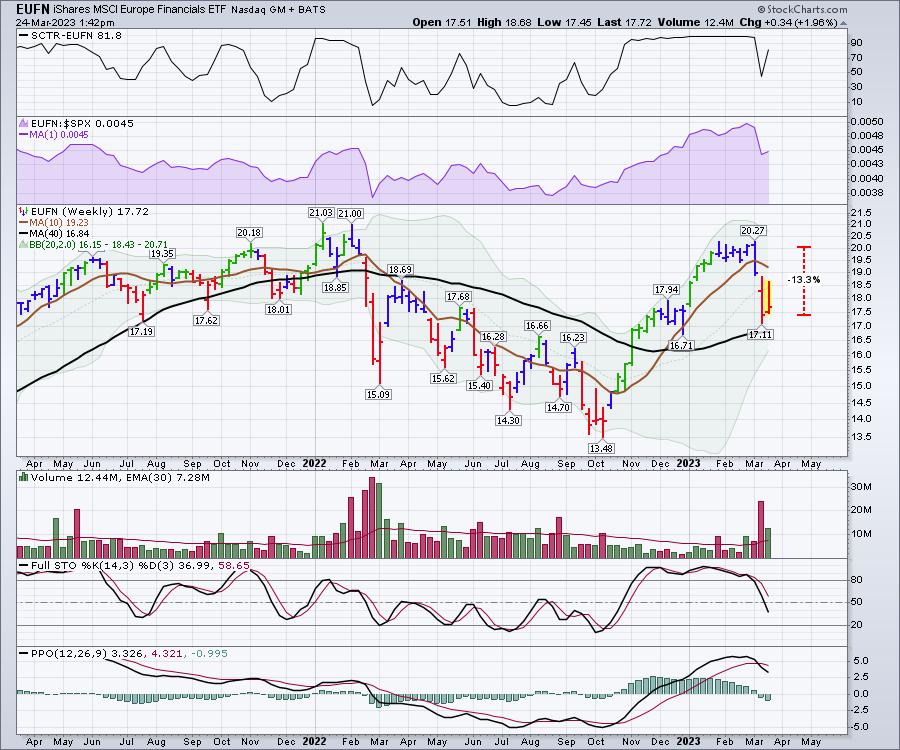

European Financials (EUFN)

When I look through this ETF, the chart is marginally damaged, but nothing that severe. The chart is down 13%.

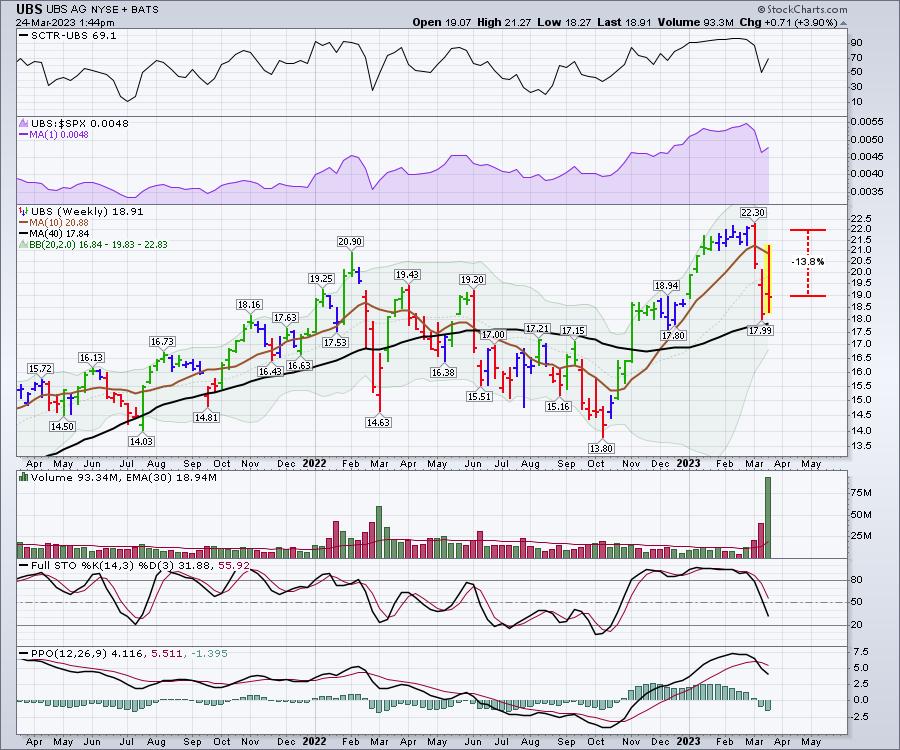

The top holding is UBS.

