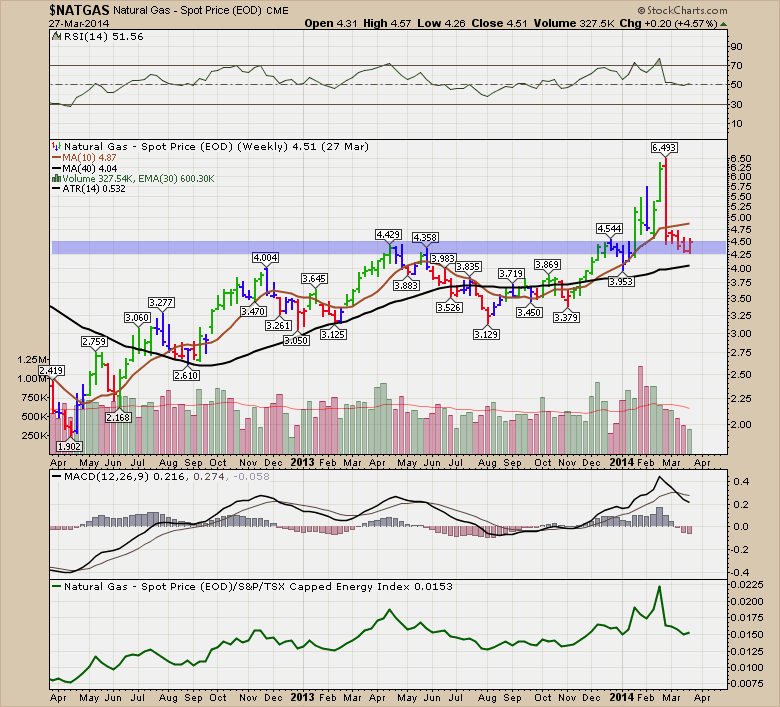

The Canadian Technician March 28, 2014 at 05:42 AM

$NATGAS looks like one of the strongest trades of the year. This accumulation of stock names should be interesting to watch for the year 2014.This blog will provide a list of Natural Gas stocks in the Canadian market... Read More

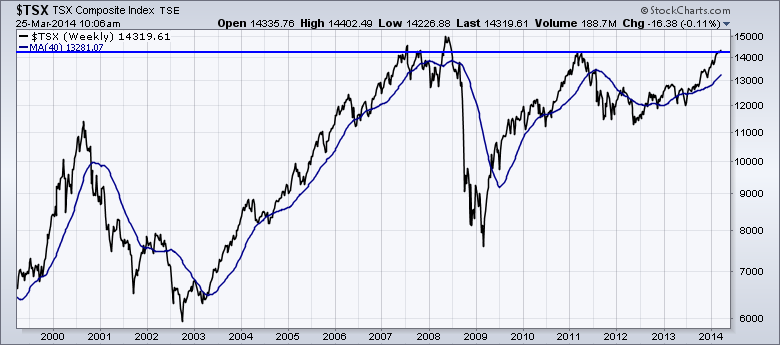

The Canadian Technician March 25, 2014 at 01:45 PM

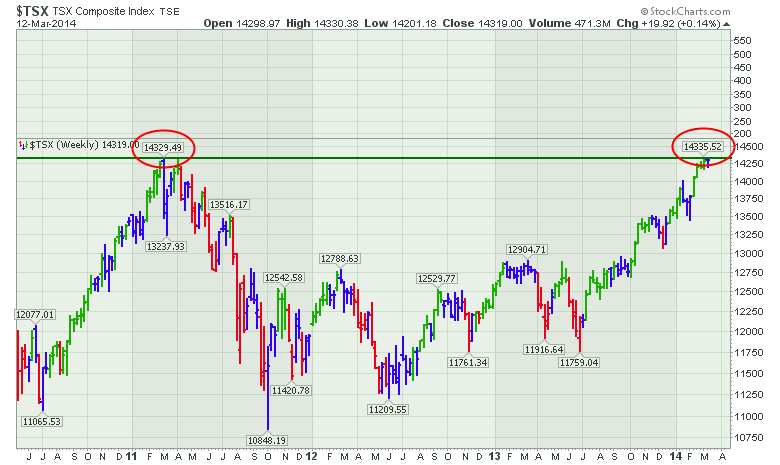

The $TSX is a great example of demonstrating both short term and long term resistance. First here is the long chart. When the $SPX made highs in July 2007, the $TSX made a spike above this blue line... Read More

