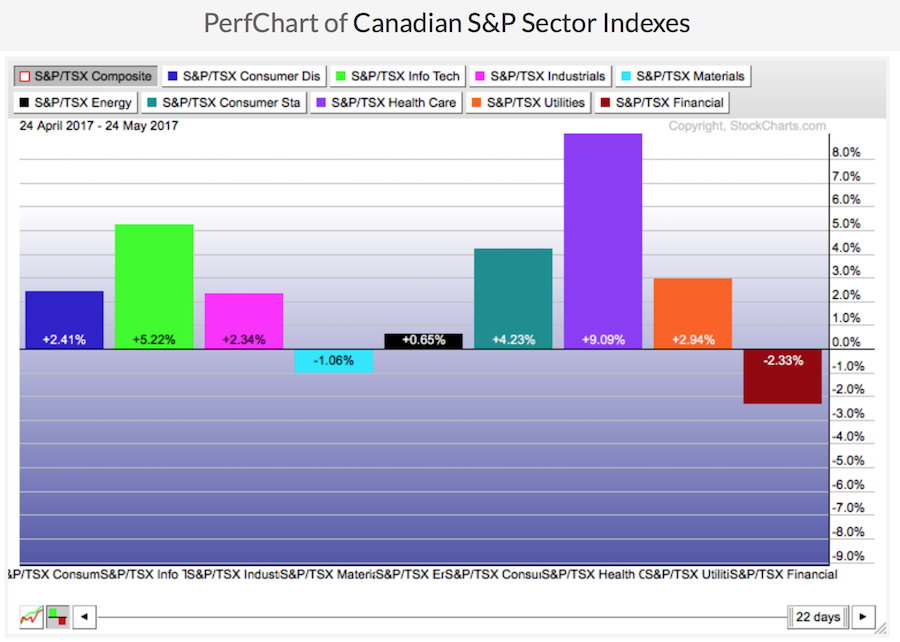

Rolling through the various sector charts shows Canada all mixed up. Technology has been holding up but the anchor tenants of the Canadian market have not. A one month view shows the Material Energy and Financials spaces as mediocre, and the other areas driving the bus. While Healthcare is bouncing off huge multi year lows, it looks impressive, but not really. Shopify and a few other names have led the Technology space higher, but the Utilities seem to be holding up.

The Utilities Sector ($SPTUT) didn't really move on the big downdraft on May 17th. Utilities had a weak day on Thursday, but have now pushed to new highs as an index.

It might be time to wander through the Utility stocks and find some nice chart setups.

It might be time to wander through the Utility stocks and find some nice chart setups.

Algonquin Power (AQN.TO) is rising every week it seems. The SCTR just kicked above 75 again in May. It is up almost 20% in 2017.

TransAlta Utilities (TA.TO) has been consolidating recently. This week it pushed back above the 10 WMA.

TransAlta Utilities (TA.TO) has been consolidating recently. This week it pushed back above the 10 WMA.

Boralex (BLX.TO) has a beautiful chart. Up a little more than 10% this year.

Boralex (BLX.TO) has a beautiful chart. Up a little more than 10% this year.