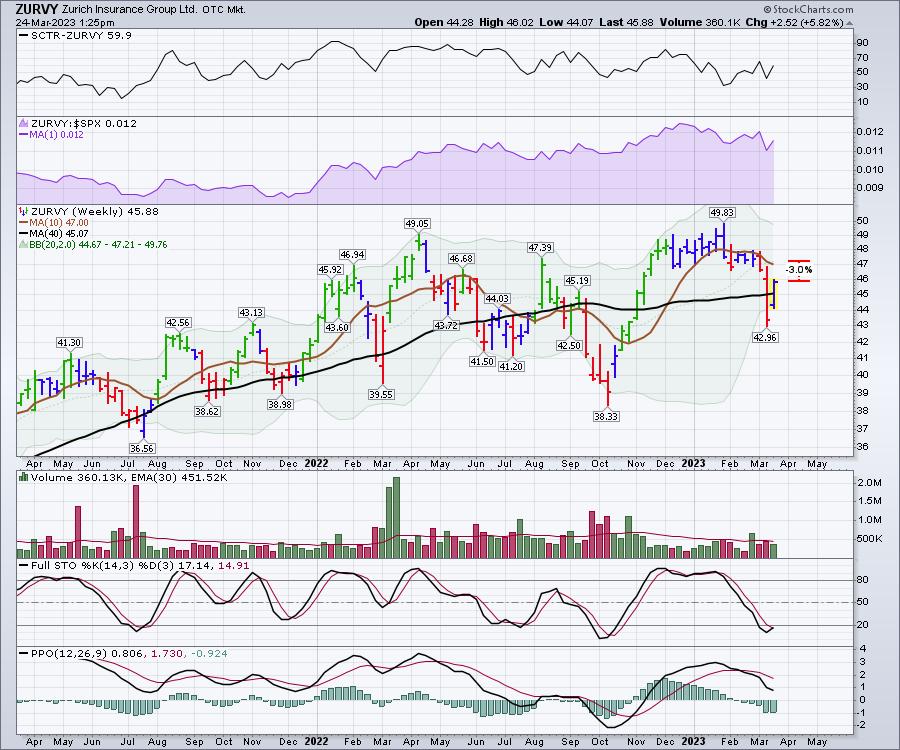

Zurich Insurance Group (ZURVY) has only dropped 4% in the last 3 weeks and is up 5.3% this week. Hardly a debacle.

Systemically Important European Financials

When I look to the names that are more systemically important, the charts are quite different.

