Archived News

Don't Ignore This Chart!11mo ago

Surprise! These Grocery Stocks are Crushing 2024 Targets

While wealthier consumers benefit from higher stock and real estate valuations, lower-wage Americans are crushed by high prices, and many fall behind in credit card debt. Meanwhile, the Fed has been telegraphing that inflation may be much stickier than initially expected Read More

The Mindful Investor11mo ago

Dow Theory Flashes Bear Signal

Dow Theory is based on the foundational work of Charles Dow, considered the "Father of Technical Analysis Read More

Members Only

Martin Pring's Market Roundup11mo ago

What Does Today's Outside Bars in the S&P and NASDAQ Mean Going Forward

A couple of weeks ago, I wrote an upbeat article on the US stock market opining that the correction was over. I still think that's the case, but I do have to note that a bearish outside bar formed on both the S&P and NASDAQ on Thursday Read More

The Final Bar11mo ago

S&P 500 Downside Target 4800?!

In this edition of StockCharts TV's The Final Bar, Dave welcomes Jeff Huge, CMT of JWH Investment Partners. David reflects on NVDA's gap higher, quick deterioration in market breadth indicators, and bearish candle patterns for ON and HOOD Read More

Members Only

Martin Pring's Market Roundup11mo ago

These Commodities are On Track for Mega Breakouts in May

It's rare when you see a multi-year breakout take place, but, when several materialize more or less at the same time, that should really get our attention Read More

DecisionPoint11mo ago

Market Looks Toppy

In spite of the massive celebration of Nvidia's earnings report, we are seeing troublesome signs that the market is in the process of putting in a top Read More

Dancing with the Trend11mo ago

Rules-Based Money Management - Part 6: Putting It All Together

Note to the reader: This is the twenty-second in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful Read More

The Final Bar11mo ago

Growth is Alive and Kicking for S&P 500

In this edition of StockCharts TV's The Final Bar, Dave welcomes Mike Singleton of Invictus Research. David highlights a bearish momentum divergence for gold, and also illustrates how mid-cap and small-cap stocks have yet to make new highs in Q2 Read More

Stock Talk with Joe Rabil11mo ago

This Semi is a ROCKET With MORE UPSIDE

On this week's edition of Stock Talk with Joe Rabil, Joe shows a specific semiconductor stock that meets all the criteria that he looks for. He starts with the monthly chart and then works down to the daily explaining all the key aspects to the setup Read More

Add-on Subscribers

OptionsPlay with Tony Zhang11mo ago

Hedging the S&P 500 All-Time Highs With Options

As equity markets print new all-time highs and the CBOE Volatility Index ($VIX) prints 52-week lows, this should be considered a bullish outlook by all accounts Read More

Fill The Gap by CMT Association11mo ago

Stock Market Behavior: Separating Signal From Noise

My initial intent was to focus on the number of major equity indices near their all-time highs or attempting to break out of long-term ranges, and how their behaviors around those prior highs over coming months will likely offer significant insight into what comes next Read More

The Final Bar11mo ago

These Sectors are Showing Strength as S&P 500 Soars!

In this edition of StockCharts TV's The Final Bar, Dave is joined by special guest Julius de Kempenaer of RRG Research. Dave hits on the out-performance of traditionally defensive sectors and breaks down the charts of FSLR, NVDA, and more Read More

Don't Ignore This Chart!11mo ago

Capitalizing on Riot Platforms' Potential: A Sleeper Stock Ready to Soar?

If you're not familiar, Riot Platforms (RIOT) is a leading Bitcoin mining company that generates revenue by mining and expanding its mining capacity. Its stock dropped by 30% year-to-date, despite reporting record Q1 2024 earnings earlier in the month for its Q1 2024 results Read More

The Final Bar11mo ago

Bitcoin Blasts ABOVE 70K!

In this edition of StockCharts TV's The Final Bar, Dave highlights strong market breadth as the S&P 500 digests last week's break above 5300 and Bitcoin powers above the crucial 70K level. He also breaks down key technical levels for CCL, HD, ZM, MSTR, NFLX, and HOOD Read More

RRG Charts11mo ago

S&P 500 Breakout: Here to STAY or Heading for a FALL?

In this video from StockCharts TV, Julius assesses the quality of the breakout in the S&P 500, using sector rotation on Relative Rotation Graphs, the volume pattern in the S&P 500 and the relationship between stocks and bonds. This video was originally broadcast on May 20, 2024 Read More

GoNoGo Charts11mo ago

EQUITIES HIT ALL TIME HIGHS AS TECHNOLOGY JOINS LEADERSHIP GROUPS

Good morning and welcome to this week's Flight Path. The "Go" trend in equities is well and truly back as we saw a string of uninterrupted blue bars this week and price hit a new all time high Read More

DecisionPoint11mo ago

DP Trading Room: What's Up With Semiconductors?

