Archived News

The Mindful Investor4mo ago

Can You Really Predict Stock Market Success Using the Yield Curve?

In this video, Dave reflects on the shape of the yield curve during previous bull and bear cycles with the help of StockCharts' Dynamic Yield Curve tool Read More

Add-on Subscribers

OptionsPlay with Tony Zhang4mo ago

Best Bullish and Bearish OptionsPlay Ideas for the Week!

In this video, Tony shows how he starts his week with a clear technical and fundamental perspective of the stocks he's likely going to enter, and of options positions throughout the week, and how you can apply that yourself Read More

Add-on Subscribers

OptionsPlay with Tony Zhang4mo ago

NVDA Stock Price Gives Bullish Signal: An Ultimate Options Strategy to Maximize Gains

As demand for advanced computing and artificial intelligence continues to surge, NVIDIA Corp. (NVDA) stands at the forefront of this revolution, with recent NVDA stock price action suggesting it may offer a compelling bullish opportunity Read More

DecisionPoint4mo ago

DP Trading Room: Swenlin Trading Oscillators Top!

On Friday our short-term Swenlin Trading Oscillators (STOs) turned down even after a rally Read More

GoNoGo Charts4mo ago

Equities Remain in Strong "Go" Trend, Edging Ever Higher

Good morning and welcome to this week's Flight Path. The "Go" trend in equities continues this week and we saw an uninterrupted week of strong blue bars. Treasury bond prices have seen a return to a "Go" trend with a pale aqua bar at the end of the week. U.S Read More

The Mindful Investor4mo ago

Five Ways You Should Use ChartLists Starting Today!

Having used many technical analysis platforms over my career as a technical analyst, I can tell you with a clear conscience that the ChartList feature on StockCharts provides exceptional capabilities to help you identify investment opportunities and manage risk in your portfolio Read More

ChartWatchers4mo ago

Navigating Holiday Stock Market Changes: Turn Sentiment Shifts into Successes

The day before Thanksgiving, the stock market took a little breather. But the weekly performance was still impressive. The Dow Jones Industrial Average ($INDU) remains the broader index leader, rising 0.96% for the week Read More

RRG Charts4mo ago

Can the S&P 500 Rally Without Tech?

In this video from StockCharts TV, Julius takes a deep dive into US sector rotation, breaking it down into offensive, defensive and cyclical sectors Read More

Trading Places with Tom Bowley4mo ago

Here's Why the Small Cap IWM Will Soar Nearly 70% by the End of 2025

If you want big returns, I'm convinced you'll find them in small caps. When I make bold predictions, and many of you know that I do fairly often, it's usually supported by long-term perspective Read More

Art's Charts4mo ago

Plunge in Treasury Yields Triggers Gap-Surge in Home Builders

The 10-yr Treasury Yield reversed its upswing with a sharp decline and the Home Construction ETF (ITB) reacted with a noteworthy gap-surge. Today's report analyzes the yield, the TBond ETF (IEF) and ITB Read More

Don't Ignore This Chart!4mo ago

How to Trade MicroStrategy's Painful Plunge: The Levels Every Investor Must Watch

On November 21, 2024, Citron Capital shorted MicroStrategy Inc. (MSTR). What made this confrontation particularly electrifying was the clash between two titans: Citron, a legendary short seller, and MicroStrategy, arguably the strongest stock of 2024 Read More

Members Only

Martin Pring's Market Roundup4mo ago

Three Charts That Could Be About to Break in a Big Way

This article is not centered around a specific theme; rather, it focuses on some charts which look as if they are about to signal an important change in trend. In this case, "important" is defined as a forthcoming move lasting at least 3-months Read More

Add-on Subscribers

OptionsPlay with Tony Zhang4mo ago

OptionsPlay: Macro Market Outlook and Options Strategies

Join Tony as he walks you through a Macro Market outlook, and shares his top bearish and bullish options trading ideas. He talks growth vs. value, commodities, bonds, the Dollar Index, sectors like homebuilders and semiconductors, and stocks like NVDA, DIS, INTC, and more Read More

The Mindful Investor4mo ago

Five Must-Have Tools for Analyzing Stock Charts

In this video, Dave shares how he uses the powerful ChartLists feature on StockCharts to analyze trends and momentum shifts as part of his daily, weekly, and monthly chart routines Read More

