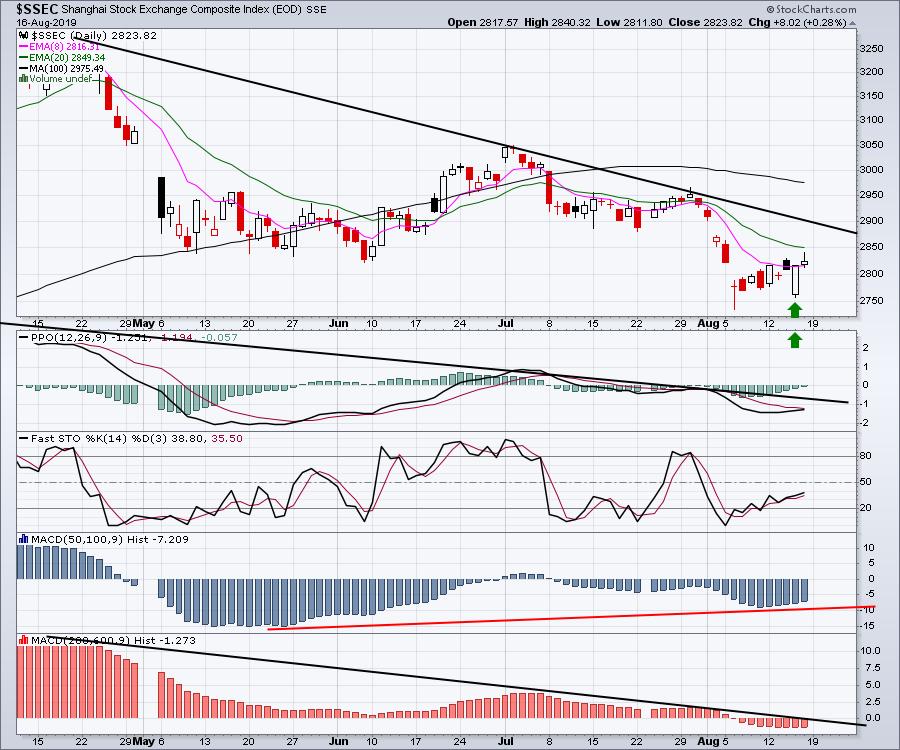

With the plunge on Wednesday, the market hit a short-term sentiment low. As the Dow ($INDU) closed down 800 points, the mood of pessimism was ripe for a pause. In Shanghai, after the US close, the market gapped lower, making it appear like the plunge was going to continue. By the end of the trading session in China, the market regained all its losses and closed higher on the day. Note the green arrows.

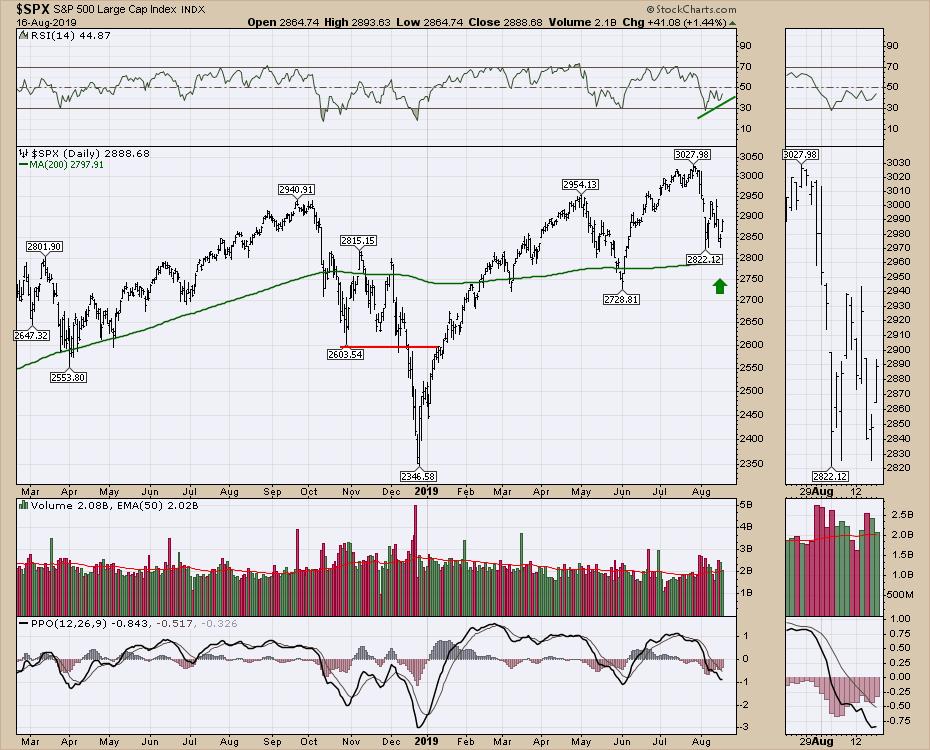

Friday was not a great candle, as it closed near the lows. However, the selling pessimism paused at an important place on the weekly chart as well. The PPO momentum indicator dropped just below zero, and the price action created an inside week to close with a higher low and a lower high. This is a little clearer on the zoom panel.

I started out this article with the Shanghai chart because it is the other half of the trade concern that is gripping American investors. If Momentum can start to turn higher in China, maybe there is a mood change in negotiations behind the scenes.

For me, those charts are critical to continue to look for some optimism on the trade front. At best, we didn't make lower lows on both sides of the Pacific Ocean, so that might be a change in sentiment.

One of the pessimism metrics is the Put/Call Ratio. While this indicator is pretty good at demonstrating short term lows, it is not always the end of the down trend, instead sometimes marking a bounce low.

The last two charts I want to include are the $NIKK and the $DAX. We are halfway through the month now, so these charts will have to meaningfully improve to not take the bearish clues to heart.

For the $NIKK, the 6-month uptrend has been broken and price made a new 6-month low in August. Both the 10 and the 40-week moving averages are pointed down. The PPO momentum indicator has rolled over below zero. The weekly and monthly price charts are below the 20-period moving averages, which is a condition we see in downtrends.

The $DAX is usually a good indicator for Europe. The chart broke to new 6-month lows this week and fell below the 40-week moving average. Momentum is accelerating lower.

While I have some optimism for a short-term bounce over the next few weeks off the high put/call ratio, the global structure is very weak. I roll through a wide variety of charts in this video. Here is a link to 3 Clues From Afar.

The defensives are leading the charge at this point. My bias is to keep thinking defensive until we get some momentum into the growth areas.

Good trading,

Greg Schnell, CMT, MFTA

Senior Technical Analyst, StockCharts.com

Author, Stock Charts For Dummies

Want to stay on top of the market's latest intermarket signals?

– Follow @SchnellInvestor on Twitter

– Connect with Greg on LinkedIn

– Subscribe to The Canadian Technician

– Email at info@gregschnell.com