Archived News

Art's Charts1mo ago

Small-caps Trigger Bearish, but Large-caps Hold Uptrend and Present an Opportunity

The Russell 2000 ETF triggered a bearish trend signal this week and continues to underperform S&P 500 SPDR, which remains with a bullish trend signal. Today's report shows the Keltner Channel signals in each Read More

Don't Ignore This Chart!1mo ago

Bristol Myers Squibb's Rising SCTR Score: Seize the Moment to Invest?

Bristol Myers Squibb (BMY) reported strong Q4 earnings earlier in February, and prospects remain strong for 2025, although it may face some headwinds Read More

Don't Ignore This Chart!1mo ago

Retail is at a Crossroads—Buy Now or Stay Away?

As "economic softening" increasingly emerges as the prevailing narrative driving the markets, the retail sector occupies a peculiar space amid these shifts in investor confidence, inflation fears, and looming tariff woes Read More

Stock Talk with Joe Rabil1mo ago

Hidden MACD SIGNAL? Key Trade Signals Explained!

In this exclusive StockCharts video, Joe breaks down reverse divergences (hidden divergence), key upside & downside signals, and how to use ADX and Moving Averages for better trades! Plus, he examines market trends and viewer symbol requests! This video was originally published o Read More

ChartWatchers1mo ago

Sector Rotation: How to Spot It Early Using Four Tools

Sector rotation is difficult to spot in real time because it unfolds over weeks or months and isn't always obvious until after the fact. Since there's no single or definitive way to monitor a rotation, you'd have to observe it from different angles Read More

The Mindful Investor1mo ago

Bearish Signals & Risk Management: Protect Your Portfolio!

In this video, Dave breaks down bearish macro signals and risk management using the "line in the sand" technique! Learn how to spot key support levels, set alerts on StockCharts, and protect your portfolio! This video originally premiered on February 26, 2025 Read More

ChartWatchers1mo ago

Decode the Stock Market's Health With This Key Indicator

The US Consumer Confidence Index® came in much lower than expectations, and the Expectations Index fell to 72.9. A fall below 80 signals a recession ahead, enough to elevate the fear of economic weakness. As a result, the stock market sold off Read More

Members Only

Martin Pring's Market Roundup1mo ago

Stocks Starting to Break Down Against This Key Asset

The S&P Composite ($SPX) briefly touched a new all-time high last week, which sounds encouraging. However, that kind of action was limited, as neither the Dow Industrials nor the NASDAQ Composite reached record territory Read More

Add-on Subscribers

OptionsPlay with Tony Zhang1mo ago

Get The BEST Options Trade Ideas for This Week with Tony Zhang

In this video, Tony breaks down the big-picture market trends before diving deep into bullish and bearish setups for META, BIDU, AMGN, NVDA, DAL, and more! Get expert insights and key analysis you won't want to miss! This video premiered on February 24, 2025 Read More

DecisionPoint1mo ago

DP Trading Room: Defensive Sectors Lead the Pack

The complexion of the market is changing. Aggressive sectors which have led the market higher are now beginning to show signs of strain as momentum slowly dissipates and prices turn lower. However, defensive sectors (XLP, XLRE, XLV and XLU) are now leading the market Read More

The Mindful Investor1mo ago

AMZN: A Case Study in Bearish Divergence

In the later stages of a bull market cycle, we will often observe a proliferation of bearish momentum divergences. As prices continue higher, the momentum underneath the advance begins to wane, representing an exhaustion of buyers Read More

