Archived News

DecisionPoint2mo ago

DP Trading Room: Gold Hits Another All-Time High

The market rebounded to start trading on Monday, but indicators on Friday suggest internal weakness. Carl gives us his latest analysis on the market as well as taking a look at Gold which is making more all-time highs. Get Carl's perspective on the Gold rally Read More

RRG Charts2mo ago

The Best Five Sectors, #6

No Changes In Top-5 At the end of the week ending 2/7, there were no changes in the top-5, but there have been some significant shifts in the bottom 5 sectors Read More

Trading Places with Tom Bowley2mo ago

Here's a Group Ready To Set Sail

Sometimes an industry group looks good technically, sometimes fundamentally, and then other times seasonally. But what happens when they all line up simultaneously? Well, we're about to find out with the travel & tourism group ($DJUSTT). On Friday, Expedia (EXPE, +17 Read More

Analyzing India2mo ago

Week Ahead: NIFTY Stares at Crucial Support; RRG Hints at Defensive & Risk-Off Setups

In what can be called an indecisive week for the markets, the Nifty oscillated back and forth within a given range and ended the week on a flat note. Over the past five sessions, the Nifty largely remained within a defined range Read More

The MEM Edge2mo ago

Nasdaq DROPS on Weak AMZN, TSLA & GOOGL Earnings!

In this video, Mary Ellen reviews the market's flat momentum as uncertainty reemerges after weak AMZN, TSLA and GOOGL reports - PLUS more tariff talk from Trump. She also highlights the move into defensive sectors as growth stocks continue to struggle Read More

