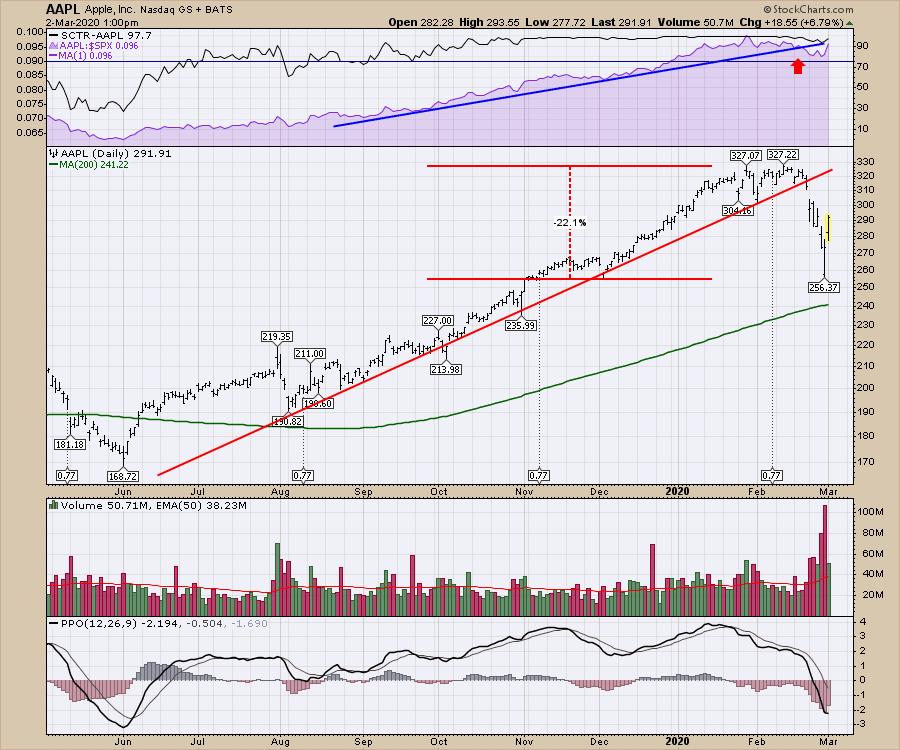

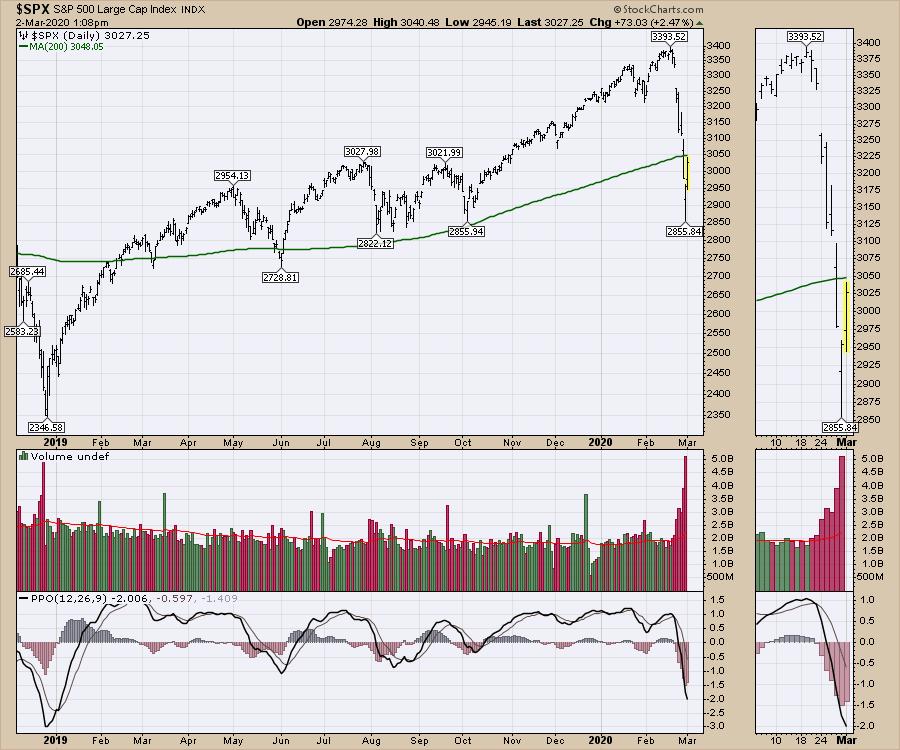

After a massive down week last week, the markets are trying to recover with a strong push to start Monday. What is difficult to assess is how much economic damage has been done. If the world slows, is that already priced in with a 15% pullback on the Nasdaq and the $SPX? I realize how many downside projections there are for the economic squeeze coming. The question is, with Apple (AAPL) and Microsoft (MSFT) market caps dropping 20% into a bear market correction, is the damage already priced in?

We did get some extreme readings on Friday suggesting enough to mark a bottom.

The volume on the Nasdaq composite was a billion shares - more than any other trading day ever! Thursday, February 27th was also a new record for volume on the Nasdaq Composite, until Friday outpaced that. With two record-setting volume days back to back, we were at big extremes.

On the $SPX, we also hit 8-year highs in volume.

From a volume perspective, we had more than enough volume to mark a low.

On December 26th, 2018, the Dow rallied 1000 points. On March 2nd, 2020 (a.k.a. Monday) the intraday high is up around 780 points just after lunch in NYC. So the rally attempt is underway, even in the face of massive momentum to the downside.

From my Twitter feed, the Fed is building a coordinated action with central banks around the world. The governments around the world are also expected to build some stimulus here. OPEC is meeting and is largely expected to cut dramatically. So there are a significant number of forces trying to stop the selling.

I did a video Monday morning after the open showing different places to look for some new investing ideas. You can find that video, titled Trying to Recover, here:

I am sure it will be turbulent coming off the lows. The real question is this: Can the bounce last? Stay tuned, but for now, we are trying to build a v-shaped low.

Good trading,

Greg Schnell, CMT, MFTA

Senior Technical Analyst, StockCharts.com

Author, Stock Charts For Dummies

Want to stay on top of the market's latest intermarket signals?

– Follow @SchnellInvestor on Twitter

– Connect with Greg on LinkedIn

– Subscribe to The Canadian Technician

– Email at info@gregschnell.com