Just checking in on the commodities and today is a little more interesting than most. Natural Gas continues to consolidate sideways but after repeated spikes down, the price seems to be stabilizing.

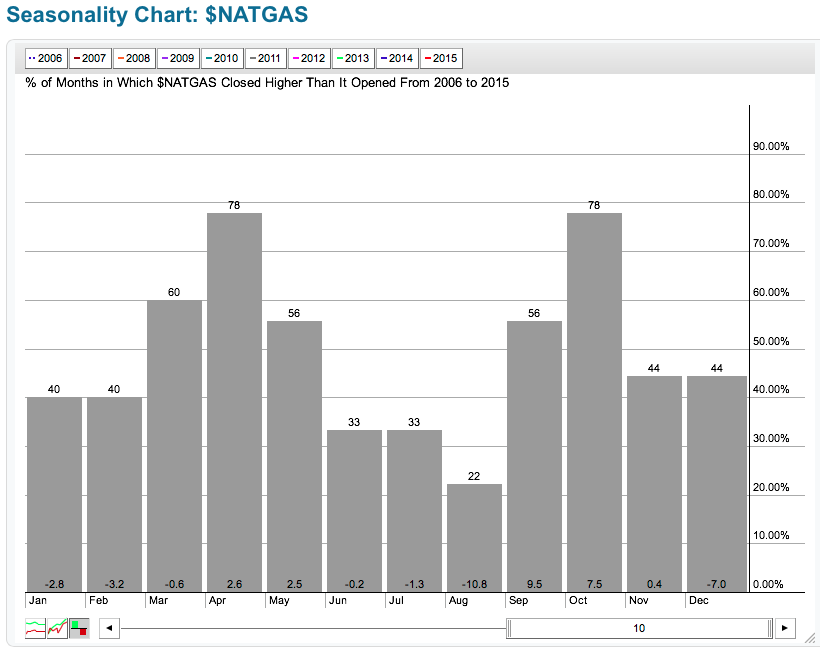

On February 22nd, I posted an article about Natural Gas (The Canadian Technician - Natural Gas Article) and I am still interested in the group. Today's surge was another one of those that just wears out the short term traders by having a big intra day move up after testing lower in the down trend shown on Chart 1. The intraday range was about 6% on the outside candle. The proximity to the top trend line makes it worthy of watching. A break of this blue trend line would be a start. Then, we'll have to fight our way through the $3.04 level. In Chart 2, I have shown the seasonality of $NATGAS. Usually March and April are pretty good as you can see.

Chart 2

One of the reasons I like the base forming at this level is the longer term chart I talked about in the other article. This base level is where $NATGAS finished in the massive collapse to the 2009 lows. The weekly MACD on Chart 3 is interesting here and looks to be basing or trying to turn up. Whether it can rally straight off these lows, remains to be seen.

So I am still very interested in the Natural Gas related plays here. With the seasonality, the depth of the lows and the moderate storage levels, I can't see a good reason for gas to trade down to $1.90. I can be wrong, but it feels like there will be some fruit to harvest in this field. 'When' will be the question for entry.

On another note, I continue to watch for a parabolic blow off top in the dollar with every trader on the same side of the trade. Can't step in front of a freight train, but the dollar move appears ripe for reversal. I actually thought it would be this week for an interim pullback to start after the EU Quantitative Easing started. I don't expect this to be the final high for the dollar, but I would expect a 3 to 4 month pause to slow the one way directional exuberance. Parabolic moves go till they stop, so I'll keep checking it out. I'll be moving into commodities for the bounce, not for the long term.

Good trading,

Greg Schnell, CMT