The Canadian Technician October 29, 2014 at 07:51 PM

The RRG Charts are going to be part of Thursday's webinar. The value of these charts is unbelievable. Here is a sample of the Canadian Sectors RRG Chart. The $TSX is the benchmark in the box above the green area of the chart. So it is the average... Read More

The Canadian Technician October 27, 2014 at 12:28 PM

It seems Natural Gas ($NATGAS) is failing. It really needed to hold $3.72. I spoke about it in the webinar but it continues to break down. Investors in the Natural Gas stocks that were looking for a bounce like I was have been disappointed... Read More

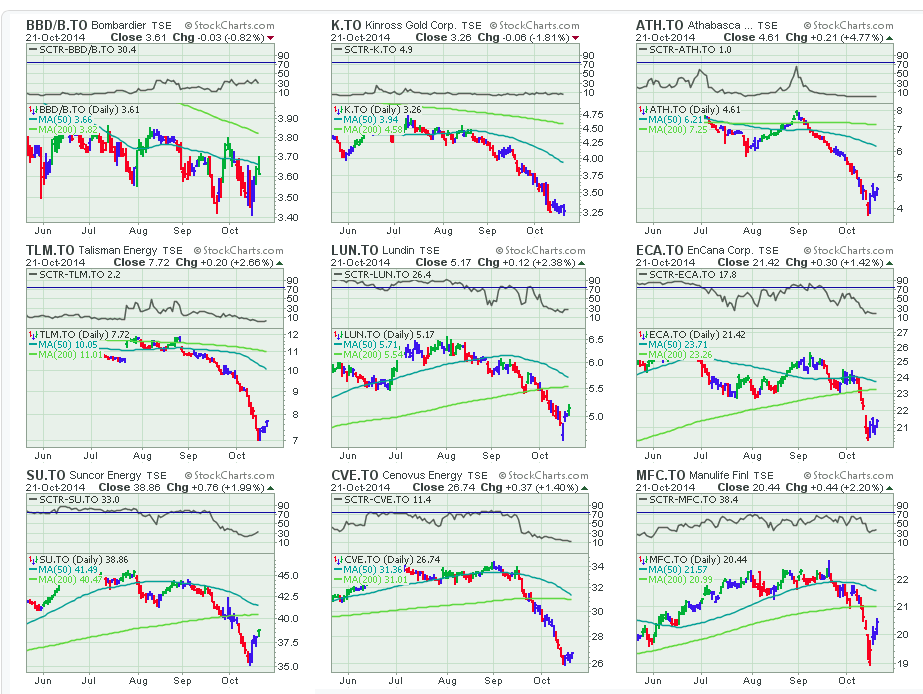

The Canadian Technician October 22, 2014 at 07:10 AM

The Canadian oil stocks have been traumatized by the recent plunge in crude. If you like to take advantage of deep pullbacks in price, these charts have been severely hit. This was just a screen shot of the most actives from the home page $TSX hot box... Read More

The Canadian Technician October 20, 2014 at 01:21 PM

Listening to the news is always a bad way to decide what is really going on. However, today offered more. IBM announced earnings that were considered lacklustre... Read More

The Canadian Technician October 17, 2014 at 11:00 AM

The energy stocks have been deeply oversold. I have mentioned them in the webinars and then spoke specifically about Cenovus (CVE.TO) coming down to support. Well, the broader energy sector is also rebounding looking at the Canadian Energy Sector ( $SPTEN) chart... Read More

The Canadian Technician October 14, 2014 at 07:05 PM

The Canadian Dollar ($CDW) is considered a commodity currency. We all know that. Here is a current chart over a 15 year period. It would also indicate that the price of the Canadian currency leads/tracks/follows crude oil... Read More

