Archived News

ChartWatchers5mo ago

Tech Stocks Plunge: What This Means for Investors

"The economy is not sending any signals that we need to be in a hurry to lower rates." These words from Chairman Powell impacted the stock market much more than this week's inflation data Read More

DecisionPoint5mo ago

Biotechs Fall Apart with Dark Cross Neutral Signal

(This is an excerpt from the subscriber-only DP Weekly Wrap for Friday) On Friday, the Biotechnology ETF (IBB) 20-day EMA crossed down through the 50-day EMA (Dark Cross) and above the 200-day EMA, generating an IT Trend Model NEUTRAL Signal Read More

The Mindful Investor5mo ago

Are the Magnificent 7 Still the Kings of Wall Street?

There's no denying the strength that the mega-cap growth names have exerted on the equity markets in 2024 Read More

Add-on Subscribers

OptionsPlay with Tony Zhang5mo ago

Spotting a Bullish Opportunity in Zscaler (ZS) with OptionsPlay Strategy Center

As the cybersecurity landscape continues to evolve with increasing digital threats, Zscaler, Inc. (ZS) stands out as a new opportunity after lagging for most of 2024. Recent chart setups in Zscaler stock suggest ZS may be gearing up for a significant bullish trend Read More

Analyzing India5mo ago

Week Ahead: NIFTY May See Mild Rebounds; Painful Mean Reversion May Continue

The Indian benchmark Nifty 50 extended its corrective decline. Over the past four sessions of a truncated week, the Nifty 50 index remained largely under selling pressure, and the markets continued with their process of mean-reversion Read More

ChartWatchers5mo ago

Riding the Cryptocurrency Wave: How to Maximize Your Gains

With cryptocurrencies evolving from speculative assets to a global economic force, investors face a critical question: how can you filter out the noise to pinpoint coins that truly matter? Whether cryptocurrency trading is part of your financial strategy or not, it's becoming cle Read More

Add-on Subscribers

OptionsPlay with Tony Zhang5mo ago

Upgrade Your Options Trading with OptionsPlay on StockCharts

Should you buy calls/puts? Should you write covered calls? Or should you trade bull/bear vertical spreads? That's a lot to chew on -- and it's just the beginning. Once you decide on a strategy, you'll have to decide on which strikes and expirations to choose Read More

Trading Places with Tom Bowley5mo ago

This Industry Just Broke Out And Is Poised To Lead U.S. Equities Higher

Now that Q4 historical bullishness has kicked in, it's time to allow the bears to go into hibernation, while the bulls search for key leadership to drive prices higher Read More

The Mindful Investor5mo ago

The Sign of Strong Charts Getting Stronger

I was originally taught to use RSI as a swing trading tool, helping me to identify when the price of a particular asset was overextended to the upside and downside Read More

DecisionPoint5mo ago

Key Support Levels for Gold

In today's DP Alert short video we discuss the key support levels for Gold as it has likely begun a longer-term correction. We also take a look at Gold Miners under the hood! Charts and commentary are taken from our subscriber-only DP Alert publication Read More

Stock Talk with Joe Rabil5mo ago

Simple Way to Find Confluence FAST Using Moving Averages

In this exclusive StockCharts video, Joe explains how to use an 18 simple moving average in multiple timeframes to identify when a stock has confluence amongst 2-3 timeframes. He shows how to start with the higher timeframes first, before working down to the lower ones Read More

Don't Ignore This Chart!5mo ago

The SCTR Report: Palantir Stock's Rise Makes It the Hottest AI Play

Palantir Technologies (PLTR) has occasionally appeared in the Top 10 StockCharts Technical Rank (SCTR) Reports. More recently, it has reached the top 5, making it a stock worth analyzing. Palantir is a data analytics company that could benefit from the AI boom Read More

Members Only

Martin Pring's Market Roundup5mo ago

The Dollar's Technical Position is Crucial from a Short, Intermediate, Primary, and Secular Standpoint

Chart 1 shows the Dollar Index has been in a trading range for the last couple of years and is now at resistance in the form of its upper part. The big question relates as to whether it can break to the upside, or if the resistance will once again be overwhelming Read More

The Mindful Investor5mo ago

Are Extremely Overbought Conditions Good or Bad for Stocks?

