Recently, this earnings campaign has been 'better' than expected according to Bob Pisani's work on the floor. Steve Grasso, a floor trader was not as optimistic. Two opinions, that's what makes a market. A buyer of bargains, or the seller of a trending market trendline breakdown.Lets make our own opinion.

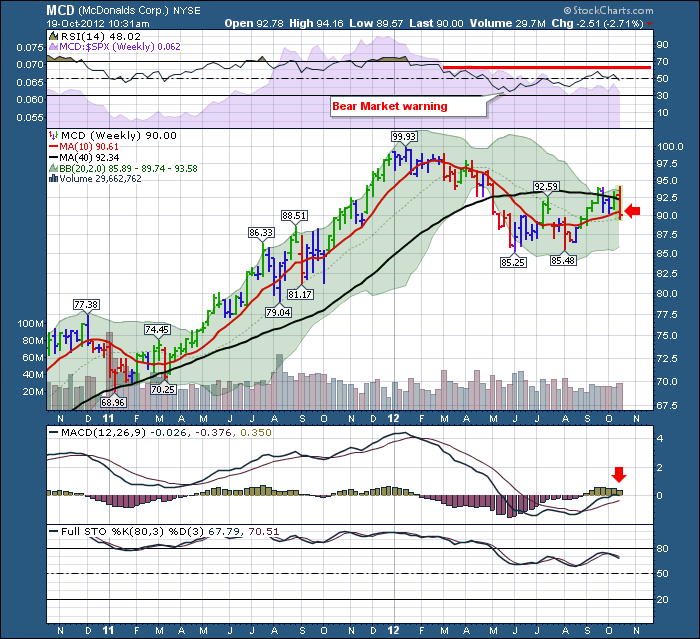

Here is MCD falling below its 40 WMA (week moving average) and the 10 WMA. I insert it here just because it was today. All the rest are techs.

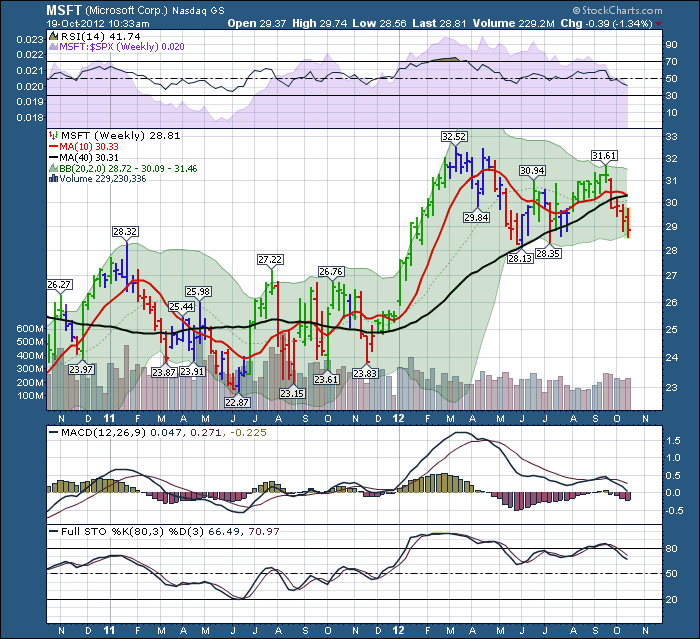

Here is MSFT

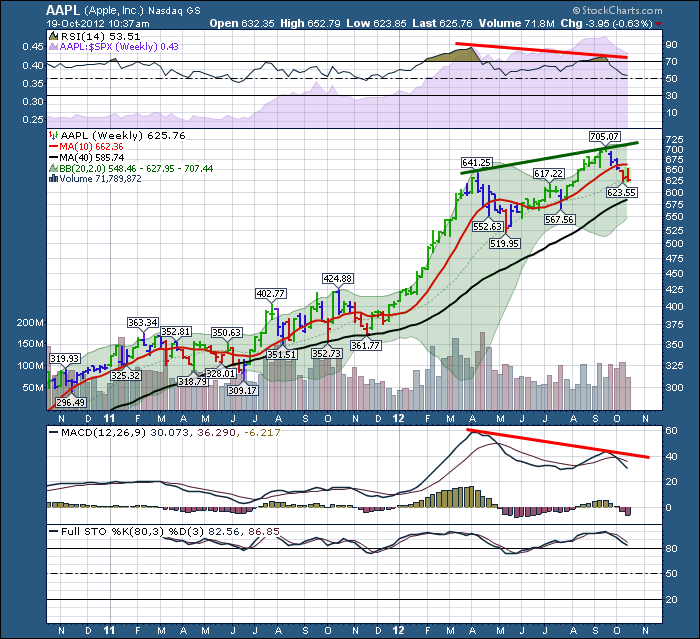

Here is AAPL

While this has not broken through the 40 WMA, The huge negative divergence and the loss of 12% while the SPX sits near the highs is an important divergence for me.

