I am a big believer in the relative strength line. This week the SPURS as I like to call it, is sitting at an important junction and so is the price. We can see the SPURS shown in purple has broken through support and is backtesting the trend line. The price is testing the 8 month trend line off the October lows. The big volume is concerning. Could this be a final exhaustion move? In the last 30 trading days the pop in volume has been significant. With all that volume you would not expect to underperform.

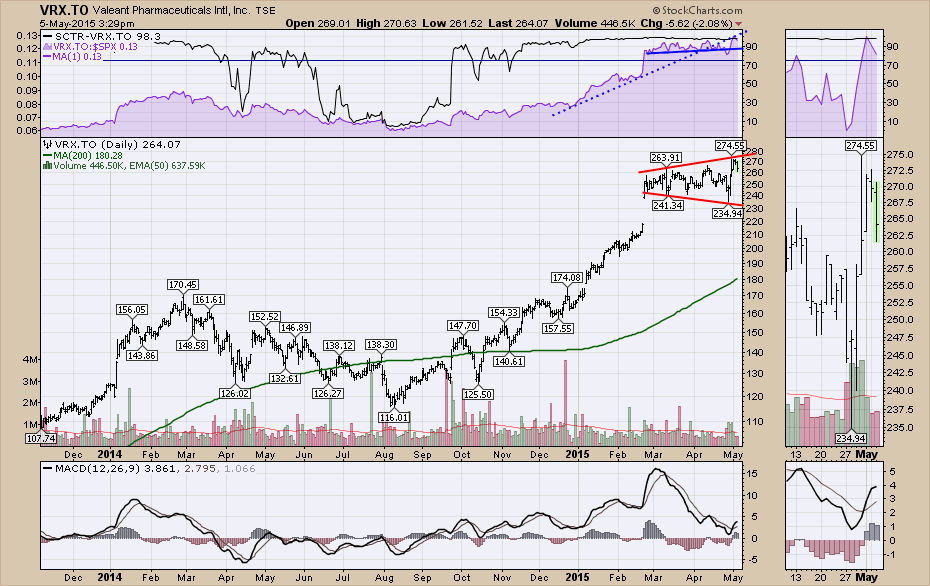

Valeant Pharma (VRX.TO) continues to be one of the biggest influencers on the sector. It has been moving really well. It has doubled since August. The broadening price pattern is a sign of indecision and recently the relative strength line dipped below and bounced back up. The rate of outperformance shown in the dotted blue line has changed and at this point Valeant is performing in line with the S&P 500. Any further weakness would be concerning.

This looks to be getting a little extended. I wouldn't sell it here with the MACD turning up, but if it rolls over here, I would want some protection to hold my gains. We don't need to be reaching for pain killers while holding such a nice growth stock! I think at this point caution is warranted.

Good trading,

Greg Schnell, CMT