When a stock shows an RSI value above 80, is that a good thing or a bad thing? In this video, Dave reviews a series of examples showing this "extreme overbought" condition, highlights how these signals usually occur not at the end of, but often earlier in an uptrend phase, and un Read More

ChartWatchers5mo ago

Riding the Stock Market's Wave: How to Maximize Your Gains

The post-election euphoria may have taken a breather on Tuesday, as the US stock market indexes closed lower. The tech-heavy Nasdaq Composite ($COMPQ) was only lower by 0.09%, whereas the S&P 600 Small Cap Index ($SML) was down the most—it closed lower by 1.54% Read More

Don't Ignore This Chart!5mo ago

What Seasonality Charts Reveal About the Top Sectors to Watch Right Now!

Where might you invest as the year winds down and holiday spending kicks into high gear? A look at historical seasonality trends might help you figure out which sectors tend to outperform in the final months and into the new year Read More

RRG Charts5mo ago

MUST SEE Updates to RRG Charts on StockCharts!

In this video from StockCharts TV, Julius pulls the curtain back on the updated Relative Rotation Graphs that are now available on the StockCharts website Read More

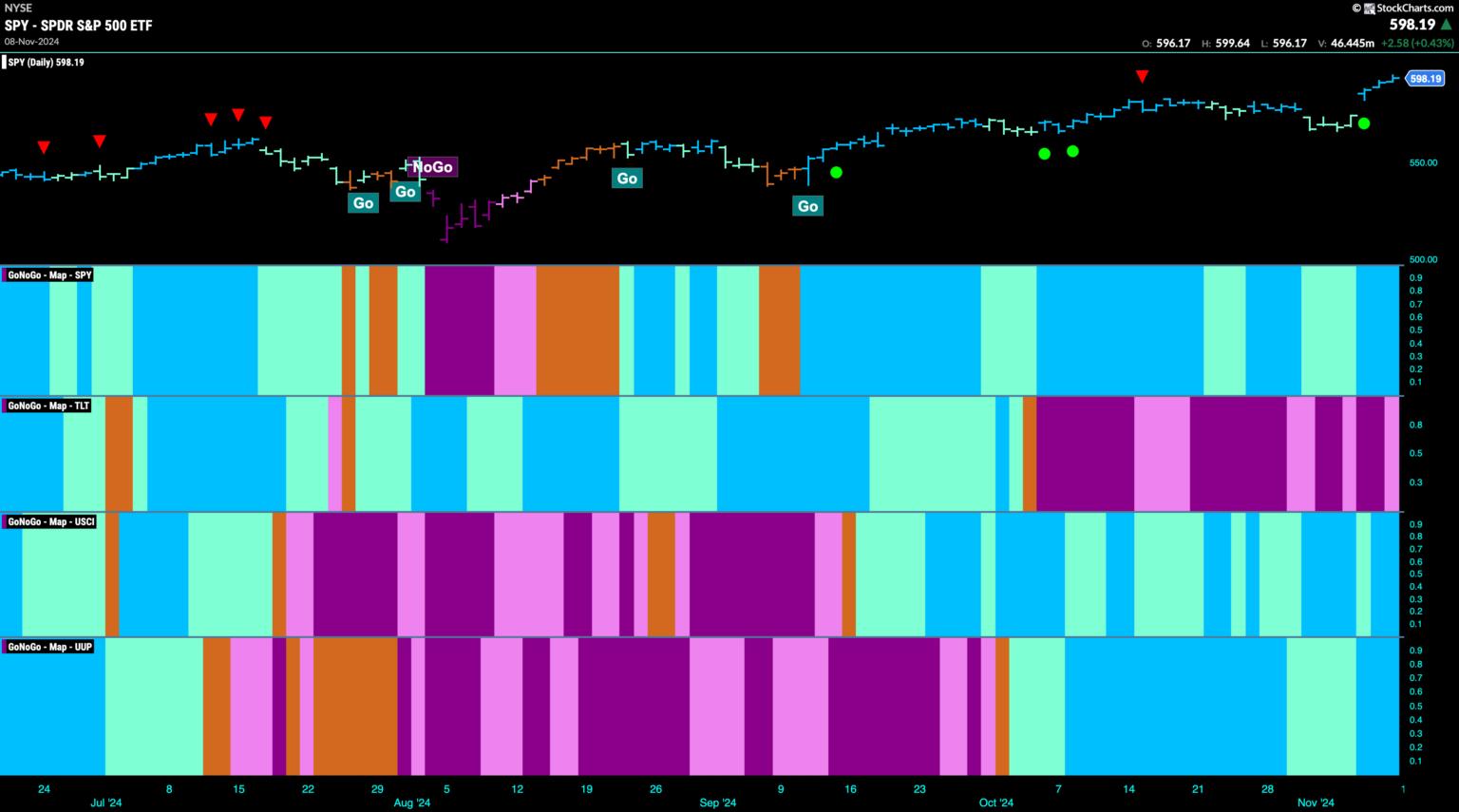

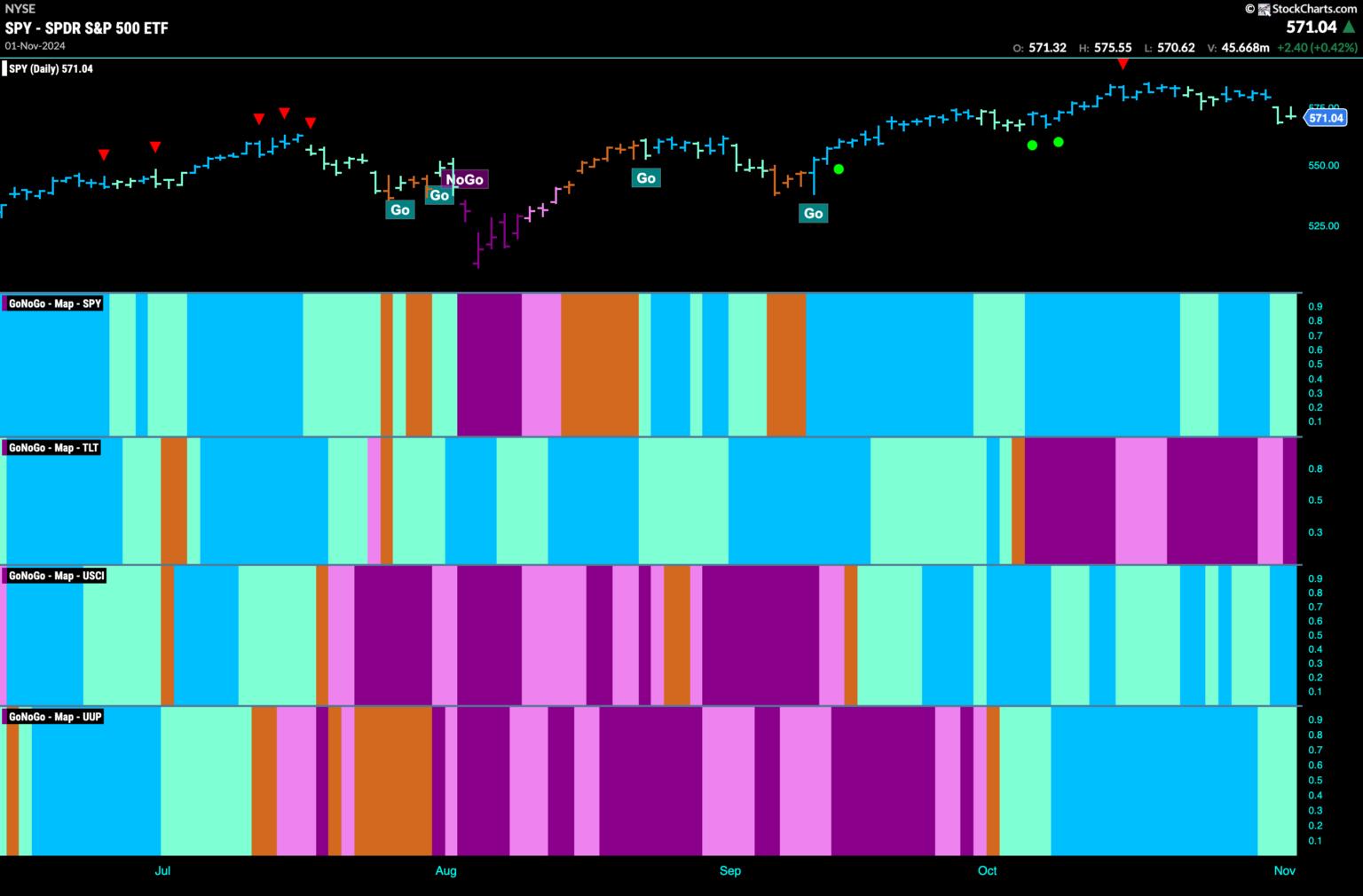

GoNoGo Charts5mo ago

Equity "Go" Trend Sees Surge in Strength as Financials Drive Price Higher

Good morning and welcome to this week's Flight Path. Equities saw the "Go" trend continued this week and price gapped higher after some weaker aqua bars. We now see GoNoGo Trend painting strong blue bars at new highs Read More

