Recently, I posted about how copper was testing the trendline on weekly charts.

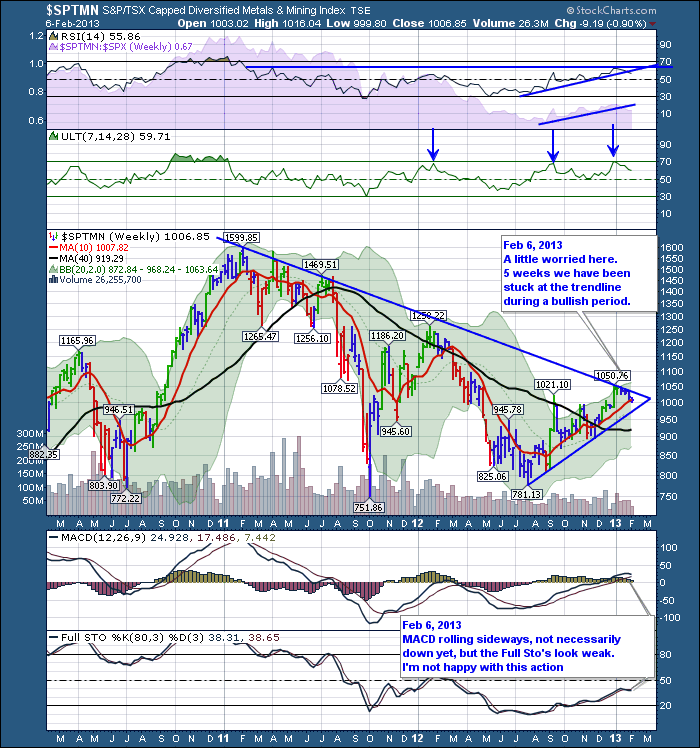

Here is the Canadian Mining Index.

I'm starting to get concerned. Its not over, but its looking weary. We still have some time.

Starting at the top.

RSI is breaking down through the upsloping trendline and failing to break above the horizontal bear market line.

The Relative strength (SPURS) in purple is breaking down...NOT GOOD.

The Ultimate oscillator has hit and bounced off the 70 line. The last 2 times marked a top perfectly.

Lets move to price. Still in a nice uptrend. Trying to find support at the 10 week line. But compared to the raging bull, blah blah blah good news, investors are moving in huge sums of money etc etc etc., this has moved sideways to down in the last 5 weeks and is testing 2013 lows. We have been unable to break through the downsloping trendline even though the macro backdrop has been bullish. The upsloping trendline sits between the 10 week MA line and the 40 week. So we have the 10 week as first support, the trendline next and then the 40 week.

Under the chart we see anemic volume. Doesn't look like a raging bull by any means.

Moving down to the MACD. Is this going to roll over at the zero line? This is very ominous. I'm not happy.

The Full Sto's are still below 50. Another bear market indicator.

It's not over. It is still in an uptrend. But it is hardly impressive especially considering it's RRSP and 401K season. If you are in a mining bull market, this chart should start to make mountains and so far it is pushing sand in a sandbox mediocrity.

Patience, master patience.....yeah, well mine is wearing down. Stay focused. Lots of my charts are mirroring the 2007 market top. I am desperately trying to see the roses and an upside breakout. The Canadian $TSX is still stuck around 12800.....This needs to breakout to the upside and normally at this time of year we would be. Sometimes it takes time to breakthrough a trendline of this significance. But it shouldn't need time if the overall market like the $SPX is surging to new highs and the investors are euphoric. This should be a hot knife through butter. The Canadian toonie should also be surging. $CDW is stuck around the par level with the $USD.

Stay tuned, the market is really trying to decide the direction after a 4 year run from the 2009 lows.

Good Trading,

Greg Schnell, CMT