For one of Canada's most storied stocks, Blackberry (BB.TO, BBRY) continues to write new story lines. We can see three major setups in Blackberry. The pattern as Blackberry failed at the top is shown, but the SCTR ranking was dismal in 2010. The same consolidation is occurring now, but this time, Blackberry is one of the top 25% in performance based on the Toronto SCTR ranking. This is an important distinction because the Oil and Gas as well as materials are very low ranking. This means that BB.TO is doing well compared to the rest of the Canadian stocks, but in this case, the rest of the stocks are not doing so well. The real decision for investors is approaching. If this breaks up and out, this will be an important entry. If Blackberry can not accelerate from here, the $10 level would mark the lower boundary of a sideways consolidation.

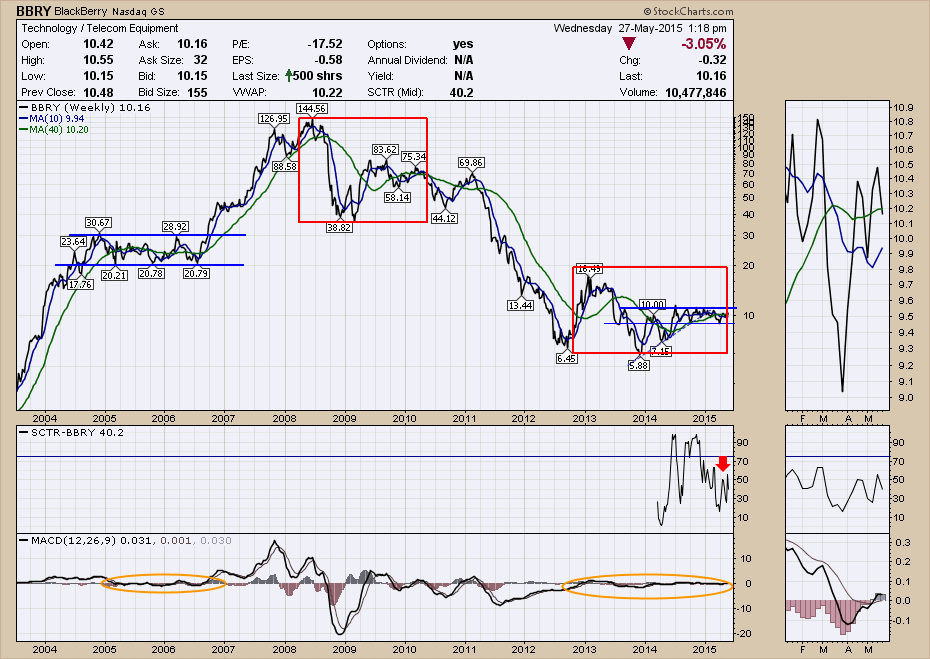

Notice the MACD going to sleep on the chart. It has been flat lining for 2 years on the big picture (weekly 10 years) with almost no emotion. The zoom box shows a slight upturn but not a weekly bullish cross yet. Sitting just above zero, this would be a great place for Blackberry to find support and move higher.

The US Version of the chart is a little different. First of all, the SCTR in this ticker is compared to the Mid-cap stocks as shown in the Full quote screen at the top. With BBRY only at 40.2 it is still one of the lower performers. I wanted to illustrate the difference in the SCTR. You can not compare SCTR rankings between different groups. The price action of BBRY is very similar inside the red boxes. The same viewpoint I expressed on the Canadian chart above holds true here on price and on the MACD.

Blackberry really needs to show some power here if it is going to change the long term trend. There is lots to focus on, but this would be the time to show acceleration.

I have started to tweet a little more (@schnellinvestor), so if you follow Twitter, I hope to post some timely charts there. I also will try to link articles or webinars through there to help you understand what I think about the markets from my lens. Tomorrow is webinar day for me (every Thursday at 4:30 EDT) and we have lots to cover. Martin Pring will join me and we will probably continue the format we tried May 14th. Two presentations, then an open dialogue about the charts. The previous one was well received, so my plan would be to continue that style. Feedback on blogs and webinars is greatly appreciated. Click here to register for Tomorrows Webinar. Thursday May 28th Webinar.

If you would like to subscribe to the blogs to receive an email or use an RSS feed, the subscribe box is top right.

Good trading,

Greg Schnell, CMT.