DecisionPoint2mo ago

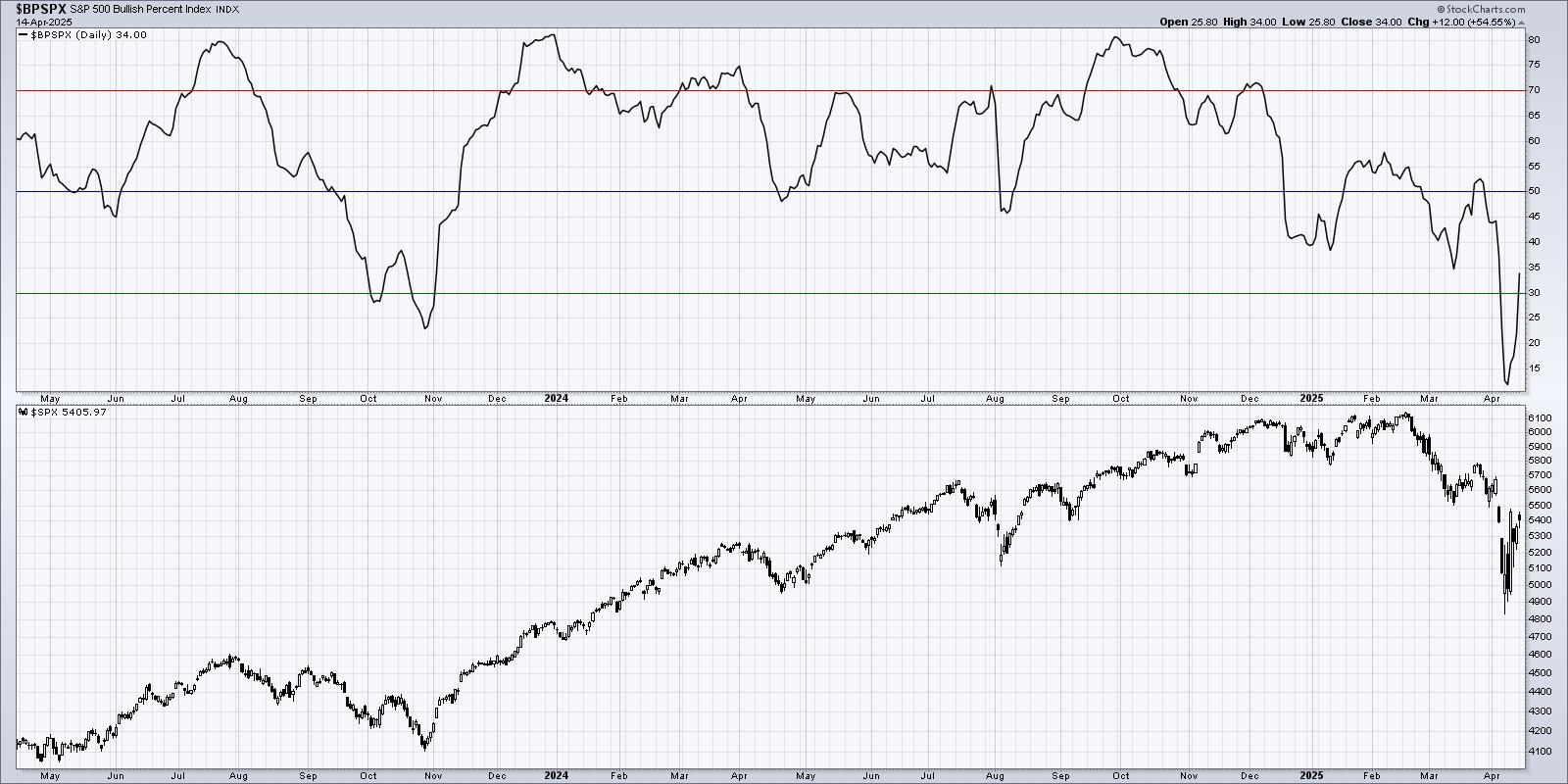

IT Breadth Momentum (ITBM) and IT Volume Momentum (ITVM) Top - Participation Draining

We are currently in a declining trend in the market and internals are telling us that this weakness will continue to be a problem. Our primary indicators in the short- and intermediate-term have topped with one exception Read More

The Mindful Investor2mo ago

Top 10 Charts to Watch for in February 2025

While the major equity averages are certainly up year-to-date, we're detecting a growing number of signs of leadership rotation. As the Magnificent 7 stocks have begun to falter, with charts like Apple Inc Read More

Art's Charts2mo ago

Bank SPDR Extends on Breakout - How to Find the Setup before the Breakout

The Finance sector is leading the market with a new high this week and the Bank SPDR (KBE) is extending on its breakout. Today's report will outline the lessons of the early January setup and show the mid January breakout Read More

Don't Ignore This Chart!2mo ago

Hotel Stocks Spike: Why You Should Add These Stocks to Your Portfolio

When you think travel industry, airline and cruise line stocks are usually top of mind. A lesser-known category in the industry is hotel stocks, which saw massive upside moves on Thursday Read More

Don't Ignore This Chart!2mo ago

Missed Amgen's 5% Surge? Here's What You Need to Know Now!

On Wednesday morning, the markets wavered, with cautious trading across the board, except for the Dow, which outpaced the S&P 500 and Nasdaq. Looking for stocks showing strength amid the uncertainty, I turned to the Market Movers tool on my Dashboard Read More

ChartWatchers2mo ago

S&P 500 Sectors Play Musical Chairs: How To Win the Game With Options

The trading week started with investors worried about tariffs, but the 30-day delay of tariffs on imports from Canada and Mexico shook off those worries Read More

Stock Talk with Joe Rabil2mo ago

The BEST Simple Moving Average Trading Strategy

In this exclusive StockCharts video, Joe presents a trading strategy using the simple moving average. Explaining what to watch and how it can tell you what timeframe to trade, he shares how to use it in multiple timeframes Read More

The Mindful Investor2mo ago

Three Behavioral Biases Impacting Your Portfolio Right Now

In this video, Dave reveals three common behavioral biases, shows how they can negatively impact your portfolio returns, and describes how to use the StockCharts platform to minimize these biases in your investment process Read More

