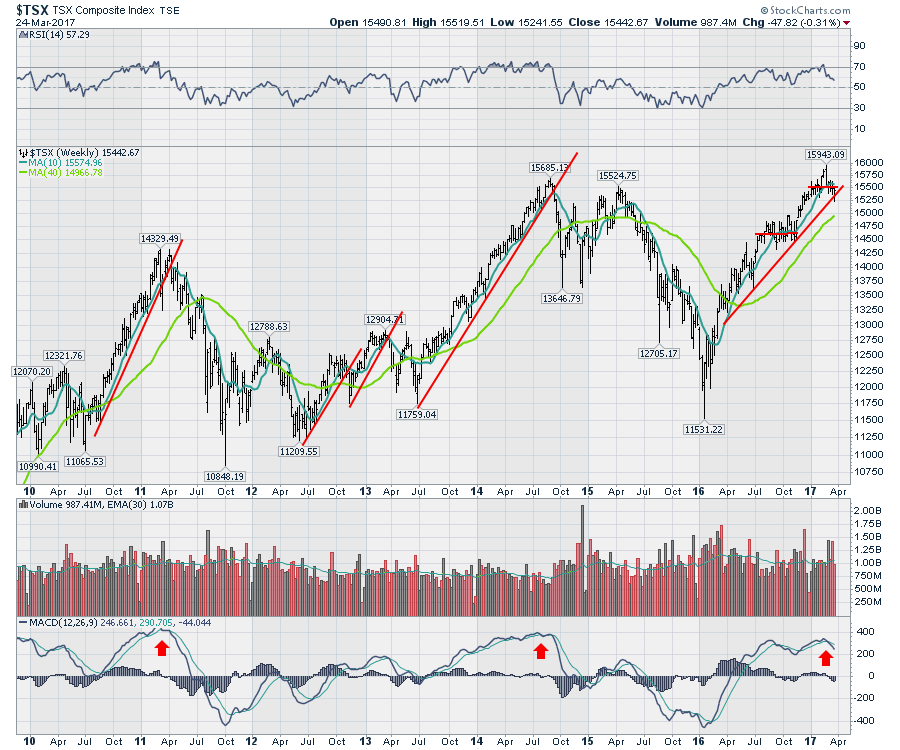

The $TSX put in another lower low and a lower high this week and closed down relative to last week. The sideways trading range we see in the Canadian market is reminiscent of the period from July to October where the market traded around a level. The level currently shown as a red line is about 15500. On the price panel, this was the first week on the one year chart below that the $TSX never touched or got above the 10 Week MA (blue line). The RSI and MACD are still in a bullish posture on this shorter term chart although the MACD has crossed below its signal line.

Using a longer chart with more data, the $TSX looks more precarious here.

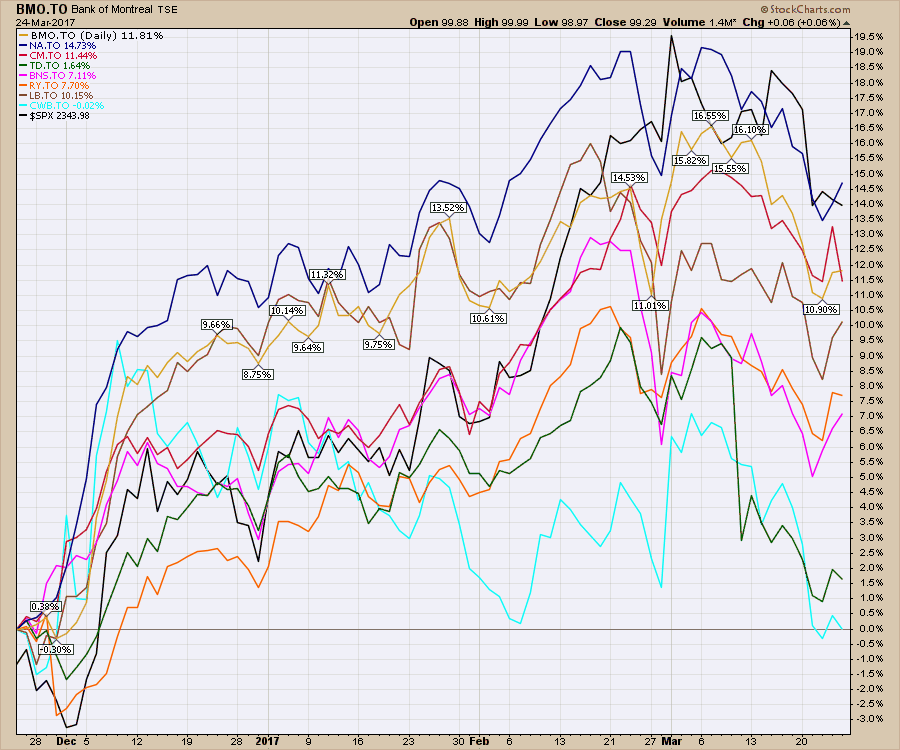

The banks have added to the weakness with a pullback in March.