RRG Charts1mo ago

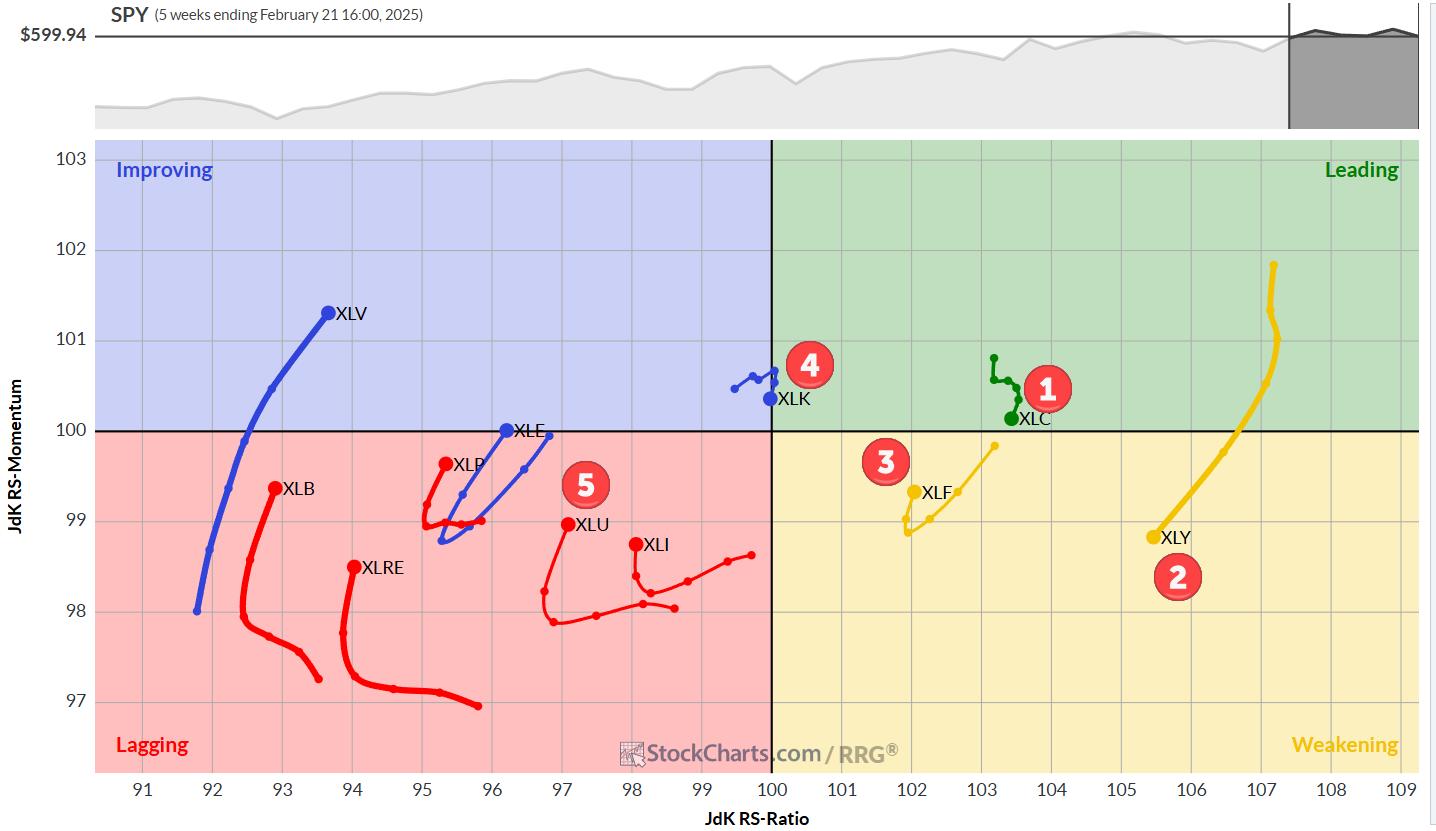

The Best Five Sectors, #8

Utilities enter top 5 Last week's trading, especially the sell-off on Friday, has caused the Utilities sector to enter the top 5 at the cost of Industrials Read More