RRG Charts2mo ago

Watch For These Seasonality Patterns in 2025

In this exclusive StockCharts video, Julius shares a new approach to seasonality by using a more granular, data-set constructed UDI (User Defined Index) for every sector. Using the UDI functionality on StockCharts Read More

Members Only

Martin Pring's Market Roundup2mo ago

Forget Technology and Take a Look at This Sector

Technology stocks, in the form of the SPDR Technology ETF (XLK), have been on a tear since their secular low in 2009. That strength has not only resulted in higher absolute prices, but also striking relative action. Chart 1 compares the XLK to its long-term KST Read More

Don't Ignore This Chart!2mo ago

Walmart, Costco, and Sprouts: The Ultimate Trade War Survivors?

Monday's market opening was a doozy, with all three indices down nearly 2% in overnight trading. This was in response to President Trump's 25% tariffs on Mexico and Canada and a 10% tariff on China Read More

Add-on Subscribers

OptionsPlay with Tony Zhang2mo ago

BULLISH on These Options Trade Ideas

In this video, Tony shares his weekly market review, discussing growth vs. value, volatility, commodities, and more. From there, he shares his list of bearish and bullish options trade ideas, including META, AMGN, GOOGL, NVDA, DIS, and more Read More

Trading Places with Tom Bowley2mo ago

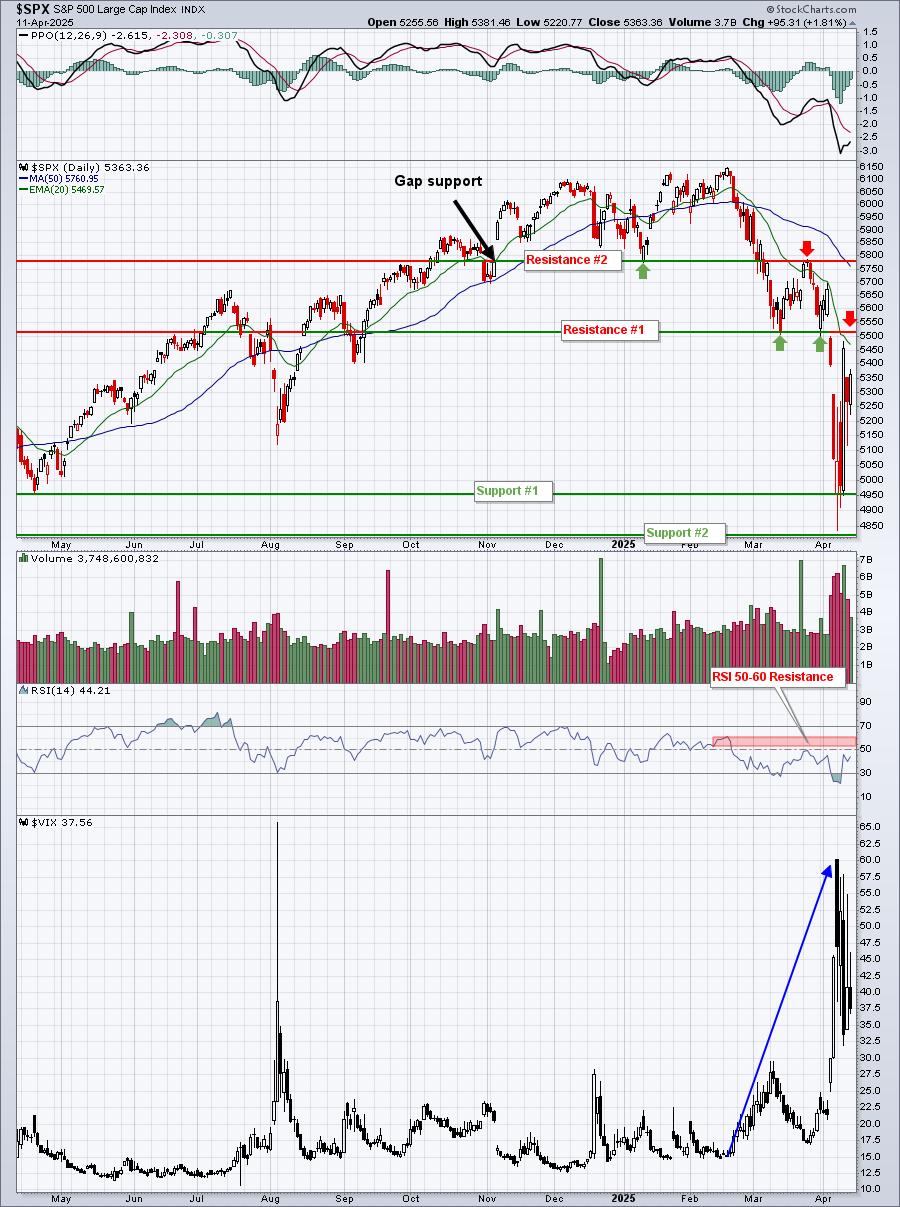

Volatility ($VIX) May Be Providing Clues of a Big Market Drop

Secondary market signals are beginning to line up for a further drop, which can sometimes provide false signals. The primary indicator for me is always the combination of price/volume Read More