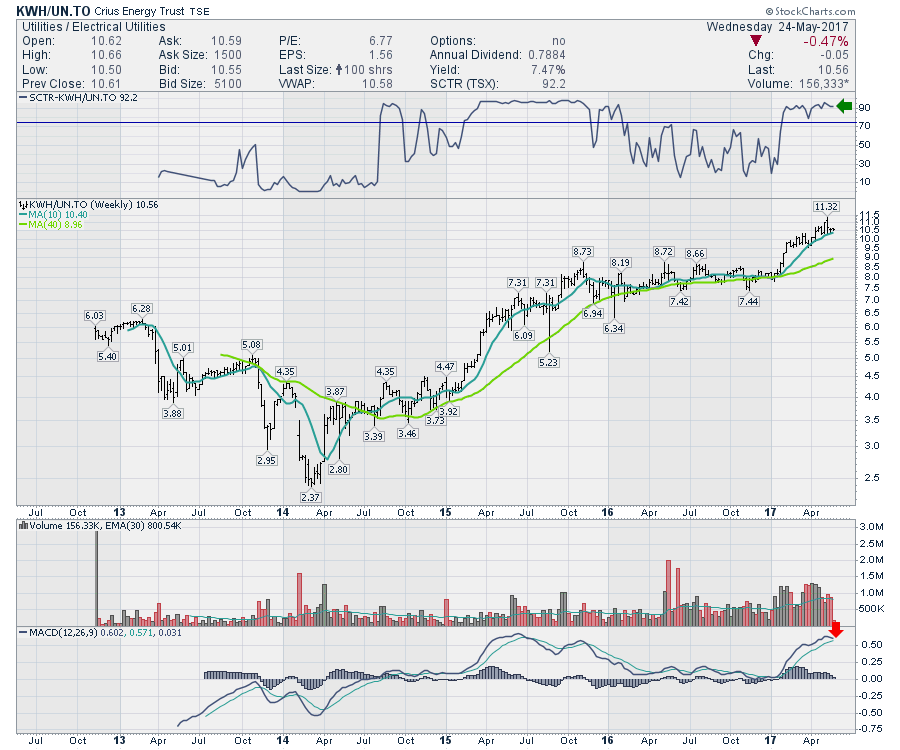

Crius Energy Trust is already up 30% since Jan 1 so a little hard to add here.

Crius Energy Trust is already up 30% since Jan 1 so a little hard to add here.

Brookfield Infrastructure Properties (BIP/UN.TO) is up 20%.

Brookfield Infrastructure Properties (BIP/UN.TO) is up 20%.

Canadian Utilities (CU.TO) looks great here. Just 5% above the breakout level on a 5 year chart! We can see this chart has a 5-year consolidation between $28 and $39. This is an exceptionally nice chart. The yield is 3.48%.

Canadian Utilities (CU.TO) looks great here. Just 5% above the breakout level on a 5 year chart! We can see this chart has a 5-year consolidation between $28 and $39. This is an exceptionally nice chart. The yield is 3.48%.

TransAlta Renewables (RNW.TO) is consolidating here. Some weak hands would have sold on last weeks drop below support.

TransAlta Renewables (RNW.TO) is consolidating here. Some weak hands would have sold on last weeks drop below support.

Atco (ACO/X.TO) is on the move. Three year highs recently, a nice little backtest and starting to surge.

Atco (ACO/X.TO) is on the move. Three year highs recently, a nice little backtest and starting to surge.

Pattern Energy (PEGI.TO) is a nice chart but the volume is too low to be considered.

Pattern Energy (PEGI.TO) is a nice chart but the volume is too low to be considered.

Brookfield Renewable Energy Partners looks good with a 4.33% yield.

Brookfield Renewable Energy Partners looks good with a 4.33% yield.

Capital Power (CPX.TO) looks great right here shining a 6% yield.

Capital Power (CPX.TO) looks great right here shining a 6% yield.

Innergex (INE.TO) has been consolidating for almost a year. The entry could be soon with the sector breaking out.

Innergex (INE.TO) has been consolidating for almost a year. The entry could be soon with the sector breaking out.

Emera (EMA.TO) looks tasty here.

Emera (EMA.TO) looks tasty here.

The Fortis chart is ok. It has a few cautionary signals on it. I would like it to stay above the 10 WMA from here on. If it can't hold it, I wouldn't hold the stock. The trend of lower highs on the SCTR and the MACD looking like it is ready to roll over are the cautionary signals. If it breaks out from this consolidation it could run for a while.

The Fortis chart is ok. It has a few cautionary signals on it. I would like it to stay above the 10 WMA from here on. If it can't hold it, I wouldn't hold the stock. The trend of lower highs on the SCTR and the MACD looking like it is ready to roll over are the cautionary signals. If it breaks out from this consolidation it could run for a while.

The last one is Northland Power. In this case you are trying to buy it at the 40 WMA. If that struggles and makes lower lows, I wouldn't hold it. But after a one year consolidation, it is a nice time to catch a new up trend on a strong chart.

The last one is Northland Power. In this case you are trying to buy it at the 40 WMA. If that struggles and makes lower lows, I wouldn't hold it. But after a one year consolidation, it is a nice time to catch a new up trend on a strong chart.

Some of these Utilities have moved faster than all the major attention getting sectors. Keep them in mind for a nice strong sector with some dividends. If I noticed one thing, it was how many Alberta utilities were doing well. Does that mean I am going to be paying more for power right away? Gulp!

Some of these Utilities have moved faster than all the major attention getting sectors. Keep them in mind for a nice strong sector with some dividends. If I noticed one thing, it was how many Alberta utilities were doing well. Does that mean I am going to be paying more for power right away? Gulp!

Good trading,

Greg Schnell, CMT, MFTA