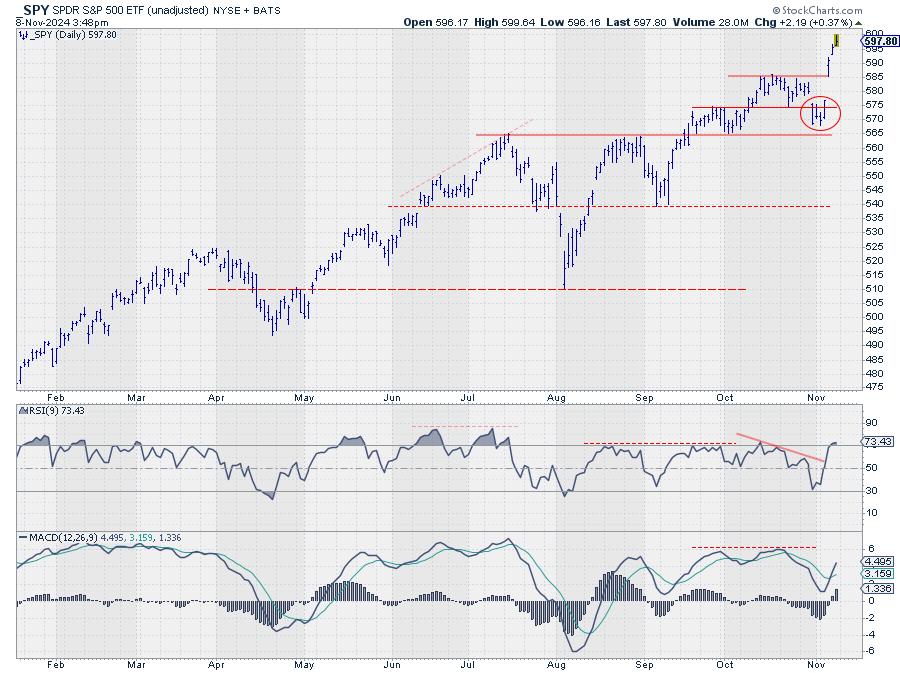

DecisionPoint5mo ago

Is the Trump Rally Like the Reagan Rally?

Today Carl compares this week's Trump Rally with the rally we saw after Reagan was elected in 1980. There are similarities and differences. The Trump rally has lifted certain sectors of the market as well as Cryptocurrencies. While the Reagan rally had different catalysts Read More

Trading Places with Tom Bowley5mo ago

Secular Bull Market Continues, But With Major Rotation

Enjoying these HUGE rallies is much easier when you have confidence the stock market is in a secular bull market and heading higher. It also helps when you enter a period of historical strength - the absolute best strength that we see anytime throughout the calendar year Read More

Analyzing India5mo ago

Week Ahead: NIFTY Likely to Stay Sluggish; Multiple Resistances Nestled in This Zone

The markets remained tentative over the past five days while continuing to trade with a weak undertone, while the Nifty digested the reaction to the US election outcome Read More

The MEM Edge5mo ago

Best Way to Capitalize on Election Rally!

In this StockCharts TV video, Mary Ellen presents a deep dive into last week's sharp rally in the markets. She highlights what areas could perform best under a Trump administration and how to spot a pullback. She takes a close look at the "New Economy" and how best to capitalize Read More

ChartWatchers5mo ago

Stock Market Hits Record Levels: Prepare for What Inflation Can Bring Next

Another packed week for the stock market has come to a close. The broader stock market indexes broke out of their sideways trading range with the S&P 500 ($SPX), Nasdaq Composite ($COMPQ), and Dow Jones Industrial Average ($INDU) closing the week out at record levels Read More

RRG Charts5mo ago

Three Sectors Leading SPY Back to Offense

First of all, for those of you looking for a new video this week, I have intentionally skipped it because I didn't want to make a video right before such an important event with much uncertainty Read More

Members Only

Martin Pring's Market Roundup5mo ago

This Sector is Worth Watching, Not Just For Itself But as a Market Bellwether

Last week, I drew your attention to the fact that out that three US market sectors had experienced bearish two-bar reversals on the weekly charts and were likely to retrace some of their previous advances Read More

ChartWatchers5mo ago

Election Aftermath: Unleashing Profitable Small Cap Stocks

The risk-on sentiment has returned to the stock market. Stocks traded significantly higher ahead of the open on Wednesday after former President Trump's victory. With the uncertainty of the election results out of the way, investors were ready to pile back into equities Read More

ChartWatchers5mo ago

Markets Surge Post-Election: Is It Time to Go All-In?