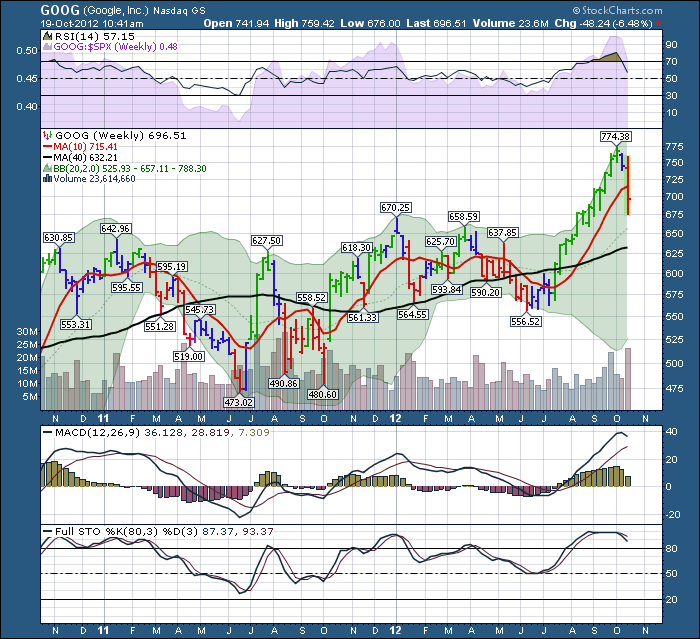

Google shows no divergence, but weak earnings. Google is a pretty interesting company. It is amazing how sensitive it is to the speed of the economy. An important support level for GOOG will be $650. Apparently click revenues have been dropping.

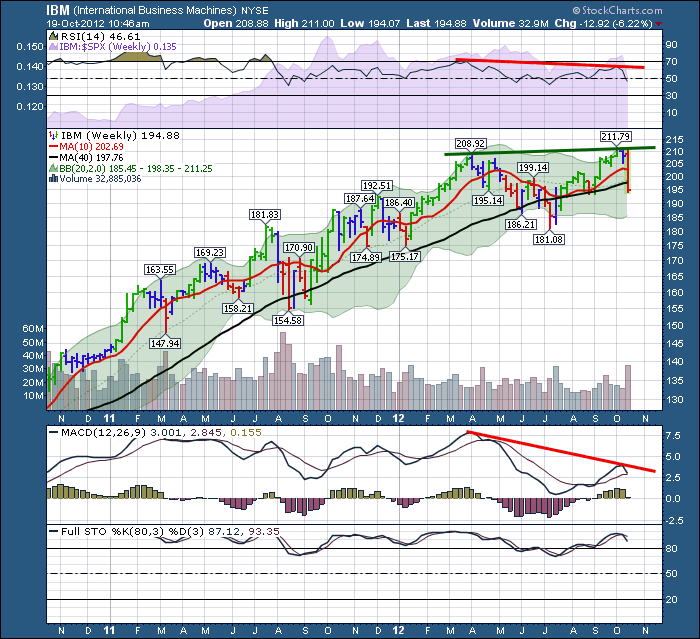

IBM cuts through the 10 WMA and the 40 WMA all in the same week. Huge Negative Divergence.