Trading Places with Tom Bowley1mo ago

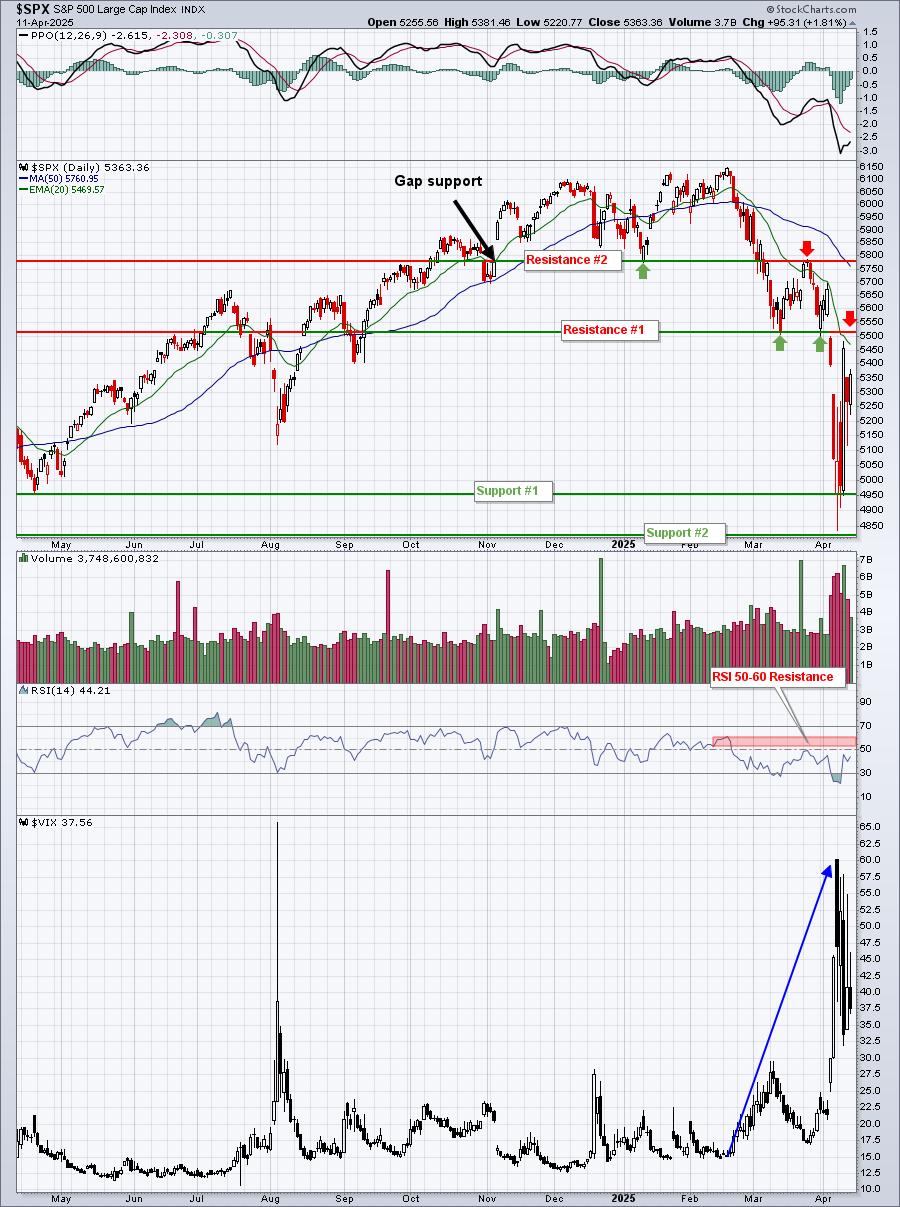

The Top is Confirmed and Now It's Just a Matter of How Low We Go

Let me start by reminding everyone that I believe the most important relationship in the stock market is how consumer discretionary stocks (XLY) perform relative to consumer staples stocks (XLP). This ratio (XLY:XLP) has a VERY strong positive correlation with the S&P 500 Read More