ChartWatchers4mo ago

Market Movements Today: Investors Rejoice as Stocks Rally, Bitcoin and Gold Backslide

It's a short trading week, and the stock market is rallying. It's clear that Wall Street liked President-elect Donald Trump's choice of Scott Bessent for Treasury Secretary Read More

Add-on Subscribers

OptionsPlay with Tony Zhang4mo ago

A Bullish Opportunity in CrowdStrike (CRWD) with OptionsPlay Strategy Center

As cyber threats continue to escalate globally, CrowdStrike Holdings, Inc. (CRWD) has emerged as a leading cybersecurity firm poised for significant growth Read More

GoNoGo Charts4mo ago

The Finances Look Good For Equity Trend

Good morning and welcome to this week's Flight Path. The "Go" trend in equities has proved to be resilient as we saw strong blue "Go" bars return this week. Treasury bond prices remained in a "NoGo" although this week we did see weaker pink bars as the trend showed weakness. U.S Read More

DecisionPoint4mo ago

Market Rally Broadens - New All-Time Highs?

Today Carl looks at the small-caps and mid-caps that have now begun to outperform the market. Clearly the rally is broadening, the question now is can we continue to make new all-time highs Read More

Trading Places with Tom Bowley4mo ago

Small and Mid Caps: Turning Lemons Into Lemonade

No matter how you slice it, small and mid caps have been absolutely crushed on a relative basis since 2021. The unfortunate part about this is that most traders have recency bias Read More