DecisionPoint2mo ago

DP Trading Room: Tariff Trepidation

Trading is being affected by the scare of a trade war. With new tariffs being placed on Mexico, Canada and China, the market fell heavily on Friday Read More

Trading Places with Tom Bowley2mo ago

Be Careful With These Topping Candles

"When do I sell?" is easily the most-asked question I've received over the years. There are multiple answers to this question based on certain variables. The first key variable is whether you're a day trader, short-term swing trader, or long-term buy and holder Read More

Trading Places with Tom Bowley2mo ago

We're Topping With BEARISH Action Ahead!

Listen, I'm generally a fairly optimistic guy. I tend to see the good in the stock market, while many others continuously focus on potential selloffs ahead. I remain mostly bullish for good reason as the S&P 500 has risen 75% of all years since 1950 Read More

The MEM Edge2mo ago

DeepSeek Rattles AI Stocks - Should You Buy The Dip?

In this video, Mary Ellen unpacks the week after the news drop roiled markets; coupled with major earnings reports, it's been a rough week Read More

DecisionPoint2mo ago

S&P 600 (IJR) Silver Cross BUY Signal May Arrive Too Late

Today on the S&P 600 (IJR), the 20-day EMA nearly crossed above the 50-day EMA for a "Silver Cross" IT Trend Model BUY Signal. Price is really going nowhere. Bulls might look at it as a bull flag, but the 'flag' is horizontal, not trending lower Read More

