My thinking is leading me in a particular direction here. Today is a particularly interesting time.

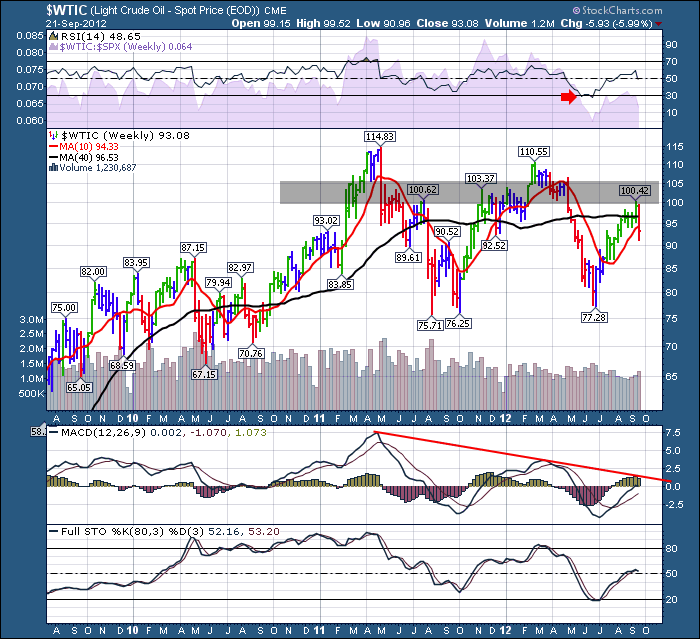

Crude was at Horizontal resistance. It tested above and failed.

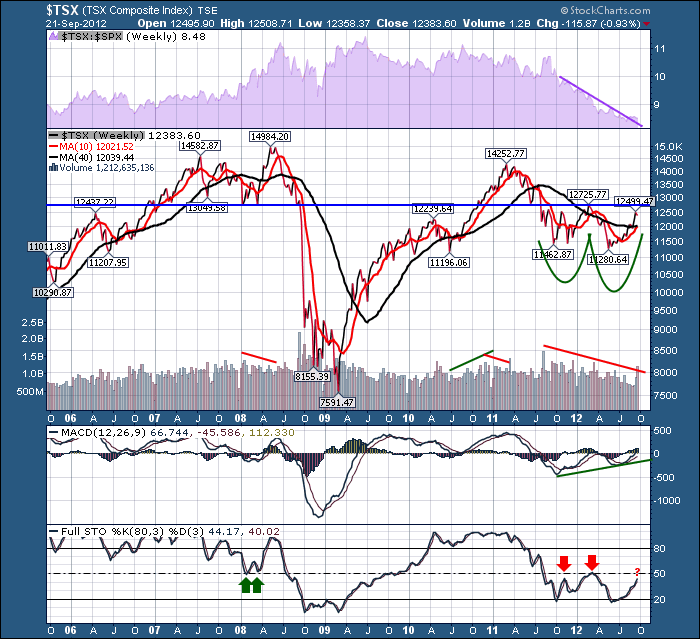

The $TSX is at a horizontal resistance. We are awaiting the breakout.

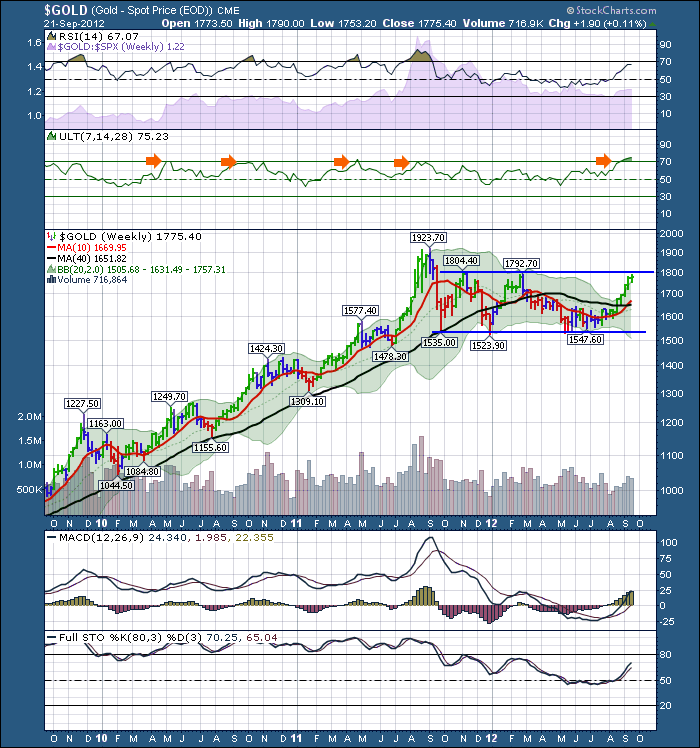

$GOLD is at horizontal resistance. We are awaiting the breakout.