RRG Charts1mo ago

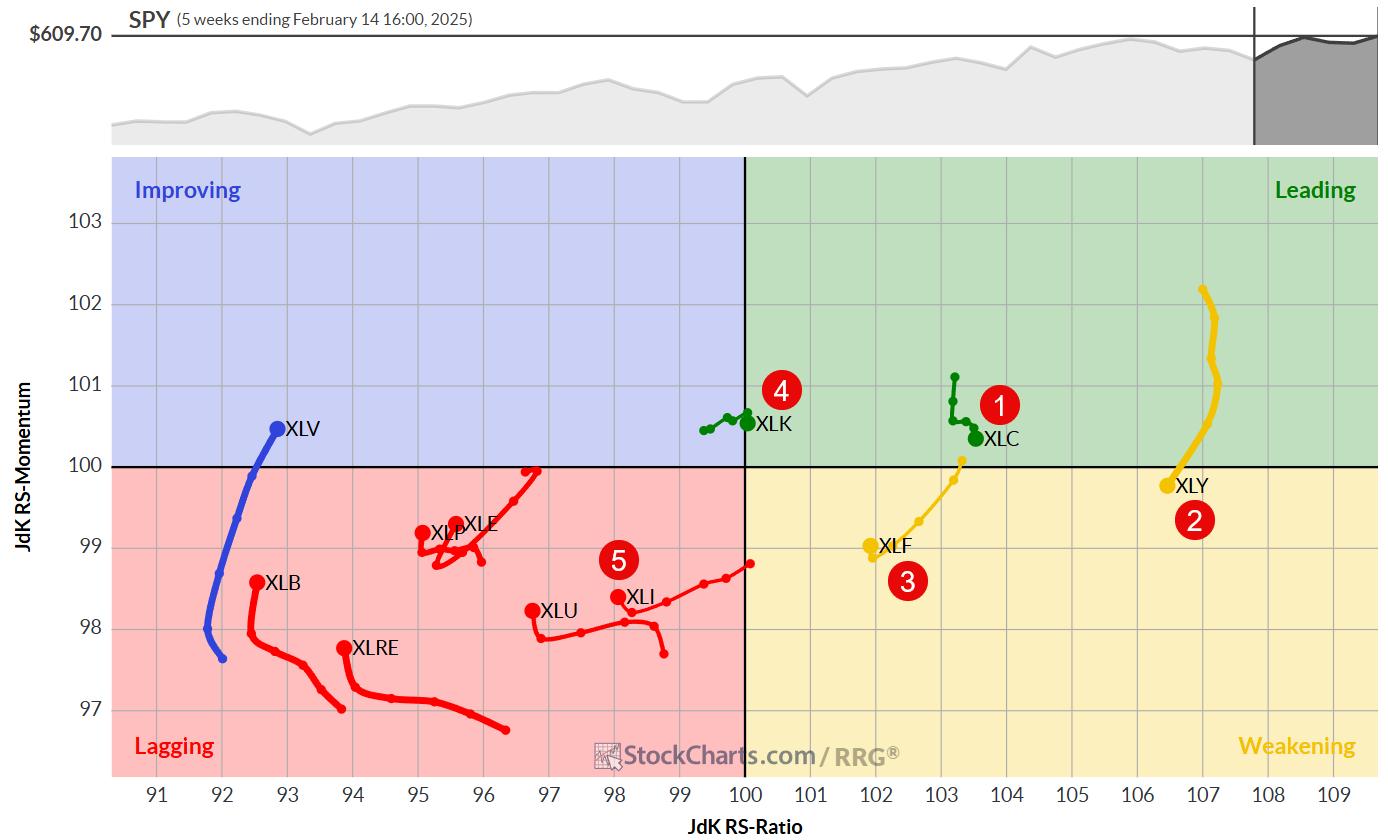

Market Rotation and Cap-Weight Dynamics: A Closer Look

With the market selling off into the close today, it's too early to write my usual "best five sectors" article. The risk of ranking changes is too high. I will make sure that an update will be posted before the markets open on Monday Read More

DecisionPoint1mo ago

Mega-Caps Weakening, More Trouble Ahead

The market declined heavily on Friday likely setting up for more downside ahead. We had already begun to notice that mega-cap stocks were beginning to weaken. You can see this on the relative strength line of the SPY versus equal-weight RSP Read More

ChartWatchers1mo ago

Gold and Silver Are Crushing the S&P 500! Here's What You Need To Know Now!