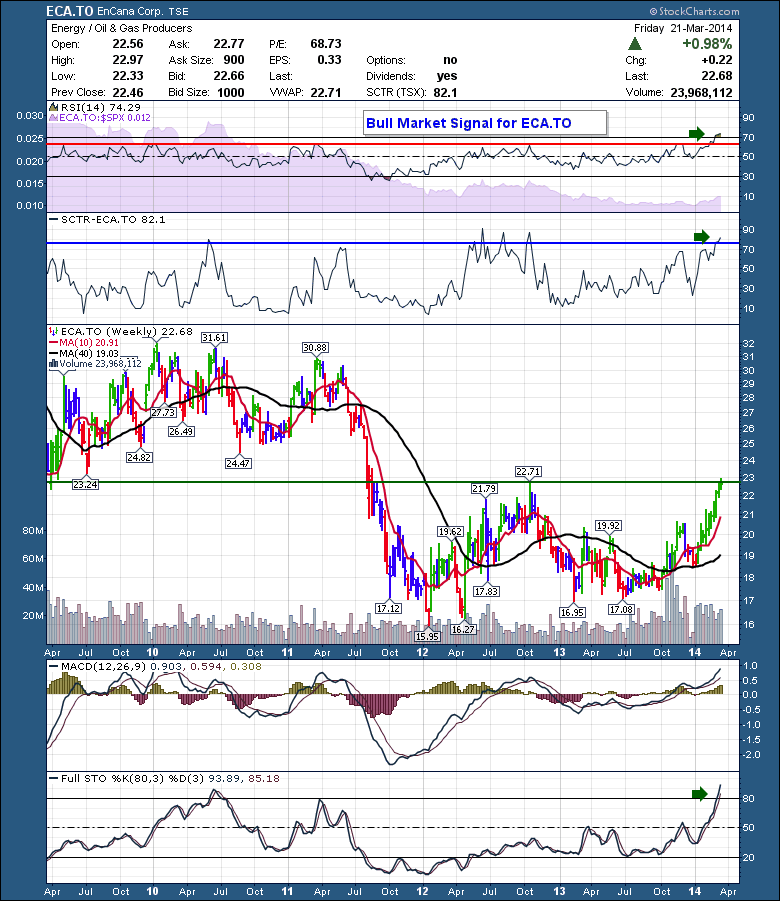

The Canadian Technician March 23, 2014 at 10:24 AM

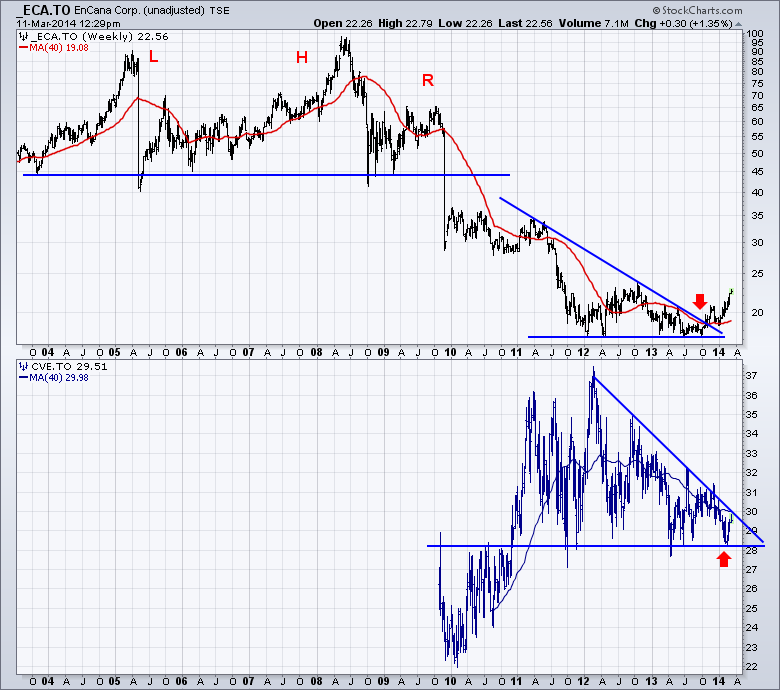

As $NATGAS went through a price spike recently, we have seen some big moves into the $NATGAS stocks. Encana and Perpetual are two Natgas names that are really starting to soar. It looks like the year for $NATGAS. Nice when the sector start to make multi year breakouts... Read More

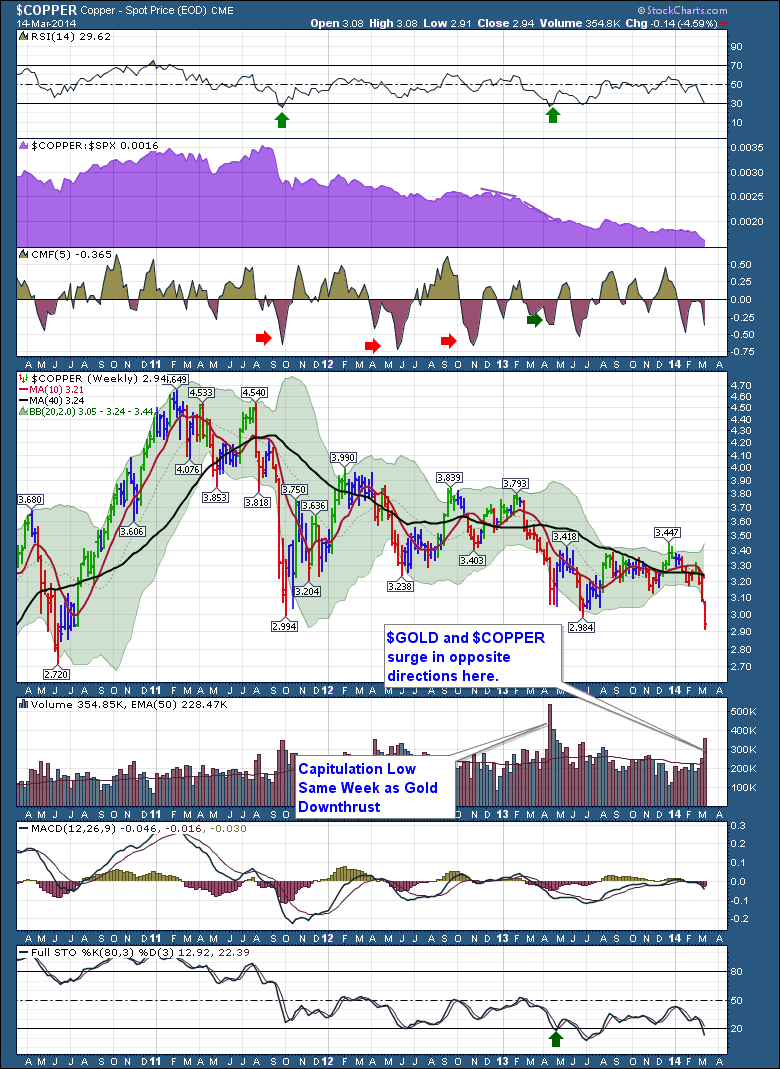

The Canadian Technician March 17, 2014 at 01:41 PM

The previous 3 articles dealt with the equity and bond markets. This one has just a few charts on $COPPER, $GOLD , $WTIC and $LUMBER. Without discussing why $COPPER is an extremely important economic indicator here, it just is... Read More

The Canadian Technician March 16, 2014 at 01:36 PM

Ok, A quick review of what we have seen. Many of the global markets are building typical topping structures. The US market is still bullish, but recent price action suggests that the market is also showing signs of indecision... Read More

