The Canadian banks have underperformed the $SPX so far this year. They have drifted lower since March but they have some interesting traits on the indicators pointing to an interesting time now. Two have yields of 3.65%, two have 3.83% and CIBC has 4.65%.

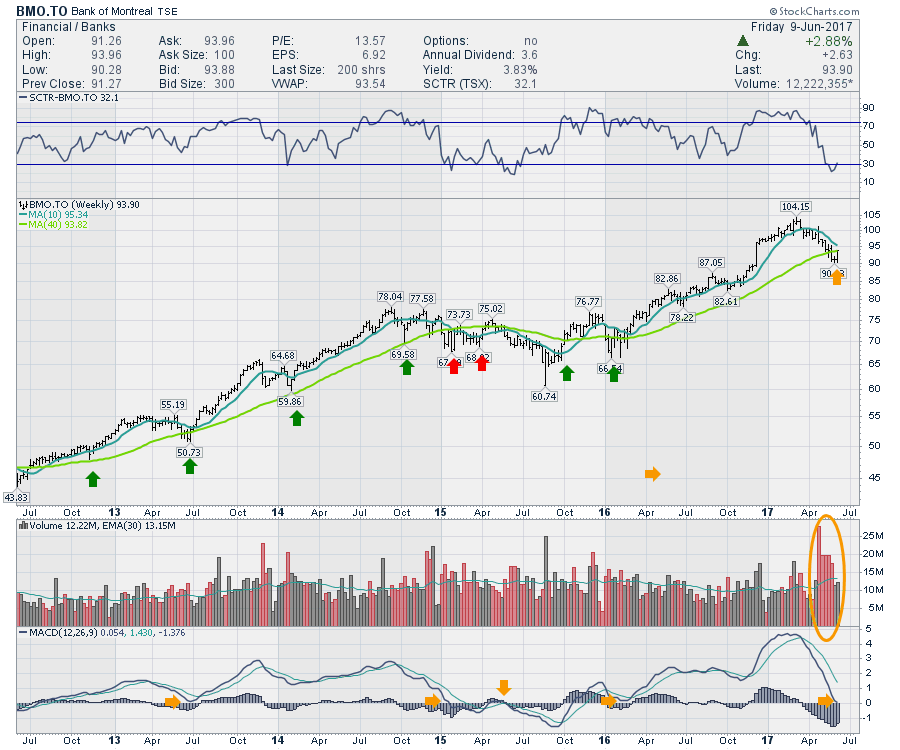

First of all, BMO. The yield is 3.8% which is very big. I'll come back to the SCTR but the downslope in relative trend was broken this week. While that is hardly a starting point, it coincides with the price breaking back above the 200 DMA. The Friday volume was great and the MACD crossed above the signal line. Looking at the SCTR, I do like when a large cap stock in Canada like a major bank dips below 25 and then starts to climb back up through 30.

Looking on a weekly chart, this is an interesting move on the SCTR. First of all, the SCTR rarely reaches this low level so it could be meaningful place for value shopping. The price action is at a critical level with the 10 WMA above and the 40 WMA just below. Looking left on the chart, there were two moves back above the 40 WMA in the last five years that did not hold up. The huge selling volume on the chart suggests a significant level of concern here. Rarely has the MACD gone below zero and usually it was for a short time. 2015 was the year that the oil and materials sectors were being bombed and that spread into the banks. With the same condition happening right now, the banks have pulled back. Most people are discussing Toronto and Vancouver housing for the bank weakness.

Scotiabank (BNS.TO) continues to rally off the 200 DMA. The SCTR is already back above 50 and the Relative Strength to the $SPX is breaking above the trend line. Scotiabank topped out in February which was slightly before BMO shown above but it has resumed its climb before BMO as well. The price has broken above the down trend.

Scotiabank (BNS.TO) continues to rally off the 200 DMA. The SCTR is already back above 50 and the Relative Strength to the $SPX is breaking above the trend line. Scotiabank topped out in February which was slightly before BMO shown above but it has resumed its climb before BMO as well. The price has broken above the down trend.

Looking at BNS.TO on the weekly, this chart looks like it has already made the turn. By breaking above the down trend this looks to be on its way. The MACD looks like it is turning up while above zero which is very positive.