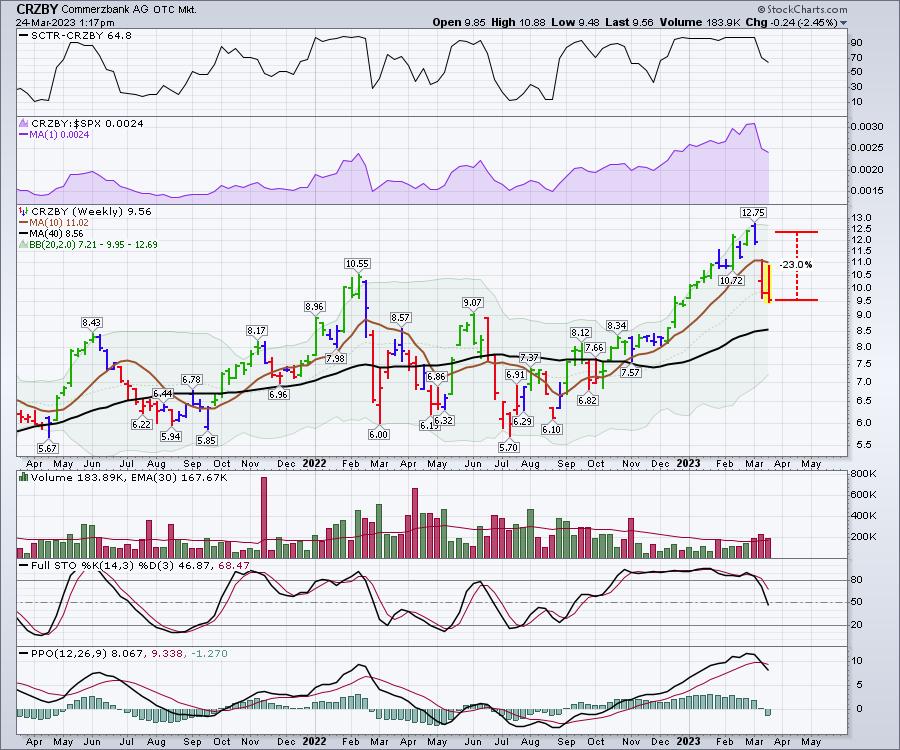

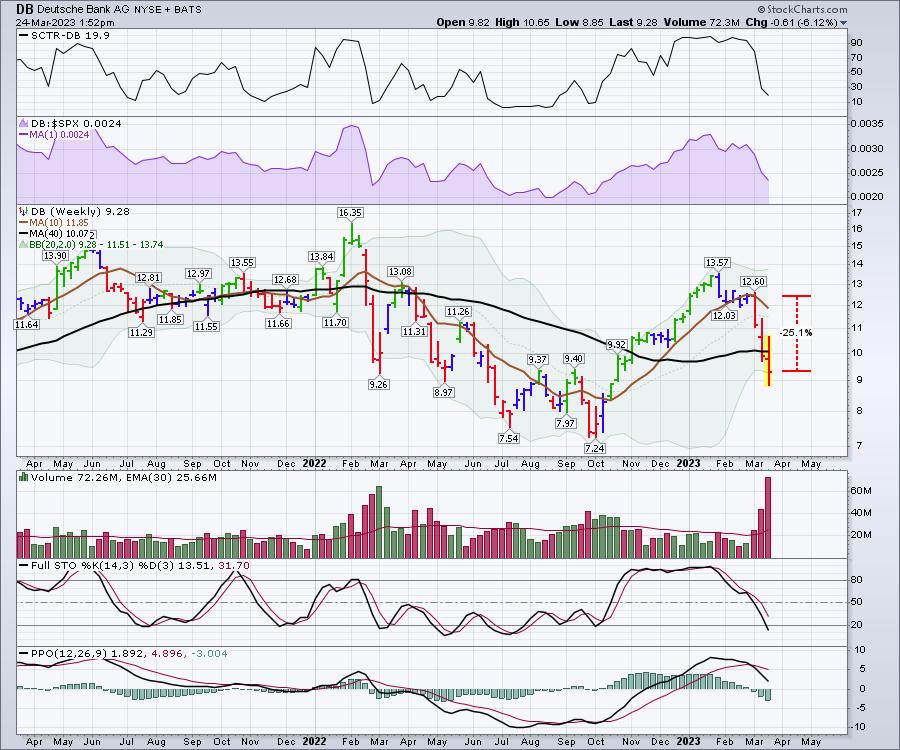

Germany has two primary banks, Deutsche Bank (DB) and Commerzbank (CRZBY). Both have been in the news.

CRZBY:

DB:

Other Systemically Important Names from around Europe

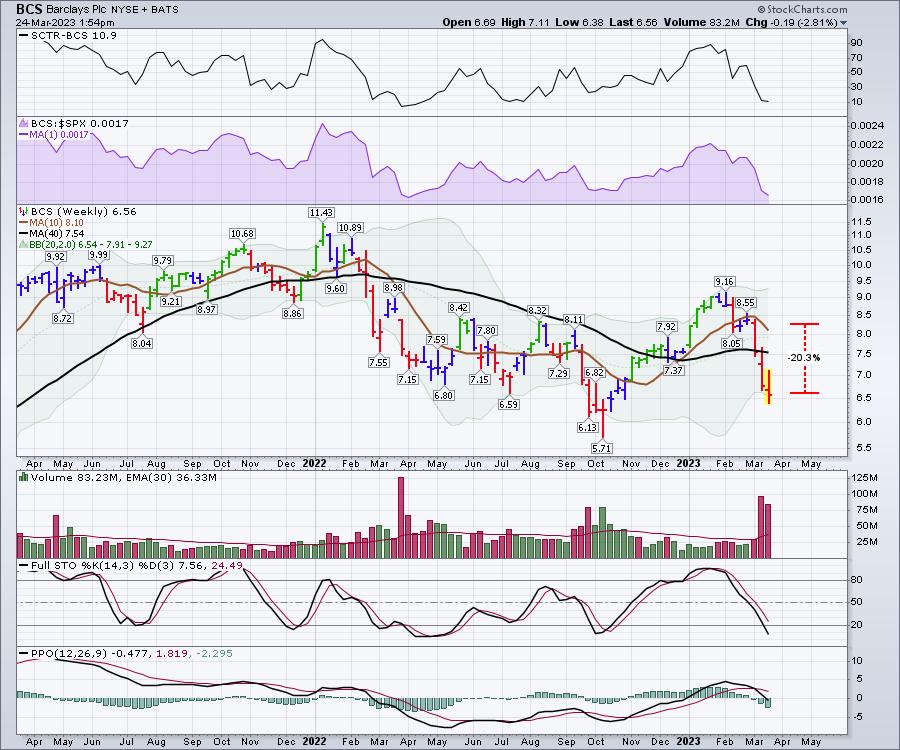

Barclay's (BCS):

