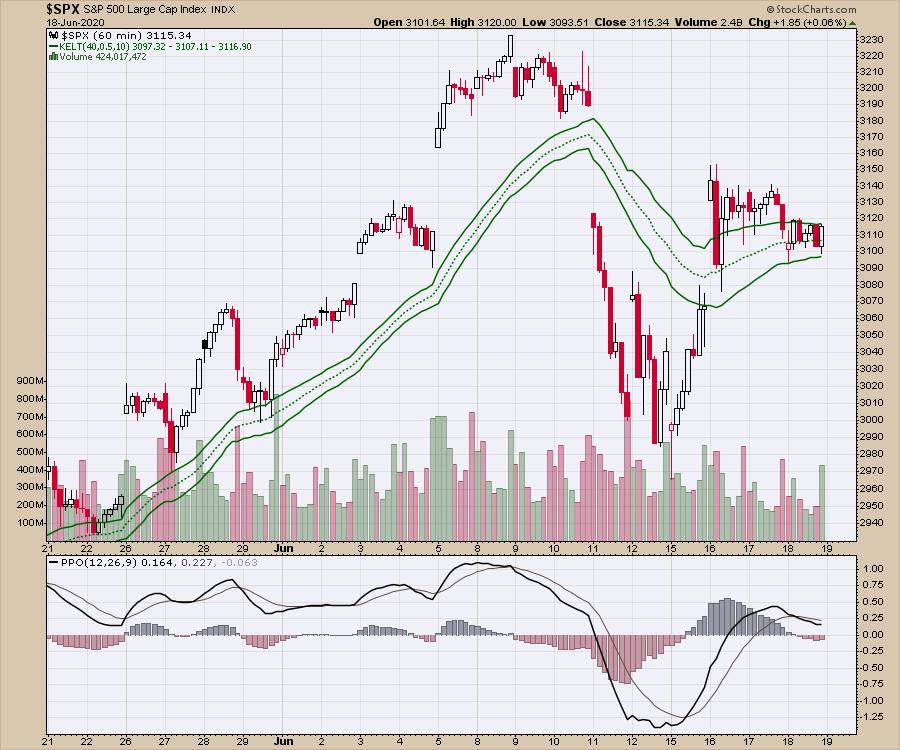

The markets have been very passive this week. Mondays move to the upside was encouraging. The spike continued to Tuesday morning opening and then the flatline for the week illustrates that perfectly.

The real question is this the calm before the storm? One of the easier ways to judge this is to look at the uptrends of the big cap tech. When we look through this chart group, the the uptrends are still intact, but the one thing I notice is the slope of the advance is losing steam. In the example of Amazon, the advance was on the green line trajectory, but now is following a marginally lower slope up as shown by the blue-dotted line.

Apple continues to have one of the smoothest advances going. That is probably because they can still do big buybacks and control the shape of the chart. With so much buyback horsepower, it makes sense that other institutional investors will also huddle here. It is still bullish as they all seem to be advancing, just at different rates of change.

Today marks another high-volume day as we go through the quarterly option expiration. Option expiration days have marked the high in February and the low in March. It is a little surprising to see the market stall after the Fed offered to go in and buy corporate bonds directly. I would think the next step is to start buying stocks outright if they don't like the slope of hope.

All that gives us room to pause here, but the underlying data is still pointing up in my work. Last weeks vibration seems to be just that; a larger than normal swing within the uptrend.

As we go back to retest the highs set before the Fed meeting, that may give us another reason to consolidate. The second quarter earnings will start mid-July. As the data starts to roll in, it will give us some better indications of market strength. The makers of recreational products seem to be doing well in the stay-cation environment. Bicycles, camping equipment and backyard renovations seems to be a theme. From my discussions with restaurant and coffee shop owners, the third quarter is still a mystery.

Will the government stimulus kick the economy back up, or will the average consumer continue to be afraid of the virus and drive employers into more negative cash flow? If infrastructure is the next wave are you ready to buy stocks like Caterpillar? Whether I look at CAT, HON, EMR, they all have similar chart shapes.

While the Fed has definitely been the supportive voice behind the market, the earnings headwinds are just starting to be announced. Currently my data points are still bullish. I'll continue to monitor that for change. Friday's futures were up at the time of writing. Have a great Father's day weekend.

Good trading,

Greg Schnell, CMT, MFTA

Senior Technical Analyst, StockCharts.com

Author, Stock Charts For Dummies

Want to stay on top of the market's latest intermarket signals?

– Follow @SchnellInvestor on Twitter

– Connect with Greg on LinkedIn

– Subscribe to The Canadian Technician

– Email at info@gregschnell.com