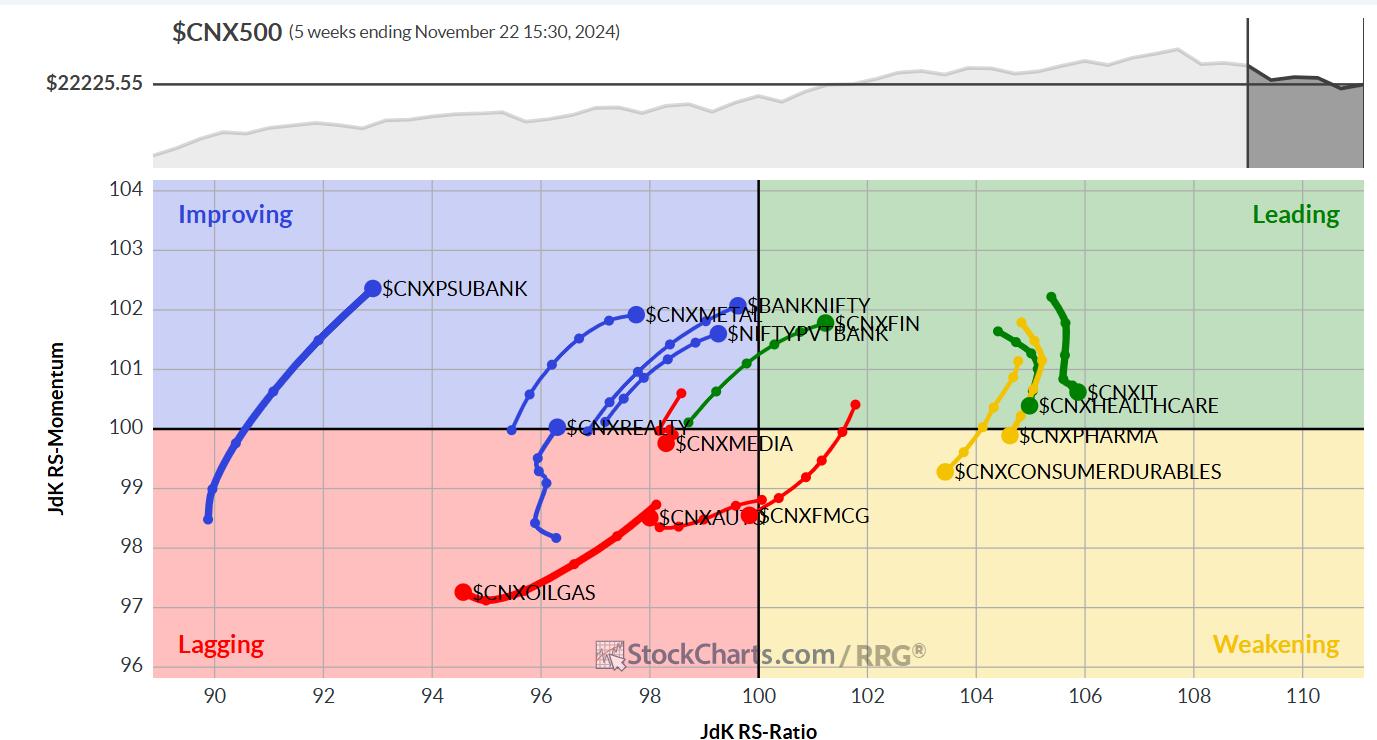

Analyzing India4mo ago

Week Ahead: NIFTY Defends This Crucial Support; Chase Rebounds Mindfully

In a truncated trading week, the Indian equities closed the week with gains thanks to a robust technical rebound that it witnessed on Friday Read More

The MEM Edge4mo ago

These Old-School Stocks Have Joined The AI Rally!

In this StockCharts TV video, Mary Ellen reviews the broad-based rally that pushed the Equal-Weighted SPX to new highs Read More

The Mindful Investor4mo ago

2024 is Shaping Up Like 2021, Which Did Not End Particularly Well

I've always found technical analysis to be a fantastic history lesson for the markets. If you want to consider how the current conditions relate to previous market cycles, just compare the charts; you'll usually have a pretty good starting point for the discussion Read More

ChartWatchers4mo ago

An All-Around Rally: Navigating Stocks, US Dollar, Gold, and Bitcoin Price Action

The last full trading week before the Thanksgiving holiday has ended on a positive note. Following up on yesterday's blog post, the S&P 500 Equal Weighted Index ($SPXEW) has continued to outperform the S&P 500's price action and hit a new all-time high Read More

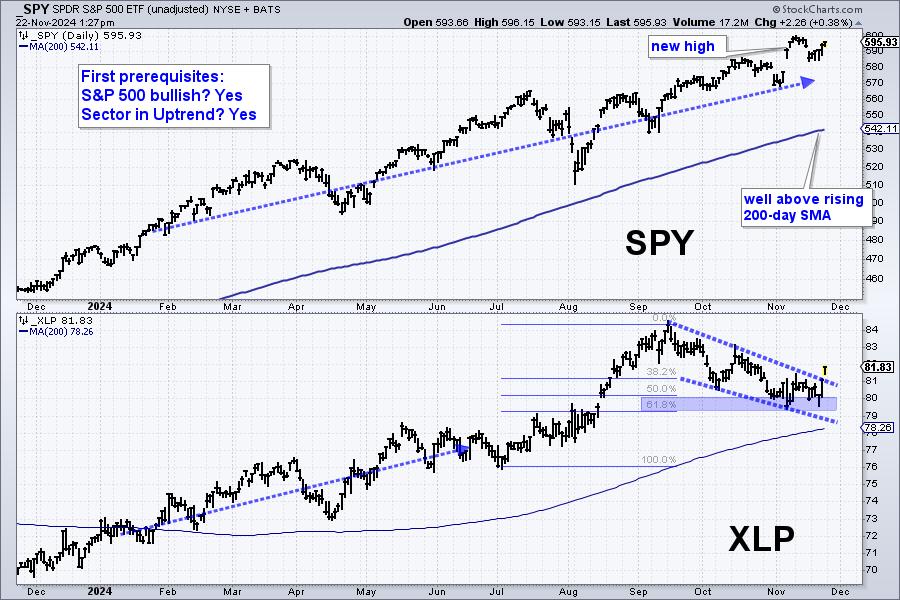

Art's Charts4mo ago

Four Prerequisites to Improve Your Odds - A Live Example

Even though trading based on chart analysis involves some discretionary decisions, chartists can improve the odds of success by systematizing their process. This report will show four prerequisite filters based on a top-down approach Read More

DecisionPoint4mo ago

Bonds Get Death Cross SELL Signal

Today, the 20-Year Bond ETF (TLT) 50-day EMA crossed down through the 200-day EMA (Death Cross), generating an LT Trend Model SELL Signal. This was the result of a downtrend lasting over two months Read More