Art's Charts2mo ago

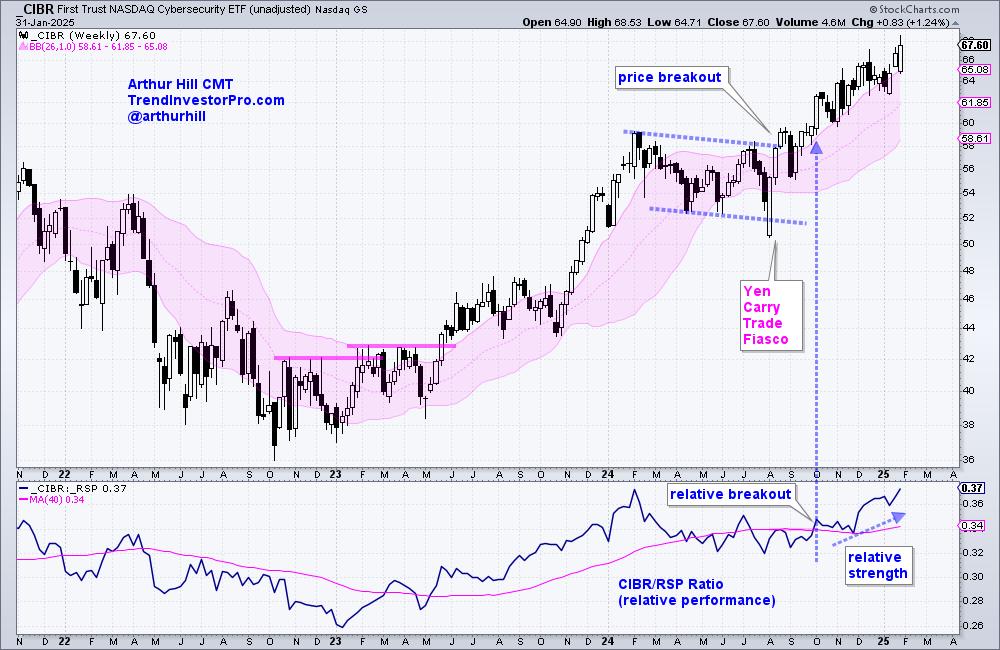

Cybersecurity Makes Yet Another Statement

The Cybersecurity ETF (CIBR) has been leading the market for a solid four months and recorded yet another new high this week Read More