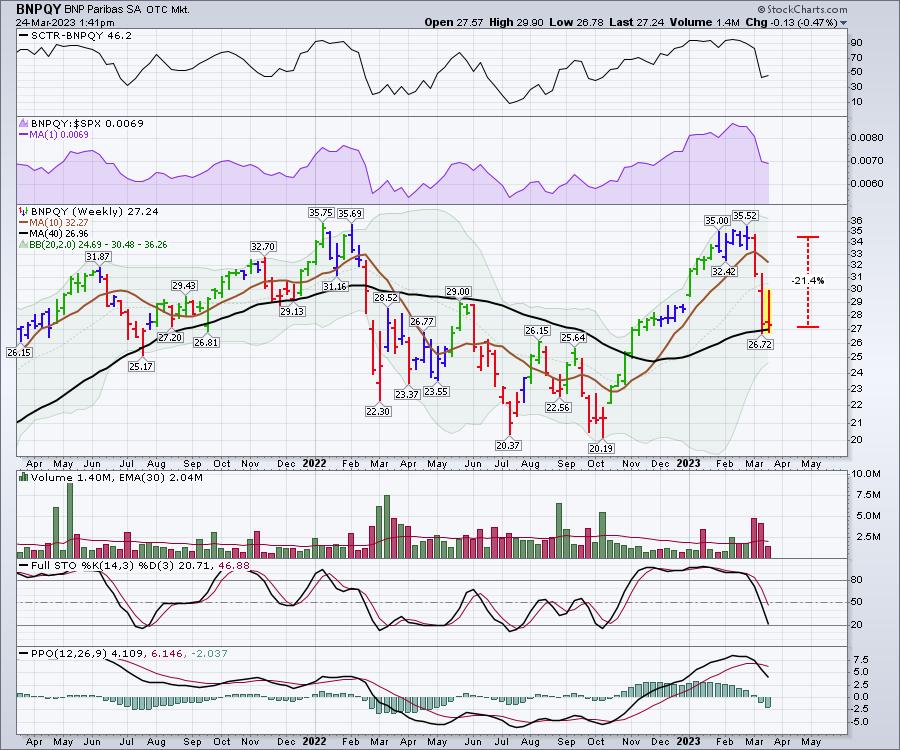

BNP Paribas (BNPQY):

