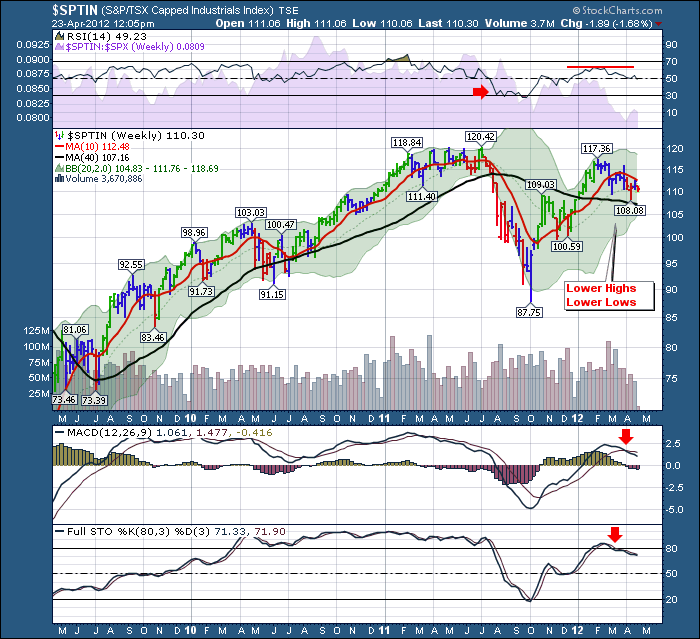

Here is the chart for the $SPTIN.

A few major concerns show up here. This has been declining for a while. Both the 40 week and the 10 week lines are pointed down. The RSI registered a bear market ahead. The Industrials are unable to push the RSI to overbought. It stopped in classic bear market territory. The full sto's have broken below 80 and the MACD has rolled over. THe MACD is still on the positive side of zero so that is somewhat good news.

The main problem is the lower highs and lower lows pattern. Losing it's 20 week MA would be a big problem. That is the centre line on the Bollinger bands. All of this is in contrast to the American Industrials.

Good Trading,

Greg Schnell, CMT