Today Erin takes a deep dive into the Semiconductors (SMH). She goes over the "under the hood" health of the industry group and then takes us within the industry group to find the leadership stocks in that area Read More

Trading Places with Tom Bowley11mo ago

One Potentially Big Problem Is Lurking For The Bulls This Summer

Last week's rally to record highs was due, at least in part, to a rather tame CPI report released on Wednesday. Inflation has been at the heart of nearly every rally and every decline over the past few years Read More

The MEM Edge11mo ago

MEM TV: Here's How to Trade Explosive Stocks After Earnings

In this episode of StockCharts TV's The MEM Edge, Mary Ellen reviews the current market conditions and key areas of growth that are in new uptrends. She then shares how to trade downtrend reversals and stocks that gap up after reporting strong earnings Read More

The MEM Edge11mo ago

Major Shifts Taking Place As Lower Rate Bets Increase

Both the S&P 500 and the NASDAQ are sitting at new highs as we wind down a very positive earning season. So far, almost 80% of S&P 500 companies have reported a positive earnings surprise, with the year-over-year earnings growth rate at the highest level since Q2 of 2022 Read More

StockCharts In Focus11mo ago

The Most Efficient Way To Follow The Markets - Customize Your Dashboard!

On this week's edition of StockCharts TV's StockCharts in Focus, Grayson walks you through the "heart and soul" of StockCharts - Your Dashboard - and explains how he customizes his layout to serve as a one-stop-shop for following the latest market action Read More