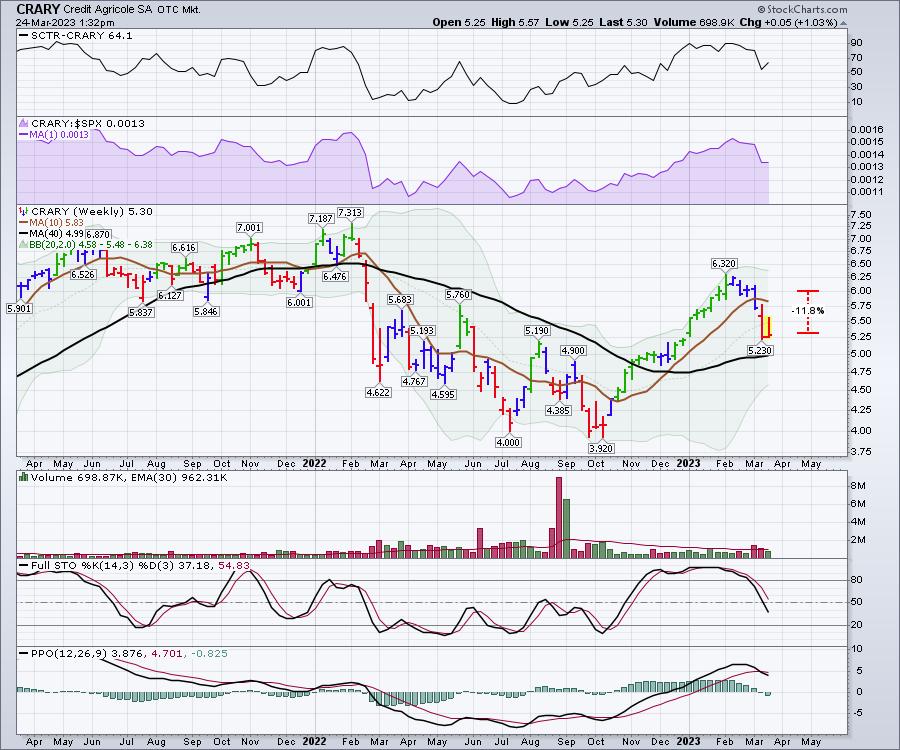

Credit Agricole (CRARY):

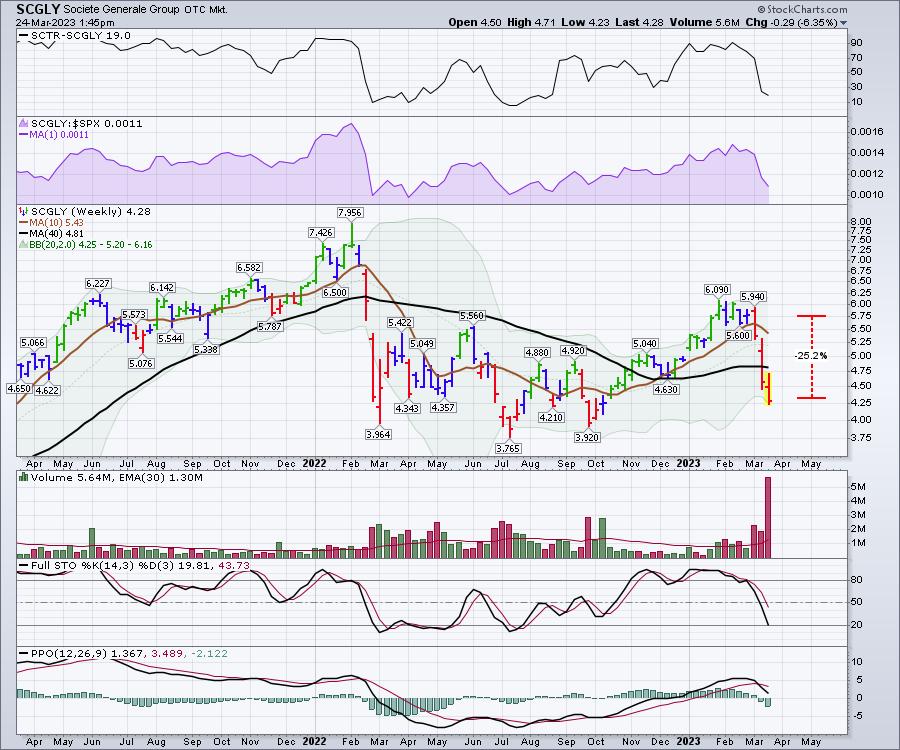

Societe Generale (SCGLY):