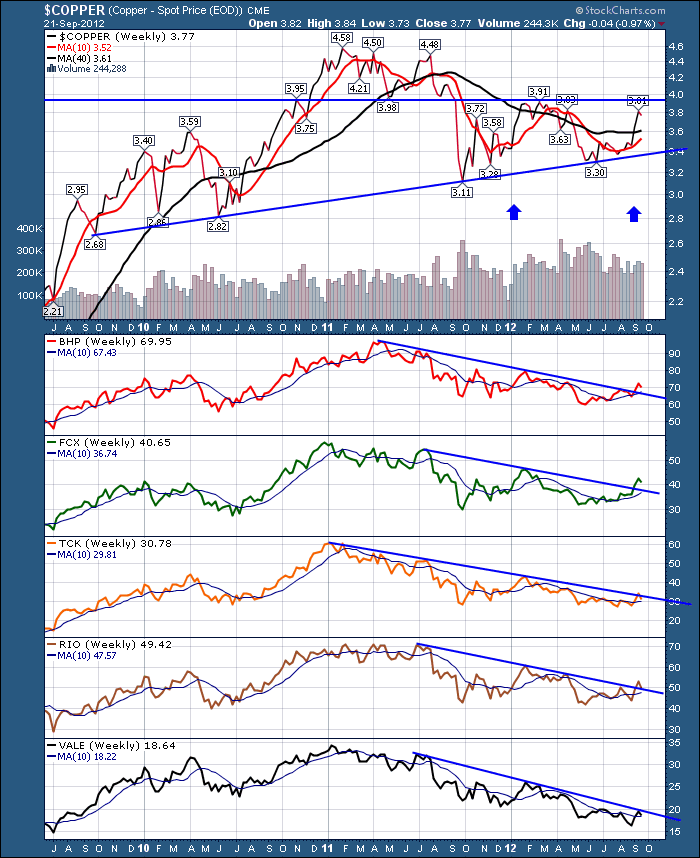

$Copper is at Horizontal resistance. We are awaiting the breakout.

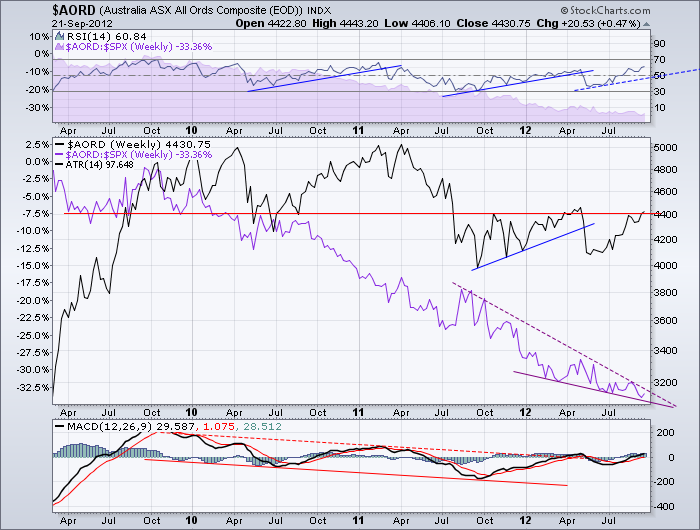

$AORD is at horizontal resistance. We are awaiting the breakout.

The Fed wants money to rotate out of bond funds and into commodities. We do too. Seeing the group accelerate from here would be a very bullish place.

We have to continue to watch the $USD and the $EURO. It will be part of the decision or the decision. The $USD got a little bounce off the 50% retracement level.

Its not a slam dunk that this commodities cycle goes higher. But it is important globally that it does go higher. The smart money from Sentiment trader is only 29% convinced things get better from here. The Retail investor seems to be all in. It feels a bit like Raiders of the lost Ark. Against all odds and with a few miracles Ben Bernanke is trying to escape getting hit by the big rolling boulder.

I want to make this clear. It is a bull market! Its a bull market till its not. All of this resistance is meaningful and we could push through. I am not happy that crude oil reversed $10 in a few days. The $WTIC MACD is slowing near zero. That needs to turn up here. All that to say, up is not inevitable. It is Fed policy with a pile of miracles that need to happen for the (QE) Infinity to exit safely. Breaking these resistance levels will be a great start. Watching the Bond trendlines break on the long term charts is just as important. More on that soon. The Fed wants low rates and commodities inflation. That is interesting math. Normally money rotates out of the 'safety of bonds' and into commodities. In this case the Fed hopes to keep the demand for bonds up so the interest rates stay low. So the Fed is the only buyer if the money goes the other way.

Good Trading,

Greg Schnell, CMT.