There's been a lot of wild speculation surrounding gold's bullish run. When you consider a gold investment, you're likely to think of the more common factors that come into play: inflation, geopolitical uncertainty, and central bank demand Read More

ChartWatchers1mo ago

Unlocking the Secrets to Profitable Semiconductor Investments

Disappointing guidance from Walmart (WMT) may have hurt the stock market on Thursday sending the broader indexes lower. But something is churning beneath the surface you don't want to miss Read More

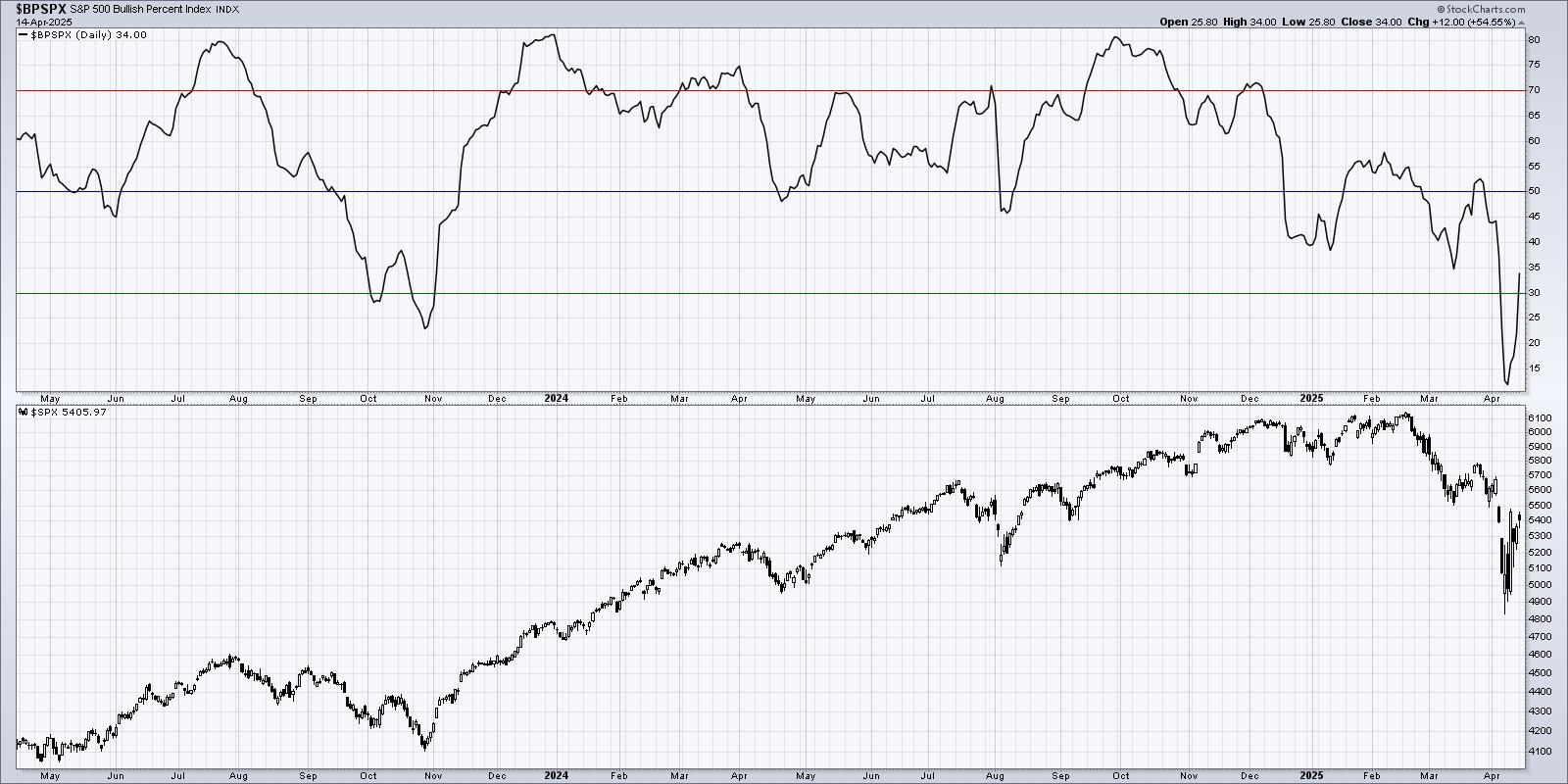

ChartWatchers1mo ago

Unleash the Power of BPI: The Key to Boosting Your Investment Returns

On Wednesday, the Federal Reserve released minutes from its January 28–29 meeting Read More

Members Only

Martin Pring's Market Roundup1mo ago

If a Rising Tide Lifts All Boats, What Does It Mean for the Dollar?

This year has not been kind to the US dollar as it has lost some ground recently. That, however, may be about to change. They say a rising tide lifts all boats Read More

The Mindful Investor1mo ago

Three Signs of the Bear and What May Come Next!

I was taught that the most bullish thing the market can do is go up. And while the major equity averages are yet again at or near all-time highs, there are three macro technical signals that I've found to be very common at major market tops Read More

Don't Ignore This Chart!1mo ago

From Crash to Comeback: Is SMCI Stock the Hottest AI Asset Right Now?

Super Micro Computer, Inc. (SMCI) stock surged over 50% after reporting earnings last week. The top and bottom line results weren't stellar. The guidance, however, was enough to fuel a buying frenzy, driving the stock's rally to a 110% gain this month Read More

Add-on Subscribers

OptionsPlay with Tony Zhang1mo ago

How To Grow Your Options Trading Account

Learn how to build your confidence in the markets with this high probability of success strategy and how to find the best opportunities every day to earn consistent income with the tools available at StockCharts.com Read More