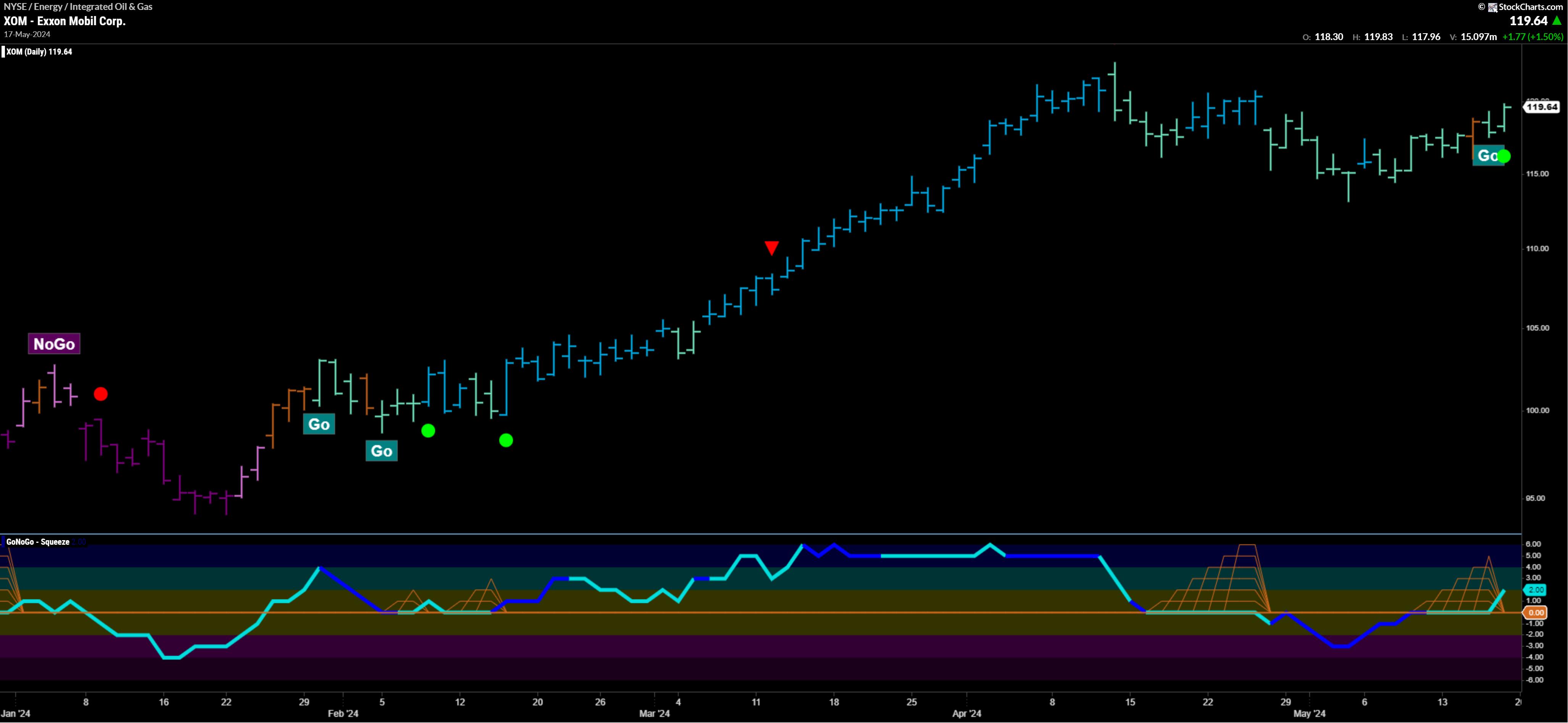

GoNoGo Charts11mo ago

Top 5 Stocks in "Go" Trends | Fri May 17, 2024

Top 5 Stocks in "Go" Trends Trend Continuation on Rising Momentum GoNoGo Charts® highlight low-risk opportunities for trend participation with intuitive icons directly in the price action Read More

The Mindful Investor11mo ago

The One Chart to Watch as S&P 500 Makes New All-Time Highs

As the S&P 500 and Nasdaq 100 have once again made new all-time highs, and the Dow Jones Industrial Average has briefly broken above the 40,000 level for the first time, how should we think about further upside for our equity benchmarks? There are two general ways to play a chart Read More

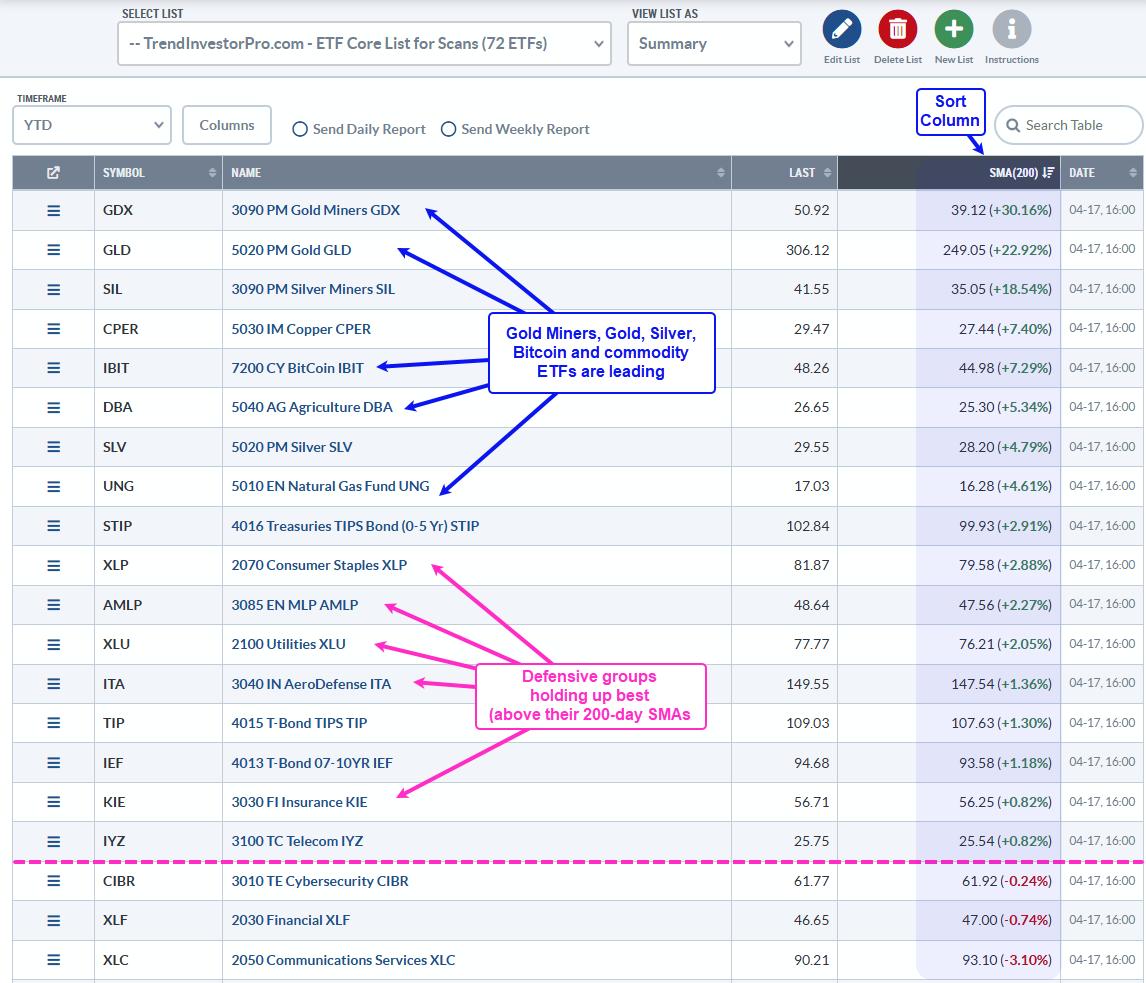

ChartWatchers11mo ago

Thrilling Week for the Stock Market: Dow Jones Makes Strong Close Above 40,000 for the First Time