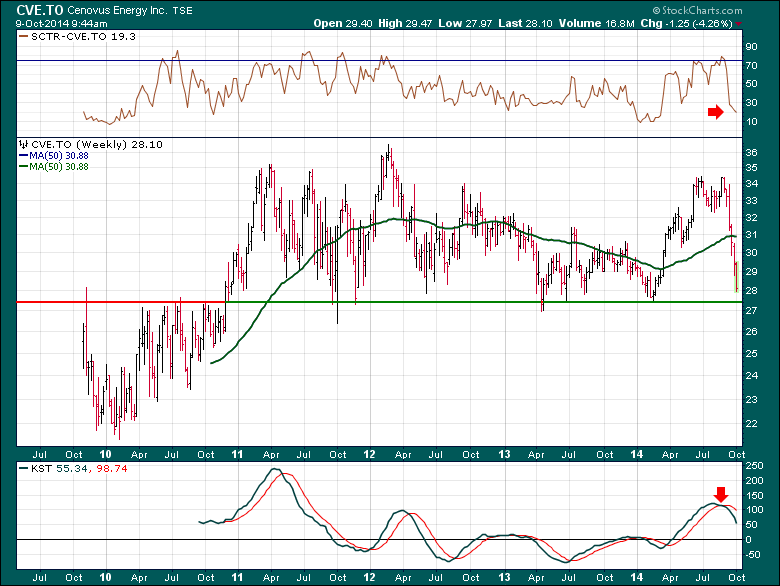

The Canadian Technician October 09, 2014 at 09:58 AM

Cenovus (CVE.TO) has been a hard stock for shareholders. The company continues to show so much promise, but the price just keeps getting pushed back down. Everything on this chart says down. The horizontal support line says interesting... Read More

The Canadian Technician October 06, 2014 at 08:45 AM

In July, one of the biggest currency moves started and dominated inter-market relationships. When the $USD broke out, a lot of major changes happened in the market. As an example, all of the commodities have been crushed and have broken through major long term trend lines... Read More

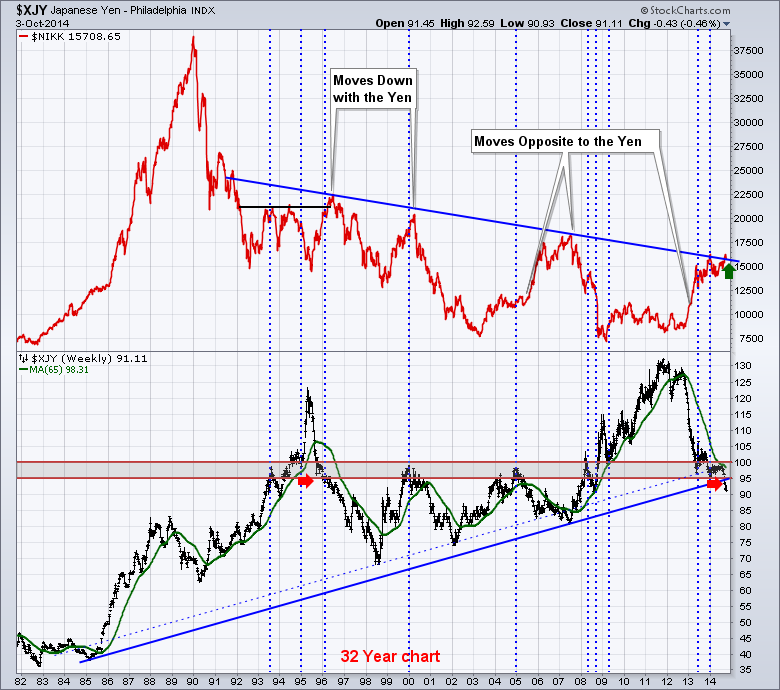

The Canadian Technician October 03, 2014 at 10:15 PM

I have been very interested to watch the Japanese Equity Market ($NIKK) to see if it can hold the breakout from the 25 year trend line. First of all, here is a long chart. Why does this matter? When a long trend line breaks it is usually very important... Read More