RRG Charts2mo ago

The Best Five Sectors, #7

Shifting Sands in the Top Five At the end of last week, there were some interesting shifts in sector positioning, though the composition of the top five remained unchanged Read More

Trading Places with Tom Bowley2mo ago

Here Are Two Great Earnings Reports This Past Quarter

For us at EarningsBeats.com, earnings season is the time to do our research to uncover the best stocks to trade over the next 90 days, or earnings cycle. We do this in various ways Read More

Trading Places with Tom Bowley2mo ago

This Is How I Crush The Benchmark S&P 500 In Any Market

It was another mildly bullish week as our major indices climbed very close to new, fresh all-time highs. We also saw a return to growth stocks as we approached breakout levels, which is a good signal as far as rally sustainability goes Read More

Analyzing India2mo ago

Week Ahead: NIFTY Tests Crucial Support; Violation Of This Level May Invite Incremental Weakness

The Indian equity markets remained under pressure over the past five sessions, witnessing sustained weakness throughout the week. The Nifty50 faced resistance at key levels and struggled to find strong footing as it tested crucial support zones on two separate occasions Read More

ChartWatchers2mo ago

Stay Ahead of Tariffs: Essential Chart Analysis for Investment Security

The stock market is like a river — constantly changing without knowing what lies ahead. Sometimes it's calm. Other times it's choppy. And when the stock market is choppy, it can leave investors in a dilemma, leading them to make irrational investment decisions Read More

The Mindful Investor2mo ago

Master Multiple Timeframe Analysis With This Simple Method

How can we define the market trend on multiple time frames, so we can better identify trend changes and ensure we are following the drive of market forces? Today I'll describe my proprietary Market Trend Model to define the short-term, medium-term, and long-term trends, and share Read More