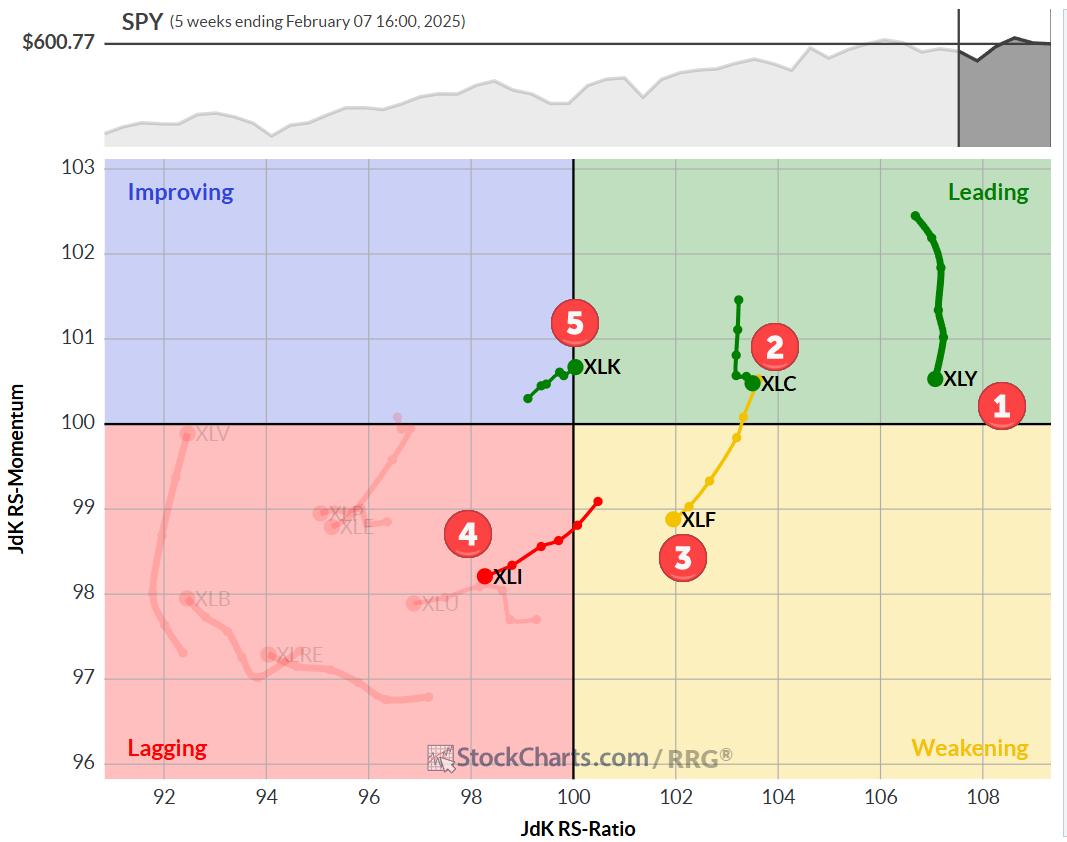

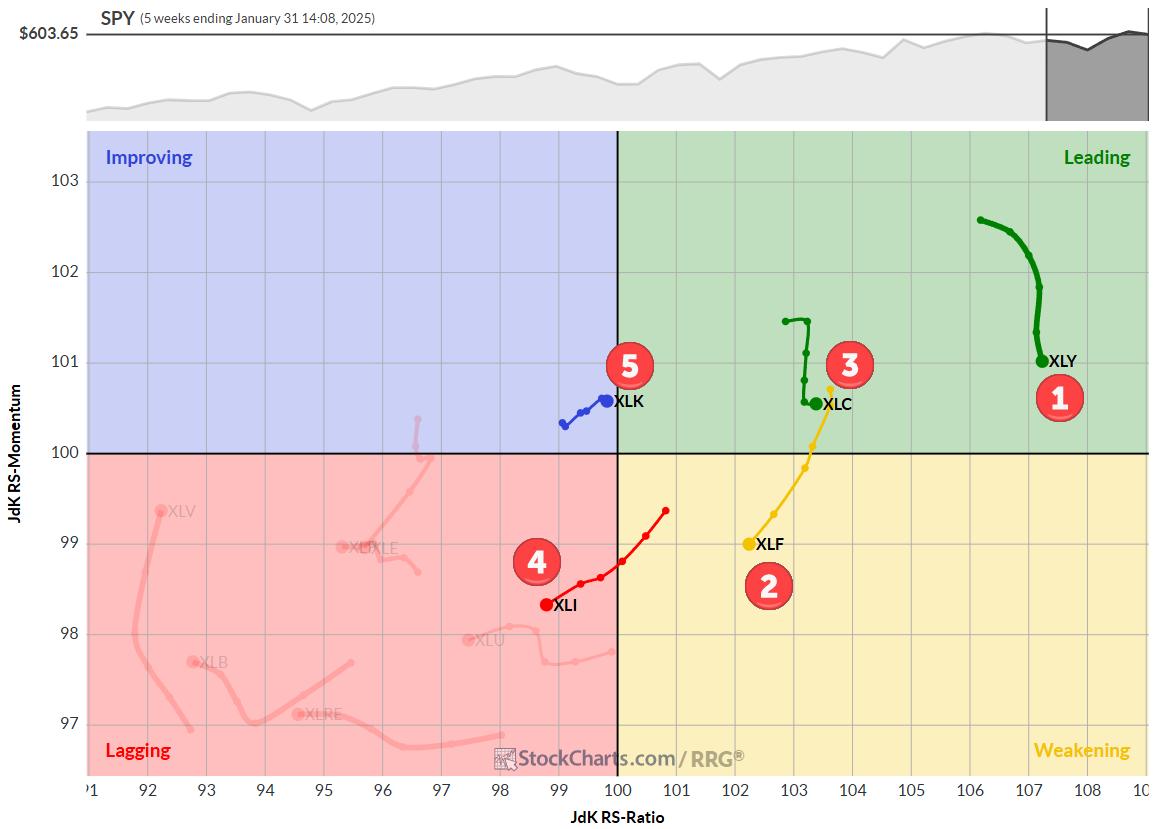

RRG Charts2mo ago

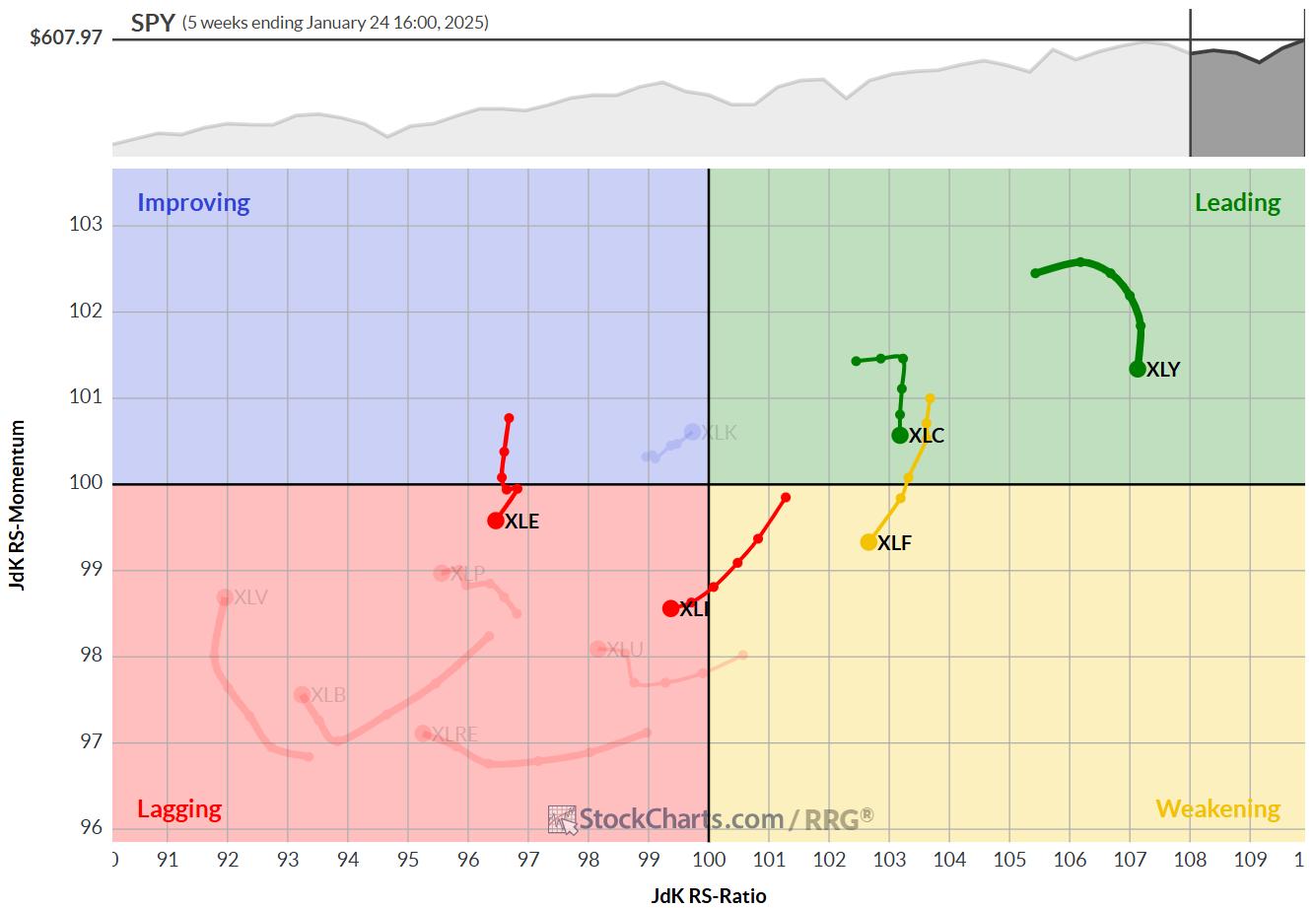

The Best Five Sectors, #5

Technology Moves Back into Top-5 As we wrap up another trading week, a notable shift has occurred in the sector rankings. The technology sector, after a brief hiatus, has clawed its way back into the top 5, pushing energy down to the 7th position Read More

Don't Ignore This Chart!2mo ago

XLF's Record Highs: Buy the Dip or Bail Out Now?