ChartWatchers4mo ago

Financial Upswing: Understanding the Stock Market Rally and Yield Rise

The afternoon turnaround seems to be more the norm than the exception. Thursday's stock market action followed the trend. What makes Thursday's turnaround more pronounced is a possible resumption of the uptrend in equities. But not all stocks are created equal Read More

Don't Ignore This Chart!5mo ago

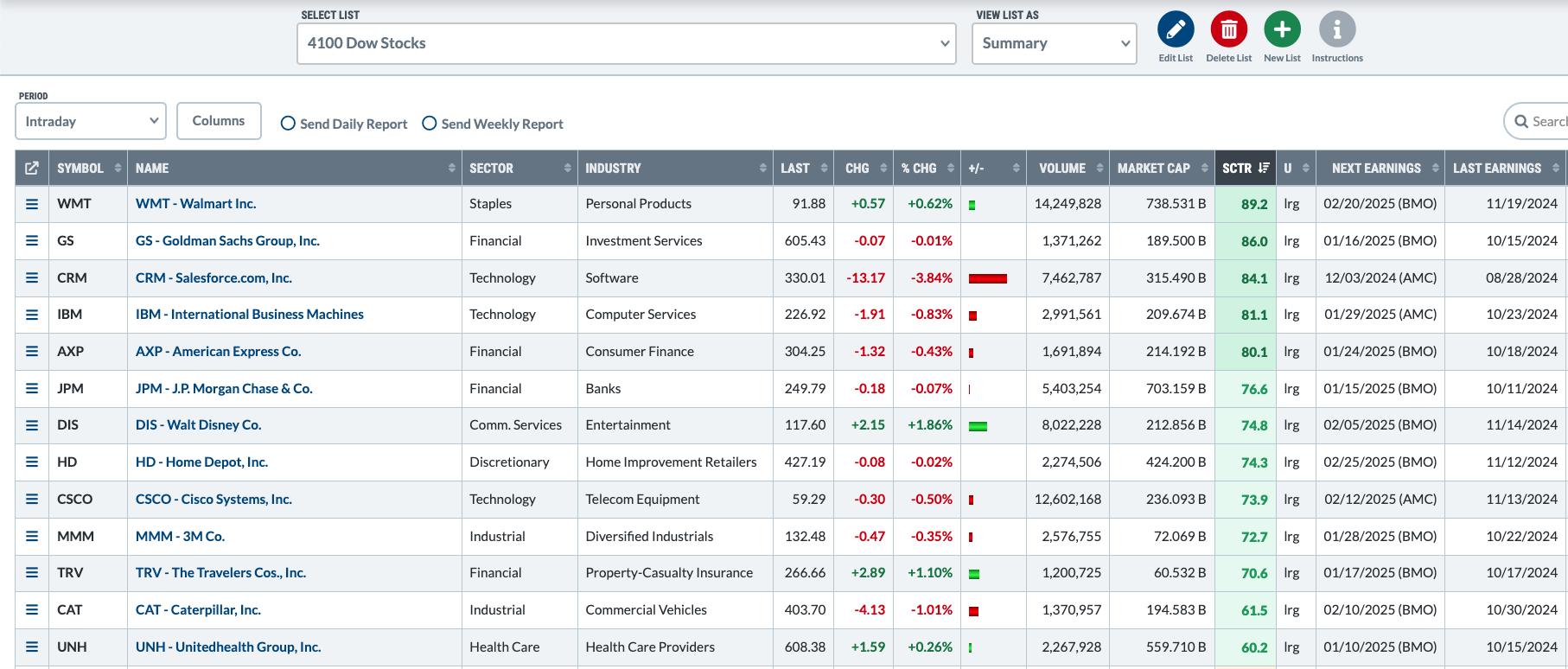

AppLovin's 1,303% Rise: The Hidden Power of the SCTR Report

How do you find the next big stock before it gains the investing public's attention? It's tricky, but there are only two ways to spot a so-called "hot stock" before the social buzz Read More