It made it! The Dow Jones Industrial Average ($INDU) closed above 40,000 for the first time, another record close for the index. What an exciting week! And most of that excitement came in the last few minutes of the trading week. We'll take it Read More

The Final Bar11mo ago

TOP 10 Stock Picks for May 2024

In this edition of StockCharts TV's The Final Bar, join Dave and Grayson as they run through the top 10 charts to watch in May 2024! They'll cover breakout strategies, moving average techniques, relative strength, and much more Read More

DecisionPoint11mo ago

Gold Is Doing Great!

While we don't typically begin with a monthly chart, it seems like a good place to start, as most of the good news is present there. Beginning on the left side, we can see how gold made a parabolic advance into an all-time high in 2011 Read More

Don't Ignore This Chart!11mo ago

Gold and Silver Set to Smash Records: Could 2024 Be Their Biggest Year Yet?

Gold is on the verge of breaking into all-time high territory, and silver is poised to challenge its four-year highs. Both metals are rallying, and it seems probable that both assets will rise above the current threshold levels Read More

RRG Charts11mo ago

Is This the Magic Upward Break Everybody Was Waiting For?

No Confirmation In Volume This week, the S&P 500 is breaking out above its previous high, undeniably a bullish sign. After the initial break on Wednesday, the market held up well on Thursday. However, a few things are holding me back from getting overly enthusiastic Read More

Art's Charts11mo ago

Bitcoin Sets Up with Classic Continuation Signal

There is a certain ebb and flow in uptrends. Often we see some sort of stair step higher with big advances and smaller corrections along the way. In Dow Theory terms, the primary trend is up and declines within a primary uptrends are considered secondary price moves Read More

The Final Bar11mo ago

Larry Williams: Dow 40k, Cycle Analysis, and Lessons Learned

In this edition of StockCharts TV's The Final Bar, legendary trader and author Larry Williams joins Dave in the StockCharts TV studio Read More

DecisionPoint11mo ago

Biotechnology (IBB) Gets Silver Cross BUY Signal

Today, the Biotechnology ETF (IBB) 20-day EMA crossed up through the 50-day EMA (Silver Cross), generating an IT Trend Model BUY Signal. If we look "under the hood," we can see that participation continues to expand Read More

Members Only

Larry Williams Focus On Stocks11mo ago

Larry's "Family Gathering" May 16, 2024 Recording

Dancing with the Trend11mo ago

Rules-Based Money Management - Part 5: Security Selection, Rules, and Guidelines

Note to the reader: This is the twenty-first in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful Read More

Members Only

Larry Williams Focus On Stocks11mo ago

"Family Gathering" Meeting Today at 2 PM Eastern

ChartWatchers11mo ago

A Grand Slam: Broader Stock Market Indexes Soar to New Highs

The bull market hasn't gone anywhere. Despite of worrying about the possibility of a correction and a long wait for movement in either direction, the stock market has finally showed its prowess Read More

Stock Talk with Joe Rabil11mo ago

Powerful Entry Strategy Using One Moving Average

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use one SMA to pinpoint great entries in pullback plays, demonstrating how it can develop in slightly different ways Read More

Add-on Subscribers

OptionsPlay with Tony Zhang11mo ago

Master The Most Underutilized Options Income Strategy: Cash-Secured Puts

In this exclusive interview, StockCharts' David Keller, CMT, sits down with Jessica Inskip, Director of Education and Product at OptionsPlay Read More

The Final Bar11mo ago

China Tariffs Drive Upside for Rare Earth Minerals

In this edition of StockCharts TV's The Final Bar, Dave welcomes Mish Schneider of MarketGauge. Mish breaks down one materials name that could benefit from recently announced China tariffs, and describes how regional banks could benefit from Fed actions in 2024 Read More

Add-on Subscribers

OptionsPlay with Tony Zhang11mo ago

Salesforce Falls Out of Favor: Trade the Bear Put Spread Options Strategy

Once a darling of the tech industry, Salesforce (CRM) had fallen out of favor until recently, when it hit a new all-time high earlier this year Read More