Looking at BNS.TO on the weekly, this chart looks like it has already made the turn. By breaking above the down trend this looks to be on its way. The MACD looks like it is turning up while above zero which is very positive.

CIBC (CM.TO) is trying to break out as well. It has definitely broke above the short term down trend. While still below the 200 DMA it looks like it has tested the support level near 100-102 and is trying to bounce off that. The MACD has been improving for a few weeks already so that is good. The SCTR is back above 27 but I like to see it jump above 30 when buying SCTR pullbacks below 25.

CIBC (CM.TO) is trying to break out as well. It has definitely broke above the short term down trend. While still below the 200 DMA it looks like it has tested the support level near 100-102 and is trying to bounce off that. The MACD has been improving for a few weeks already so that is good. The SCTR is back above 27 but I like to see it jump above 30 when buying SCTR pullbacks below 25.

The weekly chart suggests the SCTR looks like it is trying to find support around 30. Notice in the last five years, an SCTR of 25 is a low rarely reached for the stock.

The weekly chart suggests the SCTR looks like it is trying to find support around 30. Notice in the last five years, an SCTR of 25 is a low rarely reached for the stock.

TD Bank (TD.TO) looks good as well. The SCTR is back above 50, the relative strength is breaking the downtrend and the price has also broken the down trend. TD was another stock that just touched the 200 DMA and fired up from there. The MACD is moving into positive territory.

TD Bank (TD.TO) looks good as well. The SCTR is back above 50, the relative strength is breaking the downtrend and the price has also broken the down trend. TD was another stock that just touched the 200 DMA and fired up from there. The MACD is moving into positive territory.

The TD.TO chart on the weekly looks great. The price break above $65 looks good.

The TD.TO chart on the weekly looks great. The price break above $65 looks good.

The RBC (RY.TO) chart is worth looking at. This stock never got near the 200 DMA and the SCTR is already back up to 63. The Relative Strength down trend has been broken as has the price trend. The MACD is not quite in positive territory but it seems to have enough momentum to push there.

The RBC (RY.TO) chart is worth looking at. This stock never got near the 200 DMA and the SCTR is already back up to 63. The Relative Strength down trend has been broken as has the price trend. The MACD is not quite in positive territory but it seems to have enough momentum to push there.

RBC on the weekly is a beautiful chart. This is such a smooth chart, this looks like a typical correction.

RBC on the weekly is a beautiful chart. This is such a smooth chart, this looks like a typical correction.

In general, all the charts are breaking the Relative Strength down trend and the prices on all of them are breaking the down trends while bouncing near the 200 DMA. I will make two comments that add a little caution. All of the volume showing up as prices pulled back adds concern. The second thing I would add is that the bank stocks pulled back in the first half of 2013, then in 2014-2015 and now in 2017 when oil stocks were in downtrends with mineral stocks. So those are concerns as we don't know if the oil and materials pull backs are complete.

In general, all the charts are breaking the Relative Strength down trend and the prices on all of them are breaking the down trends while bouncing near the 200 DMA. I will make two comments that add a little caution. All of the volume showing up as prices pulled back adds concern. The second thing I would add is that the bank stocks pulled back in the first half of 2013, then in 2014-2015 and now in 2017 when oil stocks were in downtrends with mineral stocks. So those are concerns as we don't know if the oil and materials pull backs are complete.

Perhaps this is a signal that those sectors could start to turn up soon as well. It looks like the US banks are starting to turn higher here as well so the North American industry turning up is supportive makes this look like a good place to add to bank positions.

I would also like to thank everyone who voted in the CSTA awards program this year. I was very happy to receive the Technical Independent Analyst Award for 2017. As well StockCharts.com won 3 more awards with the most significant award being the Top Technical Analyst Team. Thank you for your appreciation of our efforts to help Canadians with their technical analysis. Please visit CSTA.ORG for more information on other great technicians who won awards!

I will be hosting the CSTA chapter meeting in Calgary on Tuesday June 13th at 5:30 PM MDT. Please register to attend! We have a fabtastic special guest to wrap up our season!

Good trading,

Greg Schnell, CMT, MFTA.