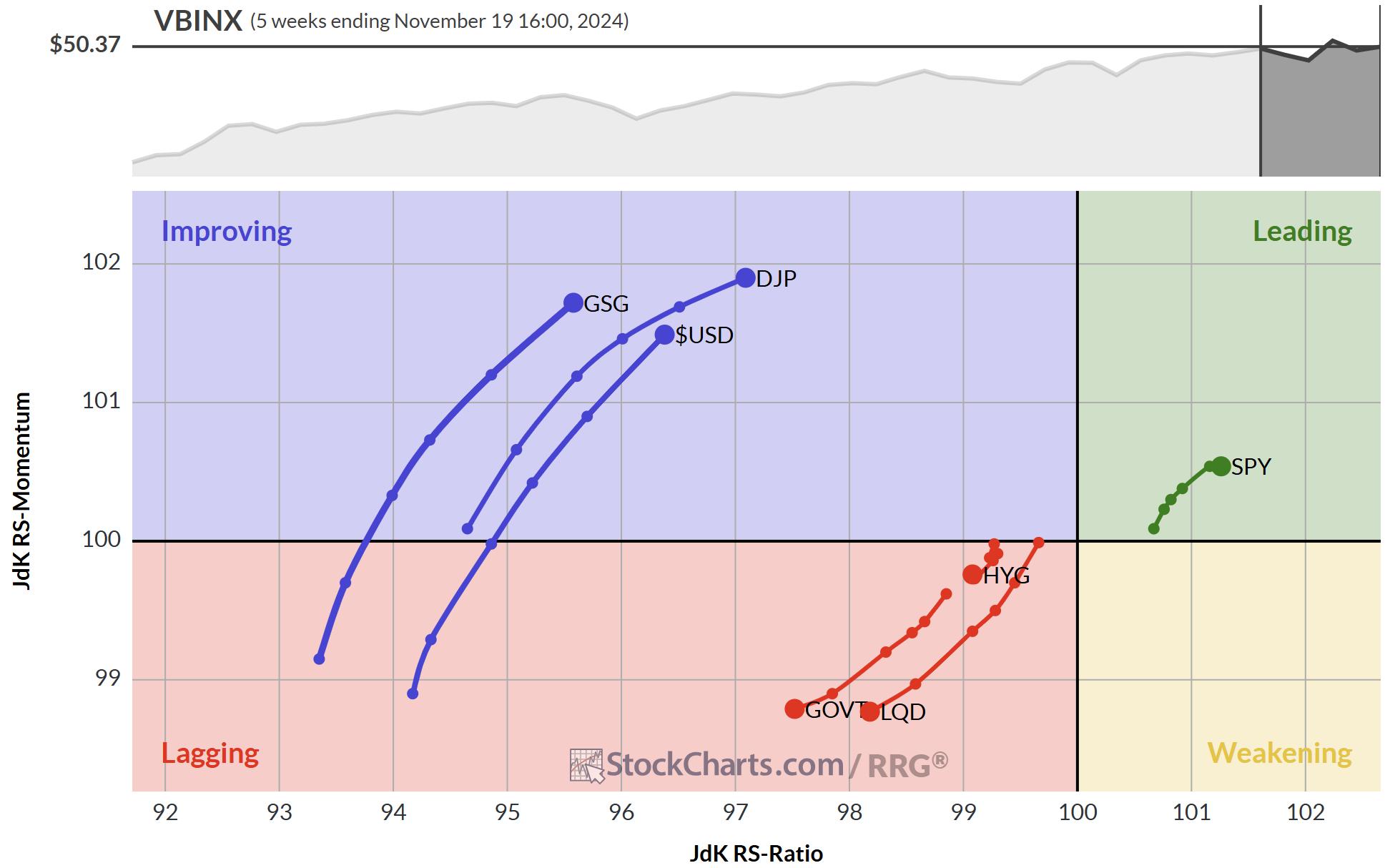

RRG Charts5mo ago

Is the USD Setting Up for a Perfect Rally?

