The market made its low on Thursday and has made some nice gains off the lows. Tuesday was another strong day. I continue to like the setup here for a rally.

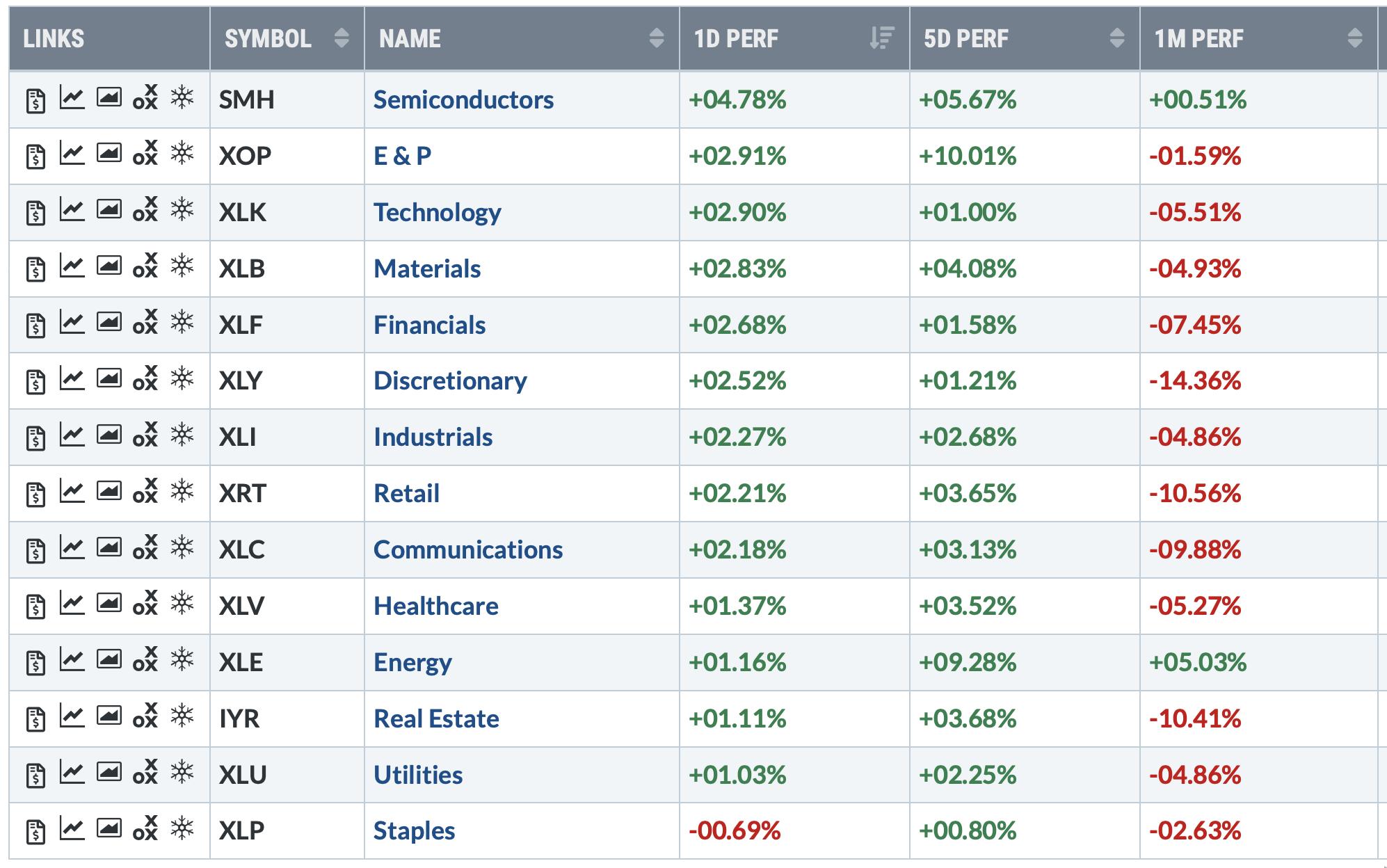

The other areas I am looking for is a rotation from defensive to growth-oriented sectors. Semiconductors really popped on Tuesday and have done well over the last 5 days. When I look at the list that is sorting based on Tuesday's results, it has growth areas on the top and defensive sectors on the bottom. One area that is not really popping yet is the discretionary sector.

