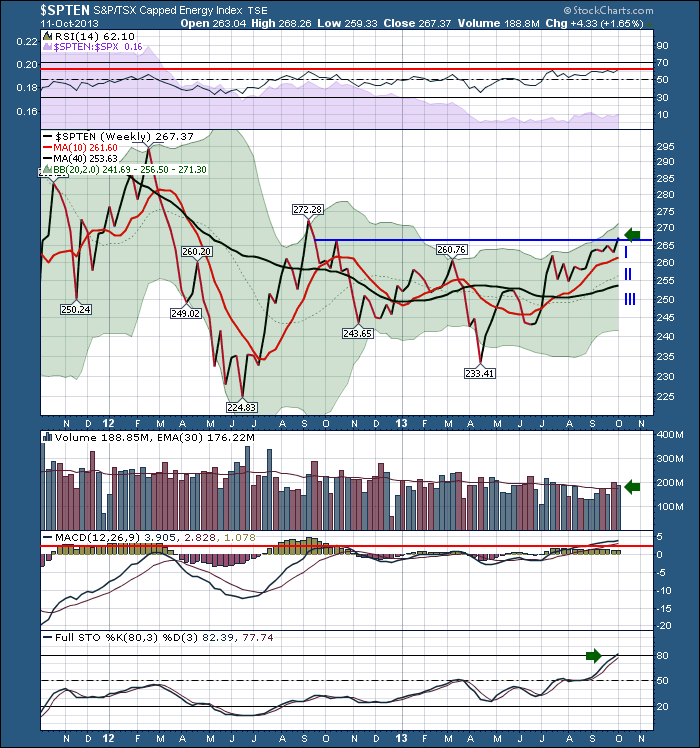

Rolling through the charts is always a pleasant way to spend some time on a quiet market Monday. The $TSX is closed for Thanksgiving Day in Canada. A nice little move took place last week to close out the volatile week. While the US had a long pullback sparked with accelerated buying going into the weekend, the Canadian market moved more sideways than down and was close to breaking out through the 2 year resistance level. The Energy sector is a key market, and the $SPTEN made a nice push to finish Friday at a new high.

The RSI has been stuck in a bear market trend for the last 2 years as shown by the red line on the RSI. We are testing the upper boundary now. The price action has broken above 52 week highs, as it just moved above the highs of October 2012. Volume in the last 2 weeks has been above average after being below for the previous 6 weeks. The MACD is above levels reached in the last 2 years which is very bullish. We can also see the Full Sto's have moved near 80. They can stay up here for a long time, which would be a very bullish place to spend the fourth quarter. You can see how the 50 level was serious resistance.

$SPTEN is trying hard and we'll continue to monitor. The drillers are some of the best technically performing stocks in Canada currently which would seem to confirm an optimistic sentiment.

Good trading and Happy Thanksgiving Day,

Greg Schnell, CMT