As the FOMC prepared to announce its rate decision on Wednesday, the Financial Select Sector SPDR Fund (XLF), which had been steadily climbing since the end of 2023, was approaching a new record high Read More

Don't Ignore This Chart!2mo ago

An Enticing Gold Mining Stock with a Strong SCTR Score

Gold stocks have risen, even after the Federal Reserve decided to keep interest rates unchanged. So it wasn't surprising to find a few gold mining stocks filtered in my StockCharts Technical Rank (SCTR) scan Read More

Stock Talk with Joe Rabil2mo ago

Quantum Computing Stocks You NEED to See

In this exclusive StockCharts video, Joe shares the details of his favorite MACD setup. Joe then covers NVDA, and cryptocurrencies, before covering which Quantum Computing stocks look the best right now, including IONQ and RGTI Read More

ChartWatchers2mo ago

AI Stocks and Their Impact on the Stock Market: Hype or Reality?

The week started with a wild ride when DeepSeek created a bizarre "deep sink" day in the stock market. NVIDIA Corp. (NVDA) was one of the most actively traded stocks, closing lower by 16.97% Read More

Don't Ignore This Chart!2mo ago

Snowflake and Twilio Stocks are Surging: Here's What to Do Now!

While StockCharts offers numerous tools you can use to find top stocks or top-gaining stocks, I decided to focus on an Outperforming SPY: 3-Month Relative Highs scan to see if I can find a few resilient stocks in early-stage trends, especially after Monday's huge market rout Read More

ChartWatchers2mo ago

Investing in the Age of Tariffs: Safeguard Your Portfolio Now

Trade tariffs have been hogging the headlines since last year, and have been a sticky debate point heading into the 2024 US elections. With newly-elected US President Donald Trump in office, the fear of tariffs is front and center in investors' minds Read More

DecisionPoint2mo ago

DP Trading Room: Black Swan Monday

The market opened with a bang as news of a cheaper Artificial Intelligence program, DeepSeek out of China. It has spurred investors to rethink the overbought Technology space, AI in particular. NVDA was down over 17% and other high profile AI companies also suffered Read More

Members Only

Martin Pring's Market Roundup2mo ago

Some Silver Linings Following a Day of AI Panic

I woke up this morning noting that NASDAQ futures had been down nearly 1,000 points at their overnight intraday low. Later, I tuned into a couple of general purpose, as opposed to financial, cable news channels. They, too, were talking about the sell-off and its rationale Read More

The Mindful Investor2mo ago

What's NEXT for Semiconductors After Monday's SHOCKING Drop?

In this video, Dave reviews the VanEck Semiconductor ETF (SMH) from a technical analysis perspective Read More

Add-on Subscribers

OptionsPlay with Tony Zhang2mo ago

Still BULLISH NVDA Despite DeepSeek?

In this video, Tony gives a macro review of where we currently stand with the broader markets given the impact of DeepSeek on the AI space. He then shares some trade ideas for the week, including NVDA, META, LULU, DIS, & AAPL Read More

The Traders Journal2mo ago

Six Dance Steps to Remember for an Extended Market

"An investment in Knowledge pays the best interest." — Benjamin Franklin It's time to revisit a few timeless lessons regarding extended markets. As I write this, the last correction of any significance was in 2022 Read More

Analyzing India2mo ago

Week Ahead: NIFTY to Stay Tentative Over 6-Day Trading Week; RRG Shows Defensive Sectoral Setup

The Indian equities continued to trade with a corrective undertone as they ended the week on a mildly negative note. Over the past five sessions, the Nifty continued facing selling pressure at higher levels while staying mainly in a range Read More

The MEM Edge2mo ago

BEWARE! META, TSLA, AMZN, MSFT & AAPL Report Earnings Next Week!

In this video, Mary Ellen reviews the new uptrend in the S&P 500, and highlights what's driving it higher. She then shares new pockets of strength that are poised to take off, and what to be on the lookout for ahead of next week's M7 earnings reports Read More

RRG Charts2mo ago

The Best Five Sectors, #4

No changes in the top-5 At the end of this week, there were no changes in the ranking of the top-5 sectors Read More

The Mindful Investor2mo ago

Semiconductors Have More to Prove Before Breakout is Believed

Despite the strength in some key growth stocks in January, semiconductors have been decidedly rangebound for most of the last six months Read More