The banks have added to the weakness with a pullback in March.

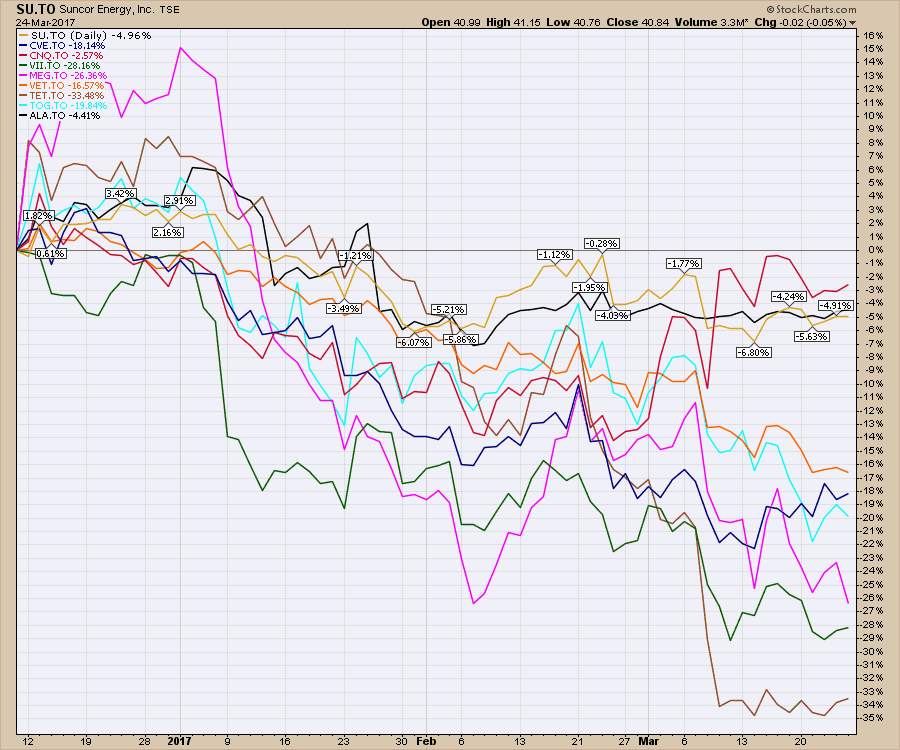

A cross section of the exploration companies show they have the same traits. CNQ.TO bounced a little on their purchase of Shell assets.

A cross section of the exploration companies show they have the same traits. CNQ.TO bounced a little on their purchase of Shell assets.

Lots of the oil and Natural gas related stocks have been on a similar downtrend across the charts. A break in this trend might give us a significant bounce. Here is Encana below. This Encana pullback has been 30% off the highs, but some of the stocks are down 50%.

The Gold industry stocks appear to be setting up for a meaningful move.

The Gold industry stocks appear to be setting up for a meaningful move.

The Industrial Metal stocks might perform well as the Relative Strength of foreign markets appears to be improving compared to the US market. Emerging Markets have a good correlation with commodities in general. However, so far, these charts are not moving back up yet. This looks like a better area to watch than invest currently.

The Industrial Metal stocks might perform well as the Relative Strength of foreign markets appears to be improving compared to the US market. Emerging Markets have a good correlation with commodities in general. However, so far, these charts are not moving back up yet. This looks like a better area to watch than invest currently.

FM.TO is also on the weak side. The Relative Strength breaking to 5 month lows is not good.