DecisionPoint2mo ago

Double Tops In Bitcoin and the Dollar

As part of the DP Alert, we cover Bitcoin and the Dollar every market day. We have been watching some bearish indications on both Bitcoin and the Dollar with the double top chart patterns. On Bitcoin, price has been moving mostly sideways above support at 90,000 Read More

Art's Charts2mo ago

Stash that Flash Right in the Trash

The news cycle is in high gear lately, leading to some extra volatility. Traders reacting to the news are getting whipsawed, while chartists remain focused on what really matters. Price. Price isn't everything, it's the only thing Read More

ChartWatchers2mo ago

Market Chaos: How to Spot Bottoming Stocks Before the Rebound

Not everyone likes to take a contrarian stance. Most people prefer to move with the market, not against it. But for those who thrive on going against the grain, extreme market movements — whether a rally or selloff — present opportunities Read More

Don't Ignore This Chart!2mo ago

Intel's Rising SCTR Score: Why You Should Add This Stock to Your Portfolio

Intel's stock price has struggled for most of 2024, even as most of its semiconductor cousins were thriving. Why pay attention to Intel Corp. (INTC) now? The stock showed up on my StockCharts Technical Rank (SCTR) scan, which is a good enough reason to analyze the stock Read More

Stock Talk with Joe Rabil2mo ago

Master Trades in Volatile Markets With This 4MA Strategy

In this exclusive StockCharts video, Joe shows how the 4-day moving average can be useful especially in volatile markets. He explains the advantages of using it in conjunction with the 18-day MA to prevent buying at the wrong time and highlighting when good opportunities appear Read More

The Mindful Investor2mo ago

Bearish Divergences Plaguing Former Leadership Names

While 2024 was defined by the strength of the Magnificent 7 stocks, 2025 has so far been marked by a significant change of character on many of these former high flying growth names Read More

ChartWatchers2mo ago

Are Trump's 25% Tariffs a Game-Changer for Steel Stocks? Here's What to Watch Now!

On Monday morning, President Trump announced plans to impose 25% tariffs on steel and aluminum imports — a sweeping policy move that's certain to reshape the Materials sector Read More

Don't Ignore This Chart!2mo ago

Why NVDA's Stock Price Shift Could Be Your Gain!

Do you remember when NVDA stock had a very high StockCharts Technical Rank (SCTR) score for most of 2023 and 2024? If not, that's OK. You'll remember when you look at the chart of NVDA later in this article. The chip company we know so well — NVIDIA Corp Read More

The Mindful Investor2mo ago

Are the Once High-Flying MAG 7 Stocks Just Mediocre Now?

In this video, Dave breaks down the formerly high-flying Mag 7 stocks into three distinct buckets. These include long & strong (META, NFLX & AMZN), broken down (TSLA, AAPL, MSFT & NVDA), and questionable (GOOGL) Read More

Members Only

Martin Pring's Market Roundup2mo ago

Dr Copper Could Be Close to a Major Breakout. What That Could Mean for the CPI

The nickname "Dr. Copper" comes from its reputation as a reliable economic indicator. That's because it is used worldwide in a wide range of industries, including construction, electronics, and manufacturing Read More

Add-on Subscribers

OptionsPlay with Tony Zhang2mo ago

Stay on TOP of the AI Revolution!

In this video, Tony highlights important moves in equities, then shares the OptionsPlay research report for bull/bear plays. Tony then spends time on NVDA, highlighting the importance of staying on top of the AI revolution. He also looks at key stocks like V, BA, META, and more Read More

The Mindful Investor2mo ago

Three Technical Tools to Minimize Endowment Bias

Have you ever held on too long to a winning position? You watch as that former top performer in your portfolio slows down, and then rotates lower, and then really begins to deteriorate, and you just watch it all happen without taking action? If the answer is "yes", then you have Read More