After the election, things have hardly settled in the world. New developments in the Ukraine-Russian conflict and the Middle East are still volatile. Worst of all, I am in Redmond, WA this week, where last night's storm caused a massive power outage in this region Read More

Members Only

Martin Pring's Market Roundup5mo ago

These Country ETFs are Looking Particularly Vulnerable

Chart 1, below, compares the S&P Composite to the Europe Australia Far East ETF (EFA), which is effectively the rest of the world. It shows that US equities have been on a tear against its rivals since the financial crisis Read More

Stock Talk with Joe Rabil5mo ago

Be ALERT for Warning Signs - S&P 500 Downturn

In this exclusive StockCharts video, Joe goes into detail on the S&P 500 ETF (SPY), sharing why using MACD and ADX together can be beneficial -- especially in the current environment Read More

The Mindful Investor5mo ago

Sector Rotation Suggests Offense Over Defense

Institutional investors tend to focus heavily on relative strength; after all, this is essentially how they are evaluated in their performance as money managers! In this article, let's review three ways to analyze relative strength and what these charts are telling us about secto Read More

Don't Ignore This Chart!5mo ago

SCTR Report: The Palantir Trade Follow-Up—Transform Insights into Actions

There are times when the price action of a stock is worth analyzing further. This article is a follow-up to last week's StockCharts Technical Rank (SCTR) Report pick, Palantir Technologies (PLTR) Read More

The Mindful Investor5mo ago

Three Ways Top Investors Track Sector Rotation

In this video, Dave outlines three tools he uses on the StockCharts platform to analyze sector rotation, from sector relative strength ratios to the powerful Relative Rotation Graphs (RRG) Read More

Art's Charts5mo ago

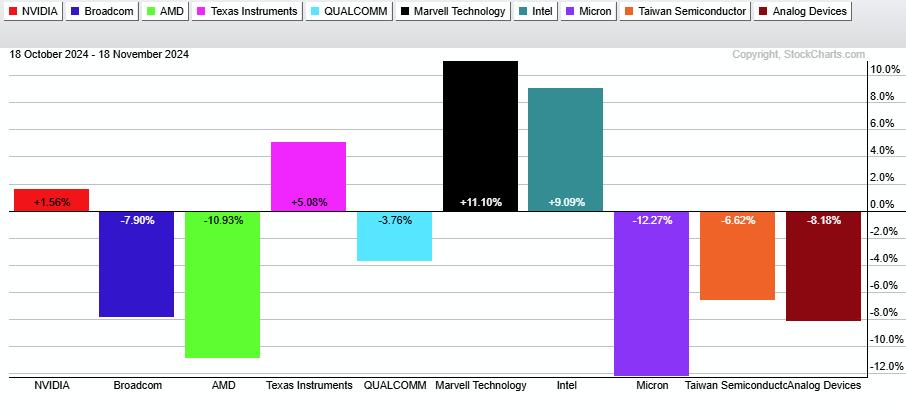

A Tale of Two Semiconductor ETFs - Why is SMH holding up better than SOXX?

Even though the iShares Semiconductor ETF (SMH) and the VanEck Semiconductor ETF (SOXX) have many similarities, there are some big differences in their component weightings and performance. Namely, SMH allows more concentration than SOXX and SMH is holding up better than SOXX Read More

Add-on Subscribers

OptionsPlay with Tony Zhang5mo ago

Macro Market Outlook and Best Options Trade Ideas!

Join Tony as he walks you through a Macro Market outlook, where he shares his top bearish and bullish options trading ideas, These include Disney (DIS), Shopify (SHOP), Intel (INTC), Adobe (ADBE), and Apple (AAPL). He explores growth vs Read More

ChartWatchers5mo ago

MarketCarpets Secrets: How to Spot Winning Stocks in Minutes!

When looking for stocks to invest in, spotting strong stocks in promising sectors poised to bounce can be tricky and complicated Read More

DecisionPoint5mo ago

Stocks: "...a PERMANENTLY high plateau"?

Today we explore the bullish sentiment that has taken SPX valuations to the moon. There are many out there that believe we have hit a plateau on prices that will continue permanently Read More