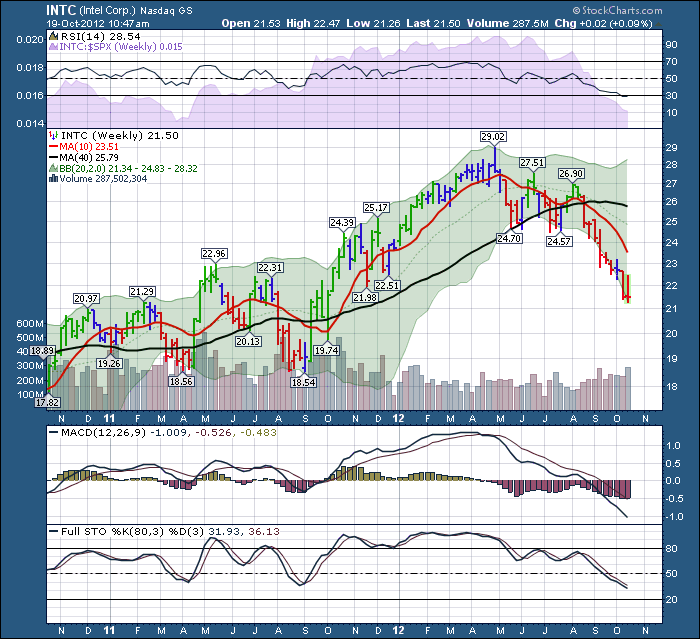

Here is Intel. Well below both MAs.

I will not bother to Chart HPQ and DELL. Both still falling. Unfortunately I don't have a chart for Samsung which might be going the other way. Would be interesting to see if it has negative divergence.

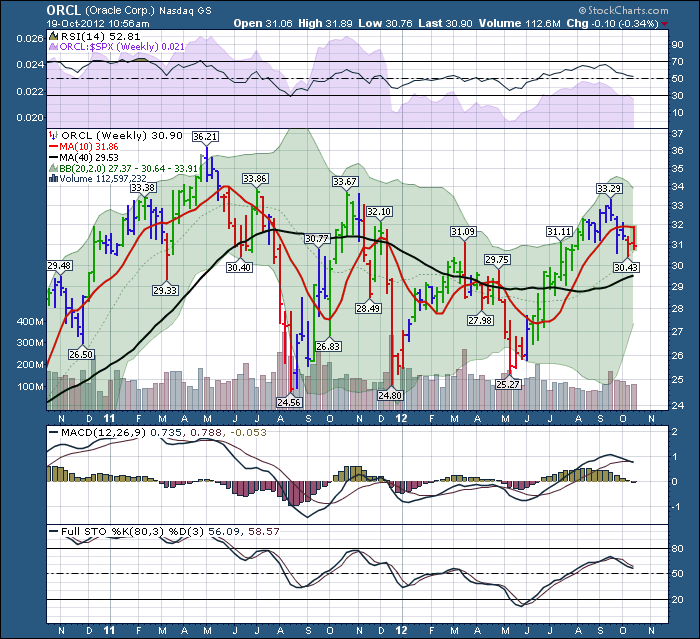

Oracle missed on revenues but earnings were ok.

falling below 10 WMA and the 40 WMA.

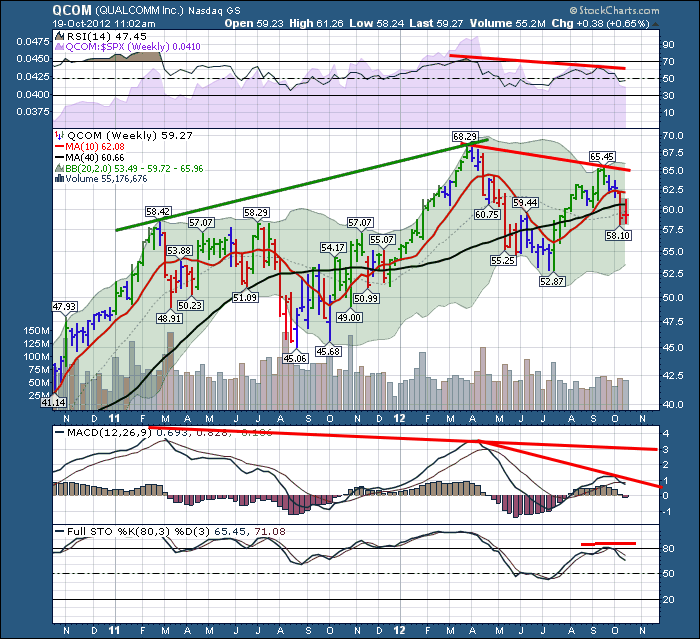

OK. So the 10 wma or 50 dma has been broken on every chart. It would also appear that the gorillas like GE missed as well. Many companies are missing the revenue line, but making the earnings per share by doing share buybacks etc.

All that to say...I am getting more and more concerned. The USD has positive divergence here.

Good Trading,

Greg Schnell, CMT