Well Yesterdays FOMC meeting was interesting. The data came out earlier than I was expecting.I was also surprised that the Fed was so focussed on generating inflation and avoiding deflation at all cost it seems. Was this QE3? Don't fight the Fed?

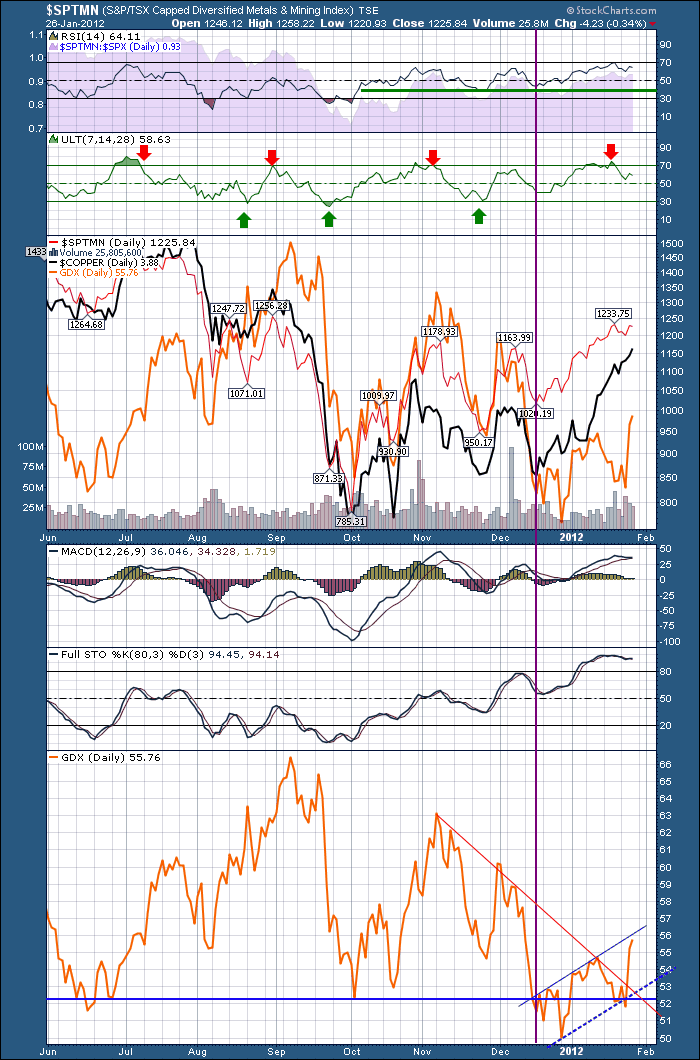

The Metals market took that to heart. So did GOLD.

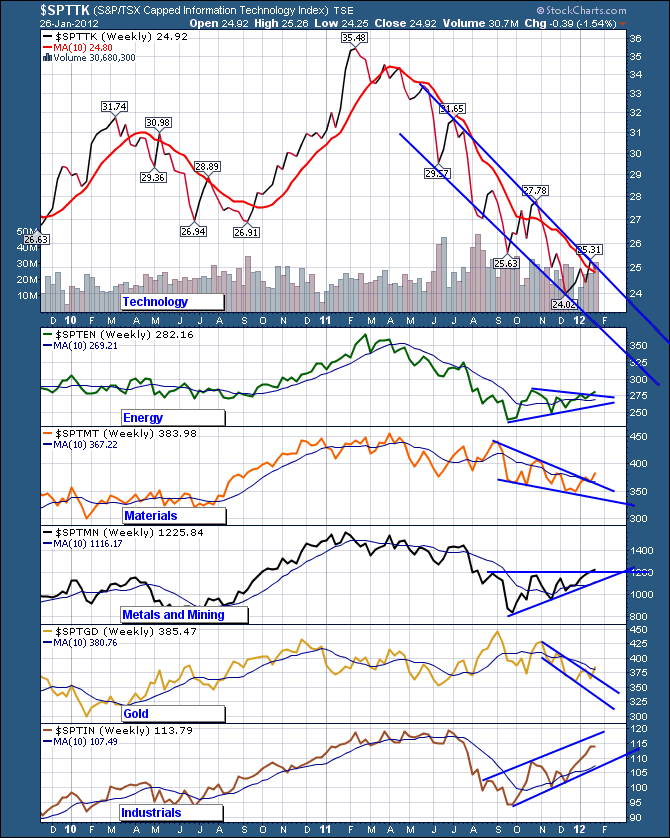

Here are the commodity sectors.

Notice how the GDX chart which I separated at the bottom looked like it was following Takkakka falls down.

Well the price was moving down significantly on the gold stocks. What a difference a day makes. Broke the red trendline and immediately changed the chart to making it look like it is breaking out to go higher. Which it clearly is. That was a change of direction as the fed announcement came out. The Previous blog (Wendesday ) I wrote about how all the charts are at a decision point. Gold Copper and the USD. Well, the Fed decided which way to go.

Here is copper.

So, the moral of the story is breakouts in Gold and Copper. Silver and OIL went the same direction. Is this just like QE2 in August of 2010 and we are breaking out to new highs. Full speed ahead? Great question... why wouldn't it be?Well we have been rallying for 4 solid months and usually the market at least takes a breather after earnings. SO I am reluctant to add to positions here. Find the strongest gold, silver, copper and oil stocks and see if you can stay in the trade. If you can it will be nice. But the stops may kick in if the overall market has to listen to EU news instead of earnings.

The Bond market didn't get any comfort from the Fed. It moved towards safety. The stock market has been pushing higher while all the short term indicators are screaming get out. But they have been for almost 2 weeks. Eventually they will be right, right? Do you believe the bond market or the stock market?

Trying to enjoy the satisfaction of a breakout is easier at a market low than a market 'high'. Of course we can't tell it is a high till we know the rest of the story. These are breakout signals. All breakouts should be acted on, even if a small position is taken. If it starts to work I can add. If it doesn't, I can have a stop kick you out. Or we can wait till a pullback shows up.

Good Trading.

Greg Schnell, CMT

About the author:

Greg Schnell, CMT, MFTA is Chief Technical Analyst at Osprey Strategic specializing in intermarket and commodities analysis. He is also the co-author of Stock Charts For Dummies (Wiley, 2018). Based in Calgary, Greg is a board member of the Canadian Society of Technical Analysts (CSTA) and the chairman of the CSTA Calgary chapter. He is an active member of both the CMT Association and the International Federation of Technical Analysts (IFTA).

Learn More