The Canadian Technician March 16, 2014 at 11:54 AM

If you did not read Part 1, some of these explanations may not be clear enough. Continuing into Europe, let's go through the charts. France is an interesting market. It still has the camel humps, but it has a flat base line. This is an expanding wedge or a megaphone pattern... Read More

The Canadian Technician March 16, 2014 at 11:53 AM

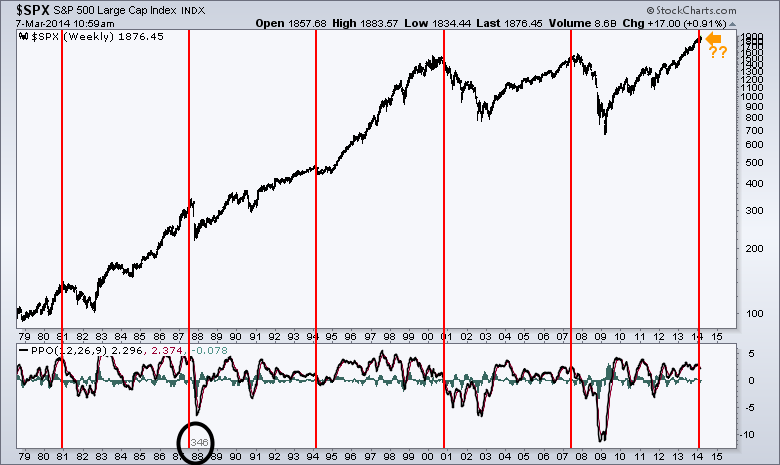

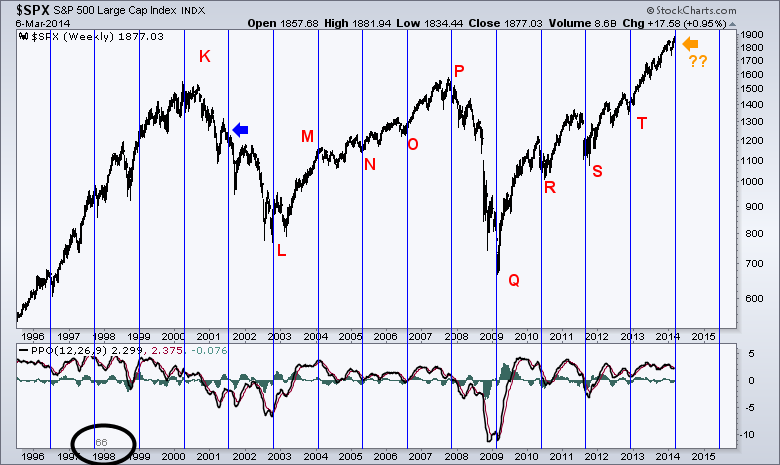

I recently presented this group of charts at the Atlanta SCU 101 and SCU 102 classes. After multiple requests to provide this as a PDF document, I thought I would post it as an article for you to read at your leisure. First of all, the next two charts have some long term views... Read More

The Canadian Technician March 13, 2014 at 04:21 AM

With all the snow we have had this year, I think Canadians coast to coast to coast will be welcoming the spring equinox on March 20, 2014. It looks like the $TSX needs something to help it over the previous resistance. Here is a 4 year view of the situation... Read More

The Canadian Technician March 11, 2014 at 04:04 AM

The historic charts for Randy Eresman couldn't be more vicious. As president of one of Canada's greatest companies, he decided to split the company in two to release shareholder value in the fall of 2009... Read More

The Canadian Technician March 07, 2014 at 02:09 PM

One of the best parts of writing a blog is getting feedback from the readers. This morning, a friend in Pennsylvania sent in a cycle length I had not looked at... Read More

The Canadian Technician March 06, 2014 at 09:03 AM

The work of cycles is fabulously interesting. It just seems hard to bet on any particular turn. George Lindsay used time spans to find places on the chart where a chart was likely to turn. He was looking for the inflection points in the market... Read More

The Canadian Technician March 03, 2014 at 02:10 PM

The JJC is a Tracking ETN for Copper. IF (a Big IF there) $COPPER closes below this trend line, this would be significant. We like Dr. $COPPER as an economic indicator. We have seen the trend weaken recently... Read More