OK which one am I talking about?

THe Nat gas trade or the long bond trade?

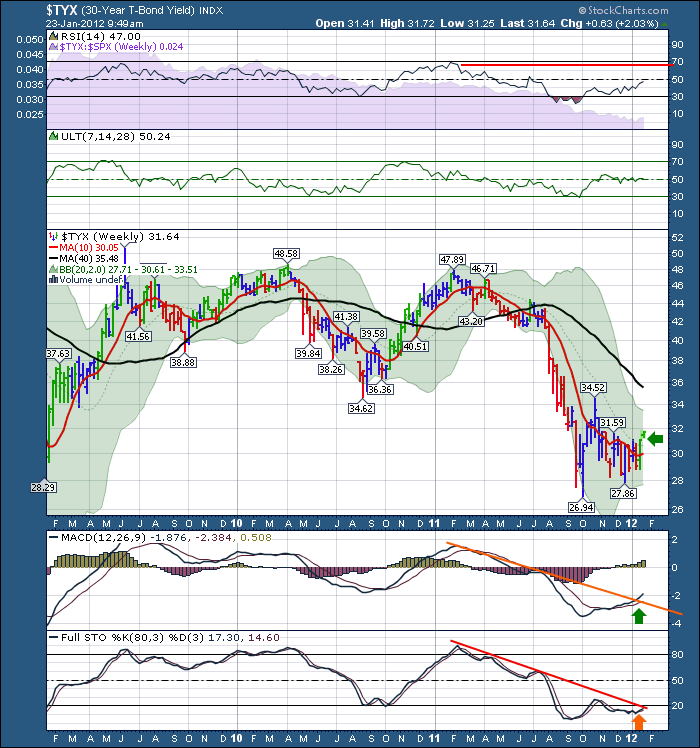

Well, it's the long bond trade.

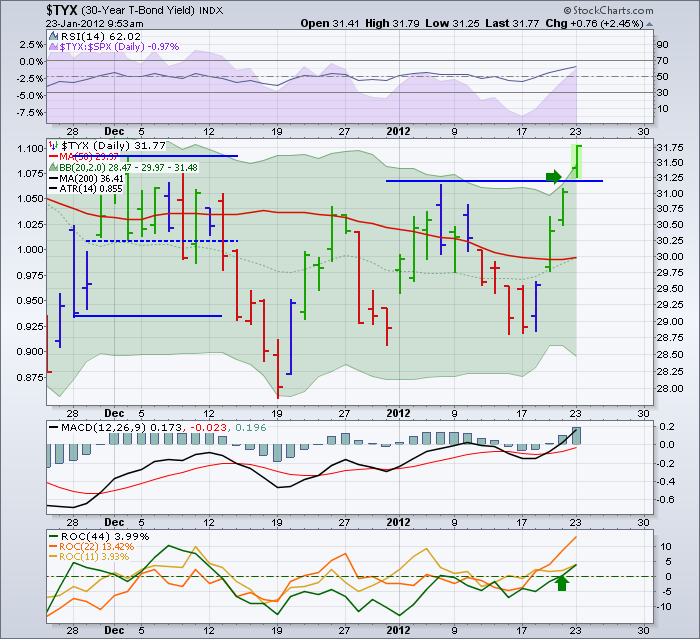

Here is a picture of the daily zoomed in on the latest time period.

So this is clearly a breakout.

Again, how can we trade it? Well, we have some choices but most of them are leveraged choices.

Most importantly, we want our stop set for sure. The overall market seems to be screaming overbought. If things turn quickly, this will too. So the stop is either right at your buy point, or just under. If this is going to take a whole bunch of us in, only to reverse, the stop will be very important.

So HTD.TO is the cdn way.

TBT is the US way.

Today, it is breaking out. It is also the most common place for a reversal. This trade without a stop is ill-advised.

Good Trading,

Greg Schnell, CMT

About the author:

Greg Schnell, CMT, MFTA is Chief Technical Analyst at Osprey Strategic specializing in intermarket and commodities analysis. He is also the co-author of Stock Charts For Dummies (Wiley, 2018). Based in Calgary, Greg is a board member of the Canadian Society of Technical Analysts (CSTA) and the chairman of the CSTA Calgary chapter. He is an active member of both the CMT Association and the International Federation of Technical Analysts (IFTA).

Learn More