When major shifts happen in the market, such as the one we're seeing the morning after the election, how can you analyze investor sentiment shifts and adapt your strategy to align with where money will likely flow in the coming weeks and months? If you checked the markets on Wedn Read More

ChartWatchers5mo ago

The SCTR Report: What Coinbase's Dramatic Price Surge Means For Your Portfolio

Now that election uncertainty is over, the stock market broke out of its sideways trading range and continued higher. Potential policy implementations benefit some asset classes, such as cryptocurrencies, which could operate in a more relaxed regulatory environment Read More

Stock Talk with Joe Rabil5mo ago

It's GAME ON for These Stocks

In this exclusive StockCharts video, Joe shows a specific trade setup in multiple timeframes that identifies the start of an important trend. He explains the 4 keys to this setup and shows 5 examples of stocks meeting the criteria right now Read More

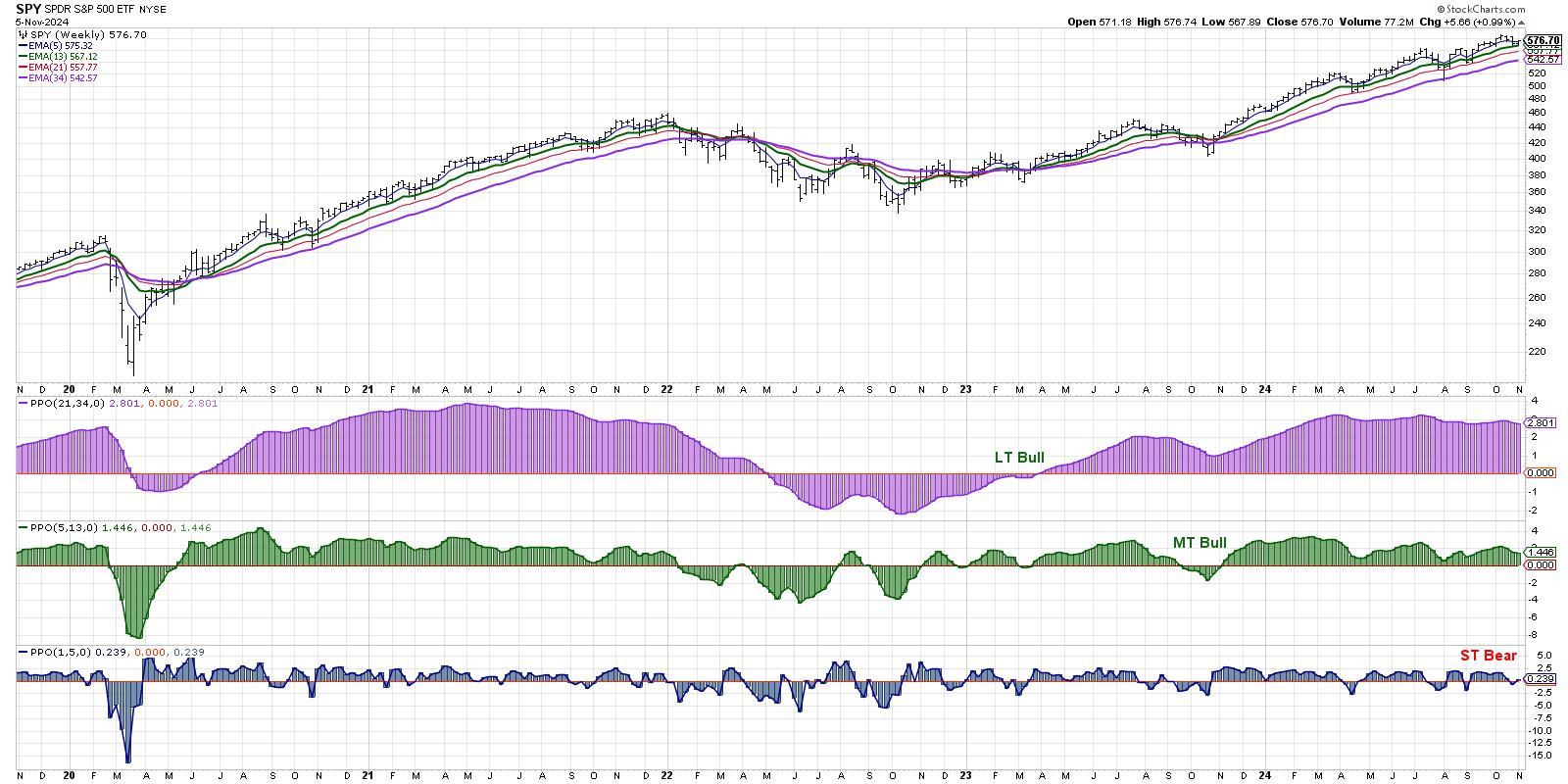

The Mindful Investor5mo ago

Short-Term Bearish Signal as Markets Brace for News-Heavy Week

Back in the day, I used to look at the weekly S&P 500 chart every weekend and ask myself the same three questions: What is the long-term trend? What is the medium-term trend? What is the short-term trend? My goal was to make sure that I was respecting the broader market direction Read More

ChartWatchers5mo ago

Stock Market Today: How to Scan for Post-Election Profit Opportunities

The stock market closed on a down note on Monday. It's just one day before the general election and, as you know from experience, elections tend to be like an adrenaline shot to the market, the effects of which can last from days to months Read More

The Mindful Investor5mo ago

Market Trend Model Flashes Short-Term Bearish, What's Next?

In this video, Dave breaks down the three time frames in his Market Trend Model, reveals the short-term bearish signal that flashed on Friday's close, relates the current configuration to previous bull and bear market cycles, and shares how investors can best track this model to Read More

DecisionPoint5mo ago

DP Trading Room: Six-Month Period of Favorable Seasonality Begins Now!

It's here! The SPY starts a period of favorable seasonality for the next six months. Carl takes us through his charts and explains favorable versus unfavorable periods of seasonality Read More