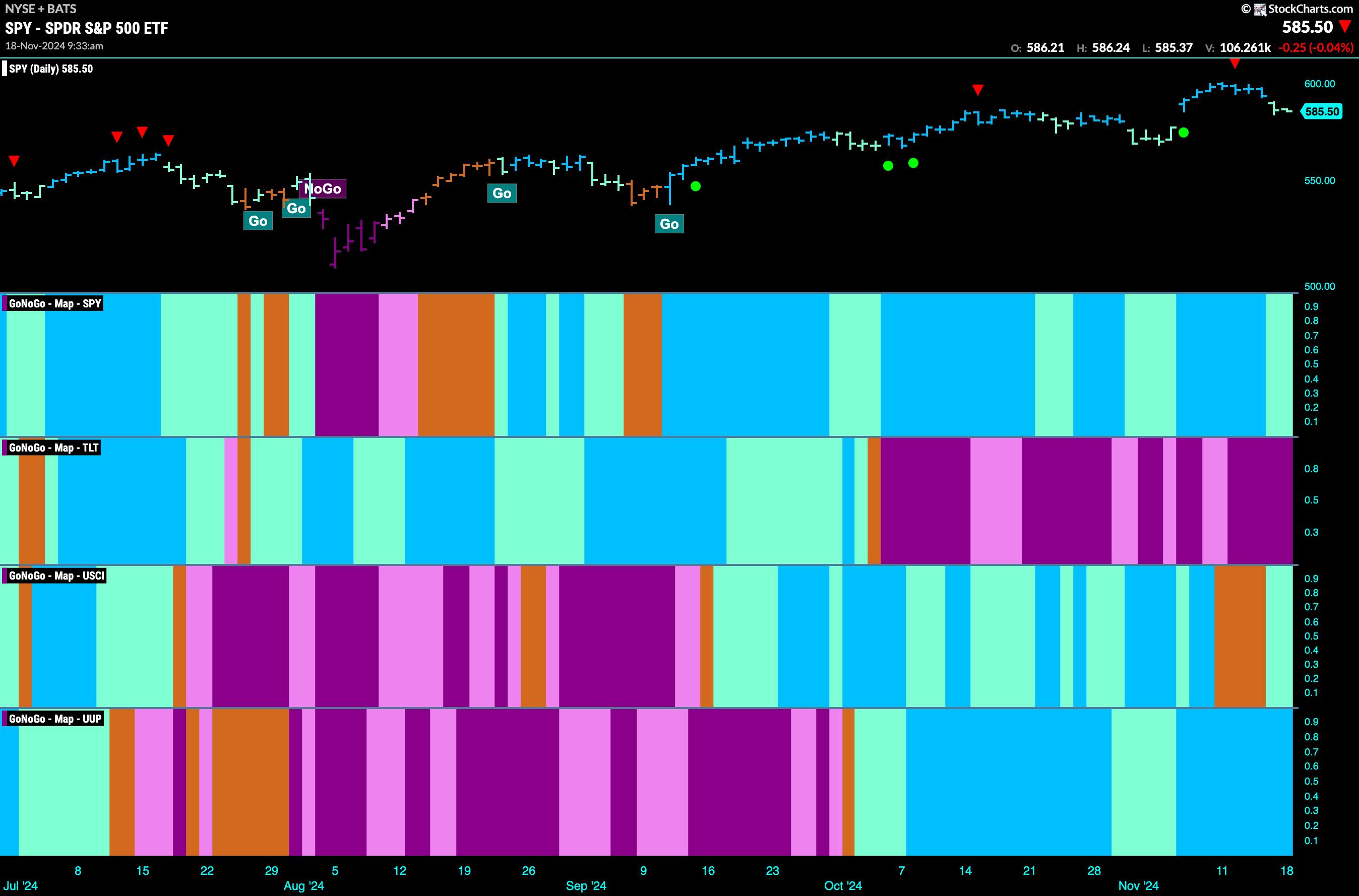

GoNoGo Charts5mo ago

Equities Look for "Energy" in "Go" Trend

Good morning and welcome to this week's Flight Path. Equities saw the "Go" trend continue this week but we saw weaker aqua bars at the end of the week. Treasury bond prices painted strong purple "NoGo" bars as the weight of the evidence suggested the "NoGo" will continue. U.S Read More

Trading Places with Tom Bowley5mo ago

3 Breakouts Ready for Massive Climbs!

As the secular bull market takes a short-term pause, now is the time to research tremendous opportunities that lie ahead Read More

The MEM Edge5mo ago

Don't Miss These Breakouts Poised to Trade Higher!

In this StockCharts TV video, Mary Ellen reveals what took place last week and how the markets closed. She also revealed what drove price action, and what to be on the lookout for next week. In addition, she shares several stocks that broke out of powerful bases on bullish news Read More