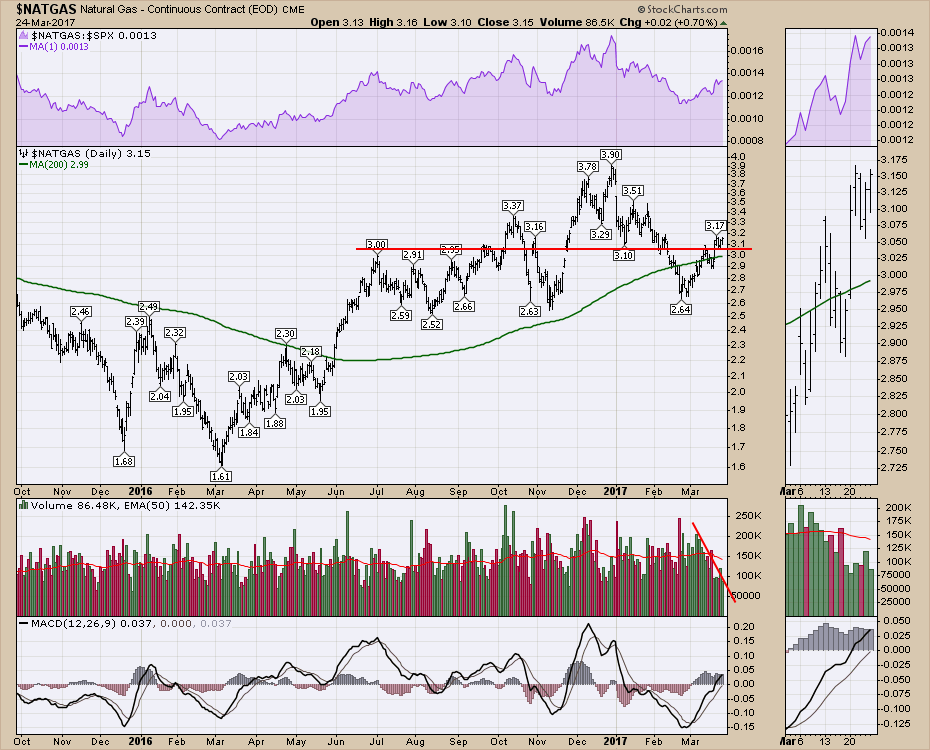

Gold and Natural Gas can rally on their own. Natural Gas continues to creep higher. The real problem here is there are not a lot of the Natural Gas stocks creeping higher. This is the same condition we saw with oil around December when the energy stocks sold off while crude held above $50.

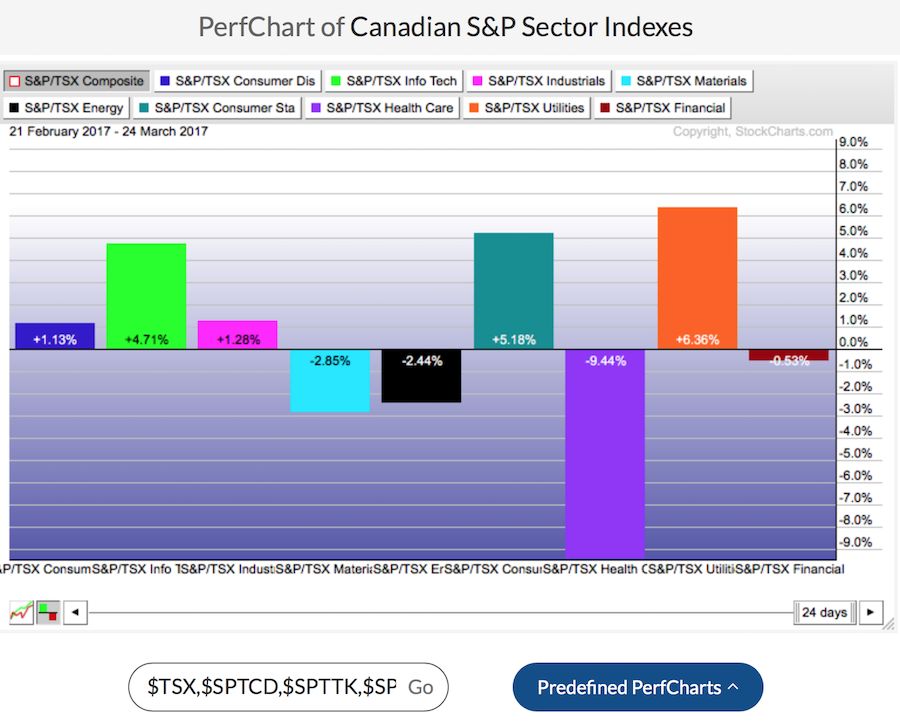

With the pullback setting up on the broader $TSX, this might be a better time to browse than shop. Seeing the energy sector down so much as the pipeline approvals come in sets up nicely for some longer term investors. Since the $TSX topped in February we can see the Materials, Energy and Financials are down. That is a significant part of the Canadian market in terms of market cap. Seeing the Utilities and Consumer Staples performing so well suggests more caution. SHopify is in the Technology sector so that is helping there.

With the pullback setting up on the broader $TSX, this might be a better time to browse than shop. Seeing the energy sector down so much as the pipeline approvals come in sets up nicely for some longer term investors. Since the $TSX topped in February we can see the Materials, Energy and Financials are down. That is a significant part of the Canadian market in terms of market cap. Seeing the Utilities and Consumer Staples performing so well suggests more caution. SHopify is in the Technology sector so that is helping there.

Looking into the Consumer Staples we see charts like George Weston improving in Relative Strength and on the SCTR. The SCTR is at 11 1/2 month highs.

In summary, the $TSX had its lowest close since the first week of January. New lows for the year is not a bullish direction. The leadership being shown by Consumer Staples and Utilities is very ominous.

In summary, the $TSX had its lowest close since the first week of January. New lows for the year is not a bullish direction. The leadership being shown by Consumer Staples and Utilities is very ominous.

If you are looking to put money to work here, I think the Gold trade is setting up and might be a good venue with a stop underneath. The Consumer Staples and Utilities are suggesting to stay defensive. With the Financials falling after the end of RRSP season, and the Oil and Gas sectors drifting lower, it will be hard for the $TSX to hold these levels.

Here is a link to the most recent Canadian Technician Video Recording of 2017-03-21. I will post another recording early next week.

Good trading,

Greg Schnell, CMT, MFTA