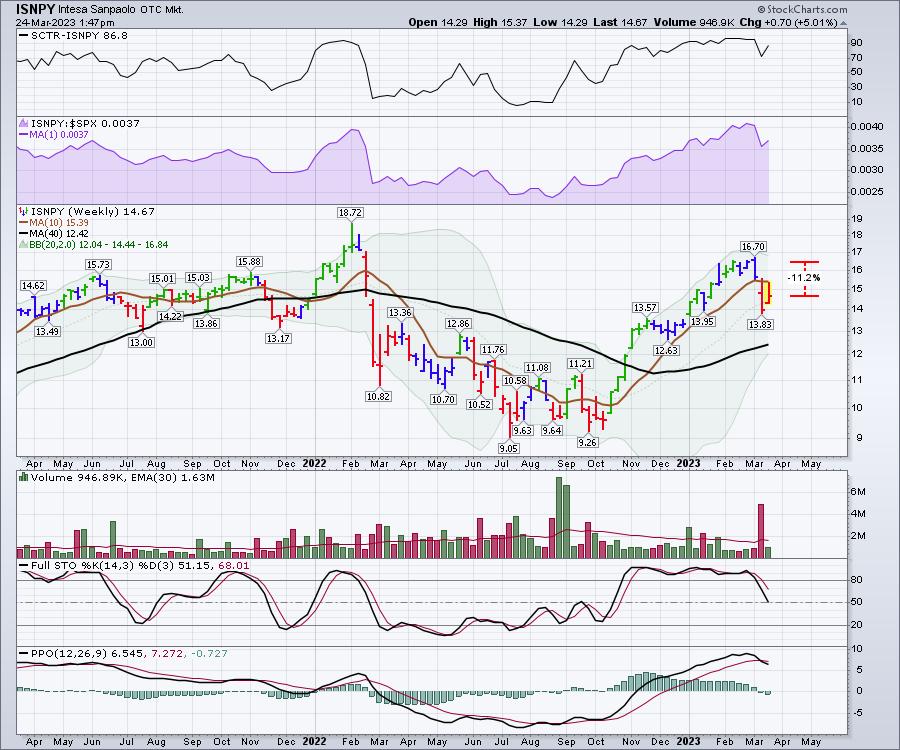

Intesa SanPaolo (ISNPY):

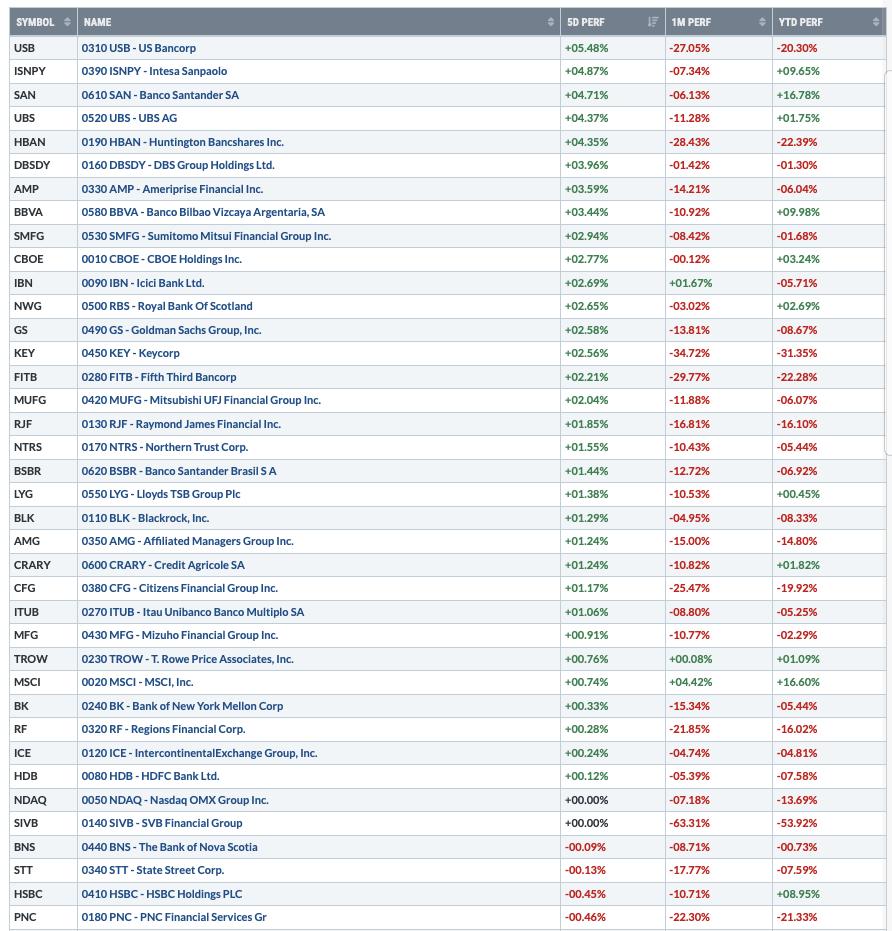

Performance

The table below shows the performance for one week, one month, and since the start of 2023. Many of these banks are up on the week. So if you are thinking of a banking plunge, many of these banks are taking it all in stride. How long will it last?

Conclusion:

The bottom line is the EUFN is not weighted based on the size of the European banks and, therefore, not as representative with the most systemically important banks. It would be down significantly more based on the top 10 European banks. But there is some resilience so far that this all works out, as a large number of banks are up on the week even in the face of the weakness on the Credit Suisse and Deutsche Bank charts.

Unnerving, but not broken, so far.

Good trading,

Greg Schnell, CMT, MFTA

Senior Technical Analyst, StockCharts.com

Author, Stock Charts For Dummies

Want to stay on top of the market's latest intermarket signals?

– Follow @SchnellInvestor on Twitter

– Connect with Greg on LinkedIn

– Subscribe to The Canadian Technician

– Email at info@gregschnell.com