GoNoGo Charts5mo ago

Equities Hang on to Weaker "Go" Trend as Communications Offers a Helping Hand

Good morning and welcome to this week's Flight Path. Equities saw the "Go" trend remain in place this week but we saw weakness with a few aqua bars. GoNoGo Trend shows that the "NoGo" trend strengthened at the end of the week in treasury bond prices. U.S Read More

Art's Charts5mo ago

Finding and Trading Oversold Conditions within Long-term Uptrends

There is only one way to trade in a long-term uptrend: long. Forget about picking tops and breaks below short-term moving averages. Leaning bearish within a long-term uptrend is not a profitable strategy Read More

Analyzing India5mo ago

Week Ahead: NIFTY May See Stable Start; Likely to Remain Under Selling Pressure at Higher Levels

The Nifty largely consolidated over the past five sessions, but did so with a bearish undertone. The Nifty traded in a defined range and closed the week with a modest gain. Importantly, the index also stayed below its crucial resistance points Read More

RRG Charts5mo ago

S&P 500 Under Pressure, Can Strong Seasonality Save It?

In this video from StockCharts TV, Julius begins by looking back at the completed monthly bars for October to assess the long term trends in the 11 S&P sectors. He follows that up with an updated view for SPY in coming weeks Read More

The MEM Edge5mo ago

These S&P 500 Stocks Are Poised To Outperform!

In this StockCharts TV video, Mary Ellen reviews the negative price action in the broader markets while highlighting pockets of strength. She shares how the rise in interest rates is impacting the markets ahead of next week's FOMC meeting Read More

ChartWatchers5mo ago

Election-Related Market Swings: How to Stay Ahead

After yesterday's "trick," investors received a "treat" at the end of the trading week, as the stock market regained its footing and bounced back a bit Read More

The Mindful Investor5mo ago

Top Ten Charts to Watch for November 2024

With the Magnificent 7 stocks struggling to hold up through a tumultuous earnings season, what sort of opportunities are emerging on the charts going into November? Today, we'll break down some of the names we've included in our Top Ten Charts to Watch for November 2024 Read More