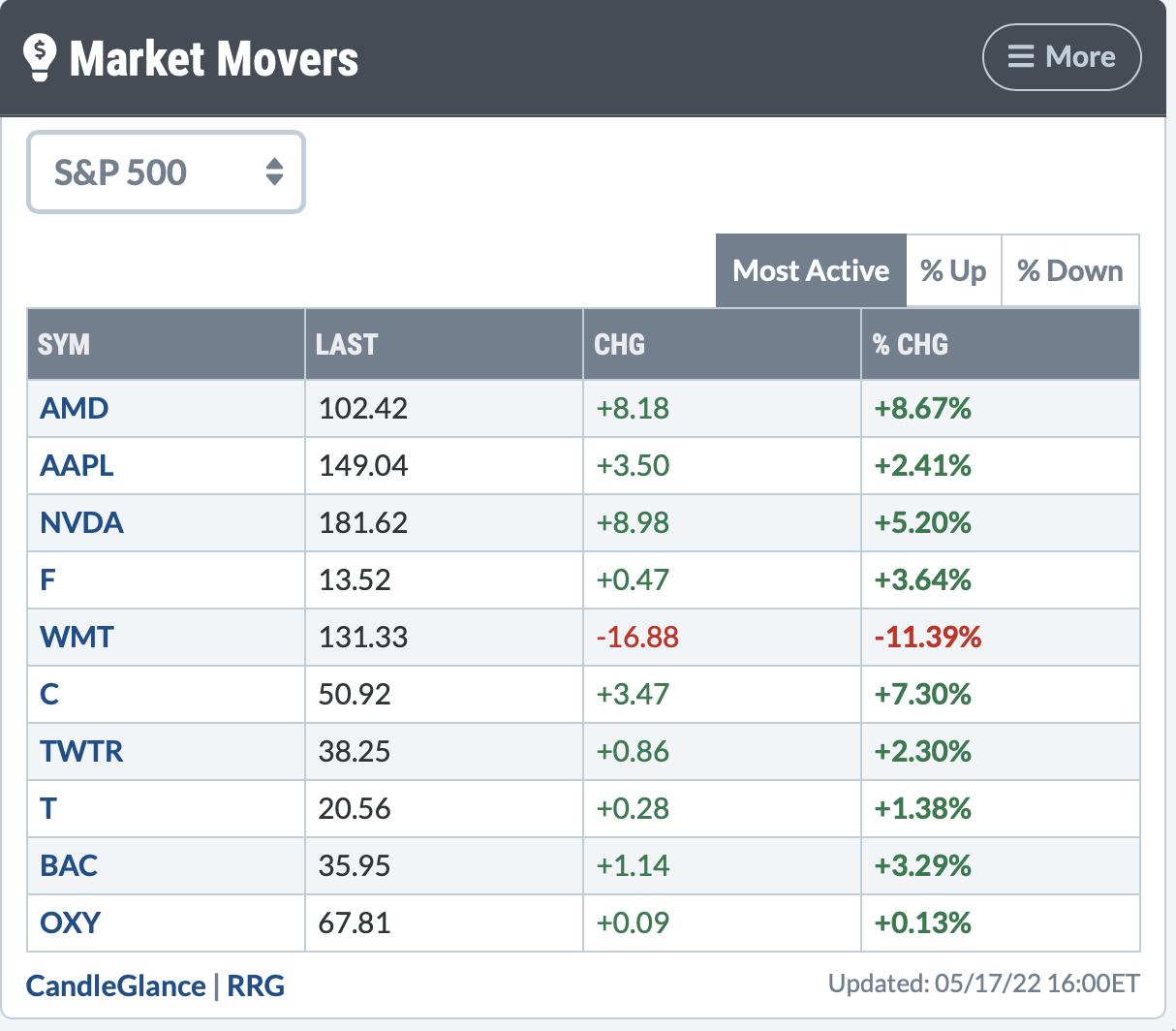

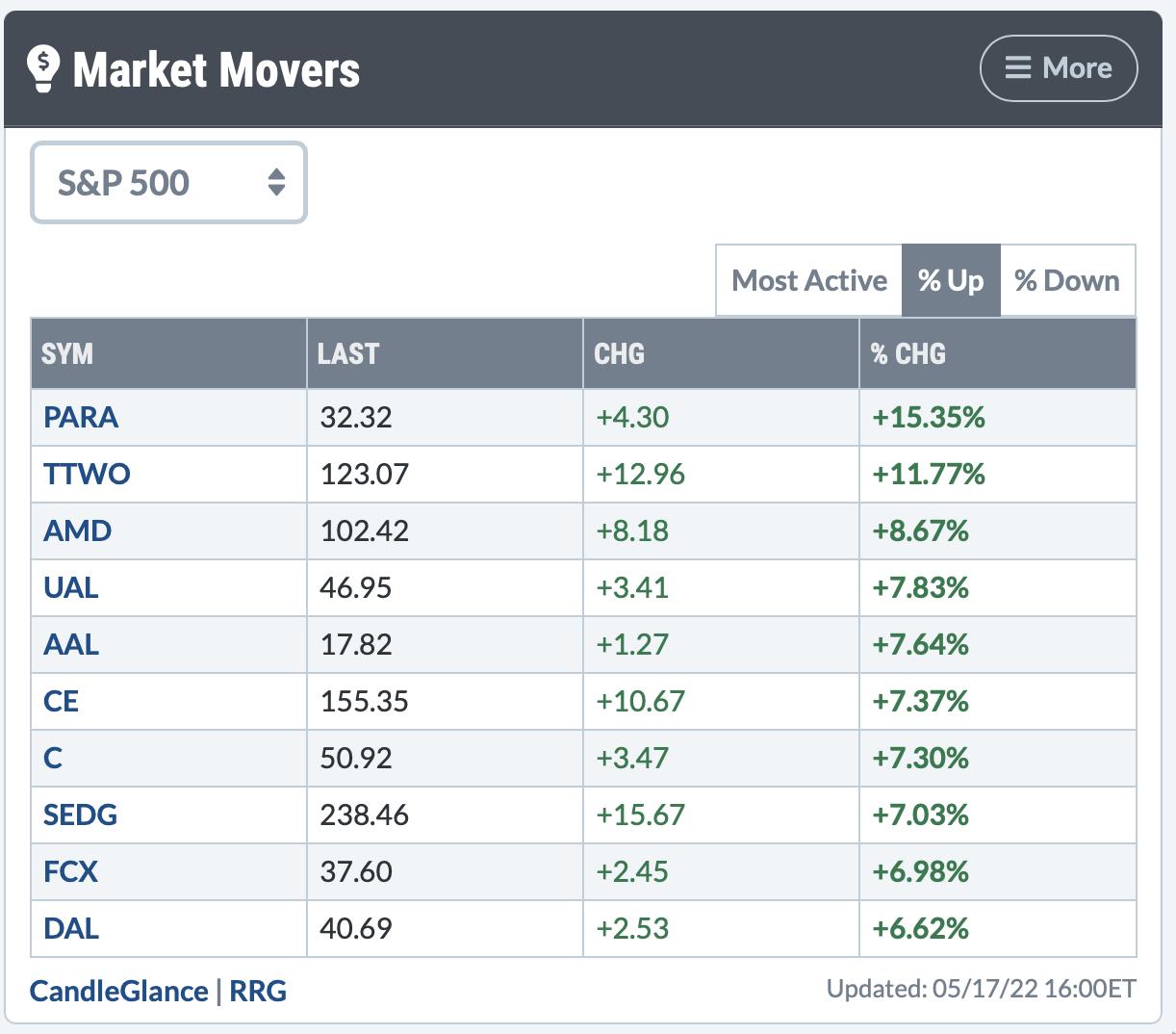

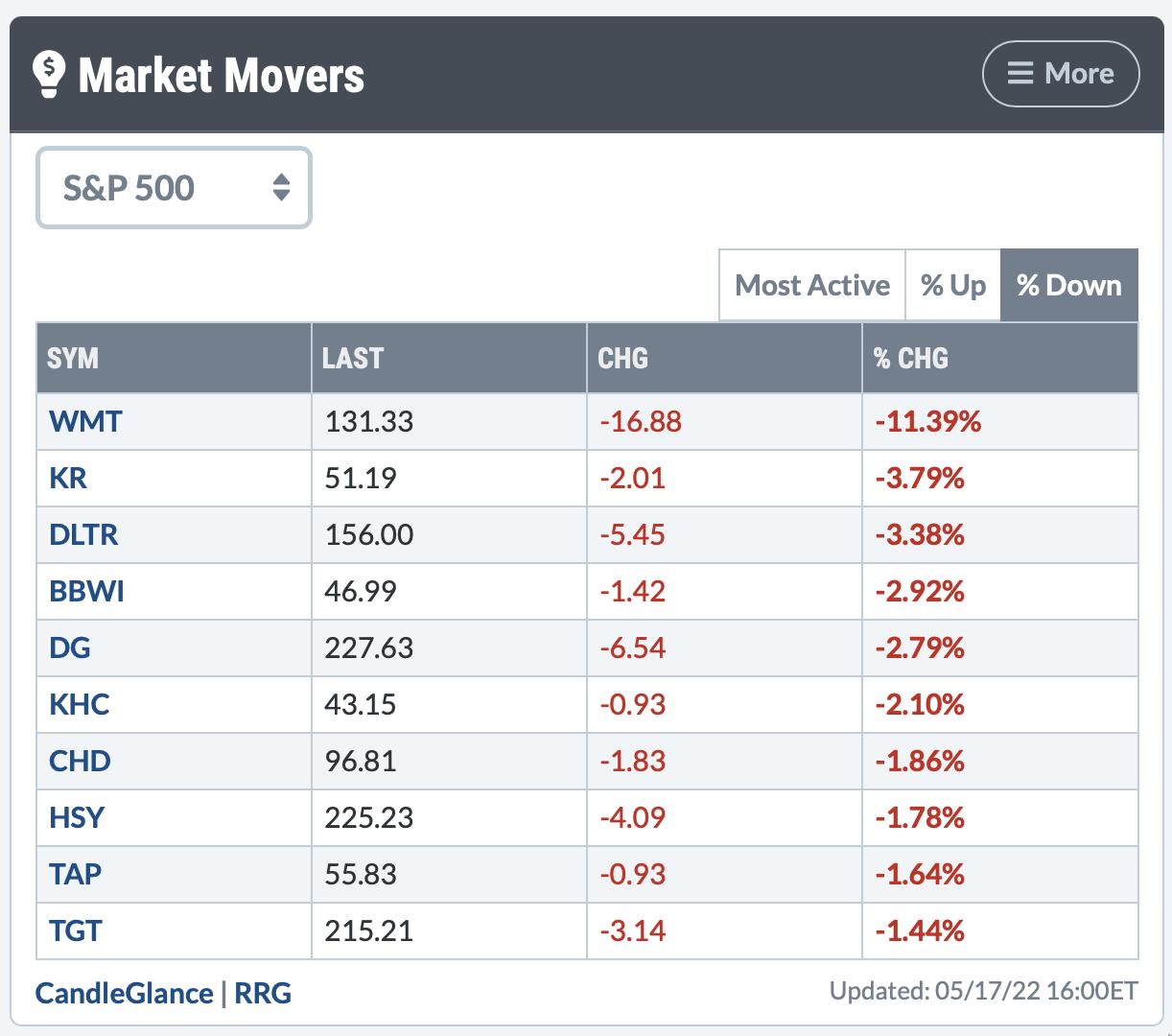

Looking at the top-performing stocks, most active names and underperforming names, it does highlight the rotation away from defensives.

In the top panel, the most active list is dominated by tech-related, but there are two banks and an oil company there.

Looking at the biggest movers, it shows a different picture. Three airlines made the list. I was surprised to see FCX and SEDG on the list actually. The copper chart has been terrible and Solar Edge was not where I would have looked. Might be more there in Clean Tech, as it has been beaten down for over a year.

One area I was not surprised to see was the defensive names as the weakest. Grocery stores, dollar stores and food companies were selling off.

To me, it looks like a rally has started. If you'd like more information on where to look for opportunities, I'd encourage you to take at look at OspreyStrategic.org and sign up for the 30-day trial for $7. That will give you access to the next 4 newsletters and videos.

Good trading,

Greg Schnell, CMT, MFTA

Senior Technical Analyst, StockCharts.com

Author, Stock Charts For Dummies

Want to stay on top of the market's latest intermarket signals?

– Follow @SchnellInvestor on Twitter

– Connect with Greg on LinkedIn

– Subscribe to The Canadian Technician

– Email at info@gregschnell.com