Archived News

DecisionPoint10mo ago

Deja Dot.com Disaster?

Today on Fox Business' Varney & Company, David Bahnsen (The Bahnsen Group) was asked if the current market reminded him of the Dot.com Bubble. He said it did, but not the part about all those worthless dot.com companies that went bust Read More

RRG Charts10mo ago

Price Pays... But For How Long?

While the S&P 500 continues to move higher, the number of stocks participating to the upside continues to decline. In other words, market breadth is deteriorating Read More

Dancing with the Trend10mo ago

Investing with the Trend: Conclusions

Note to the reader: This is the twenty-fifth and final in a series of articles I'm publishing here, taken from my book, "Investing with the Trend." Hopefully, you will find this content useful Read More

ChartWatchers10mo ago

Analyze This: Will the Dow Soar or Crash in 2024?

The Dow Jones Industrial Average ($INDU) may not be the comprehensive measure of the US economy it once was in the early 20th century Read More

Members Only

Martin Pring's Market Roundup10mo ago

Is the Eighteen-Month Dollar Index Trading Range About to be Resolved?

Chart 1 shows that the Dollar Index has been in a trading range since the start of 2023. Its sheer size indicates the ultimate breakout could be followed by a sizeable move in either direction Read More

Members Only

Larry Williams Focus On Stocks10mo ago

June & Gloom | Larry's "Family Gathering" June 18, 2024 Recording

The Final Bar10mo ago

NVDA Wreaks Havoc on Technology Benchmark

In this edition of StockCharts TV's The Final Bar, Dave celebrates Nvidia's rise to overtake Microsoft (MSFT) as the largest company by market cap, creating chaos in the Technology Sector ETF (XLK) with implications for Apple (AAPL) Read More

Don't Ignore This Chart!10mo ago

Seasonality Suggests a Massive Energy Market Shift This Summer—Are You Ready?

We're heading deeper into the summer months, which usually means higher demand for energy products, namely crude oil and gas. While demand tends to be seasonal, the entire crude complex is also sensitive to changes in macroeconomic and geopolitical environments Read More

RRG Charts10mo ago

Market Stumbles Near The Edge of a CLIFF

In this video from StockCharts TV, Julius shares a rare RRG rotational pattern that he's never seen before! He then follows up with a breakdown of the current sector rotation into offensive, defensive, and sensitive, and finds that only one sector is on a positive relative trajec Read More

Members Only

Larry Williams Focus On Stocks10mo ago

"Family Gathering" Meeting Today at 2 PM Eastern

The Final Bar10mo ago

It's TOO EARLY to Be Bullish on Tesla

In this edition of StockCharts TV's The Final Bar, Dave breaks down an upside follow-through day for the S&P 500 and Nasdaq, and highlights the continued weakness in market breadth indicators. Dave identifies key levels to watch for GLD, FSLR, ENPH, TSLA, AVGO, and BIO Read More

Fill The Gap by CMT Association10mo ago

Gold Top? Focus on These Potential Price Objectives

In early 2024, gold reached the price objective derived from the breakout of the large triangle that had evolved beginning in early 2022. Upon reaching the area of the objective, a classic buying climax halted the trend Read More

DecisionPoint10mo ago

DP Trading Room: Natural Gas (UNG) Bearish Again?

Carl and Erin return to the trading room showing you the charts you need to see to start your week! Carl covered the market trends and condition to start the program. He also covers Bitcoin, Dollar, Gold, Silver, Gold Miners, Bonds, Yields and Crude Oil Read More

GoNoGo Charts10mo ago

EQUITIES HIT ALL TIME HIGHS AGAIN WITH TECHNOLOGY IN THE DRIVING SEAT

Good morning and welcome to this week's Flight Path. Equities remained very strong this week as we saw a continued string of bright blue bars and a new price high. Treasury bond prices saw a surge in strength in the second half of the week as we see a return to bright blue bars Read More

Trading Places with Tom Bowley10mo ago

Prepare NOW For A Potentially Huge Storm Ahead

I'm not trying to be overly dramatic, because most of you know how I feel about the stock market's long-term direction. We're going higher. Fight that at your own risk. However, short-term, we have a major storm brewing Read More

Analyzing India10mo ago

Week Ahead: NIFTY May Stay Tentative; Look For Stocks With Strong Relative Strength

The week that went by was in stark contrast to the week before that, as the markets remained in an extremely narrow range before closing with modest gains Read More

Art's Charts10mo ago

Finding Emerging Leaders within Key Groups

The broader market is fairly mixed with one clear leader: technology. I am also seeing mixed performance within the technology sector and within specific groups. Semiconductors are strong overall, but groups like cybersecurity are more mixed. This makes it a stock pickers market Read More

The MEM Edge10mo ago

GET IN EARLY! These Tech Stocks Are Just Taking Off

In this StockCharts TV video, Mary Ellen reviews the overbought condition in the markets after last week's move to a new high in price. She highlights select areas that pushed the markets higher and covers NVDA, AAPL, and more Read More

The Mindful Investor10mo ago

Could the QQQ Turn Dramatically Lower?

There is no denying the strength of the bullish primary trend for stocks off the April low. The Nasdaq 100 index continues to make new all-time highs, closing just under $480 on Friday after gaining about 3.5% over the last week Read More

The Final Bar10mo ago

Breadth Thrust Can Validate a New Bull Phase for Stocks

In this edition of StockCharts TV's The Final Bar, Dave describes how the "breadth thrust", popularized by legendary market strategist Martin Zweig, can help to validate a new bull phase for stocks Read More

Add-on Subscribers

OptionsPlay with Tony Zhang10mo ago

A Debit Spread in American Express to Add Long Exposure

As consumers become more selective in their spending, restaurants and travel remain bright spots in consumer spending. With American Express's focus on premium customers who continue to spend in these categories, AXP is positioned to outperform its industry Read More

The Traders Journal10mo ago

How to Stop the "Wealth Destroyers" by Deploying Your Sell Methodology

"We are in the business of making mistakes. Winners make small mistakes. Losers make big mistakes." — Ned Davis There are zillions of cliches that paraphrase what Ned Davis said. The umbrella axiom with your portfolio should be to cut your losers Read More

ChartWatchers10mo ago

Stock Market Pushes Higher, But Is There a Bond Market Surprise Brewing?

Well, the awaited CPI came in cooler than expected. The stock market liked what it heard, and equities rallied. So did bond prices. Later in the day, the Fed announced its interest rate decision, which, as expected, was unchanged Read More

The Final Bar10mo ago

Bearish Divergences in 2 KEY Growth Stocks: BEWARE!

In this edition of StockCharts TV's The Final Bar, Dave recaps a fresh new all-time high for the S&P 500, a concerning "hanging man" candle for the SPY, and troubling bearish divergences on the charts of AMZN and GOOGL Read More

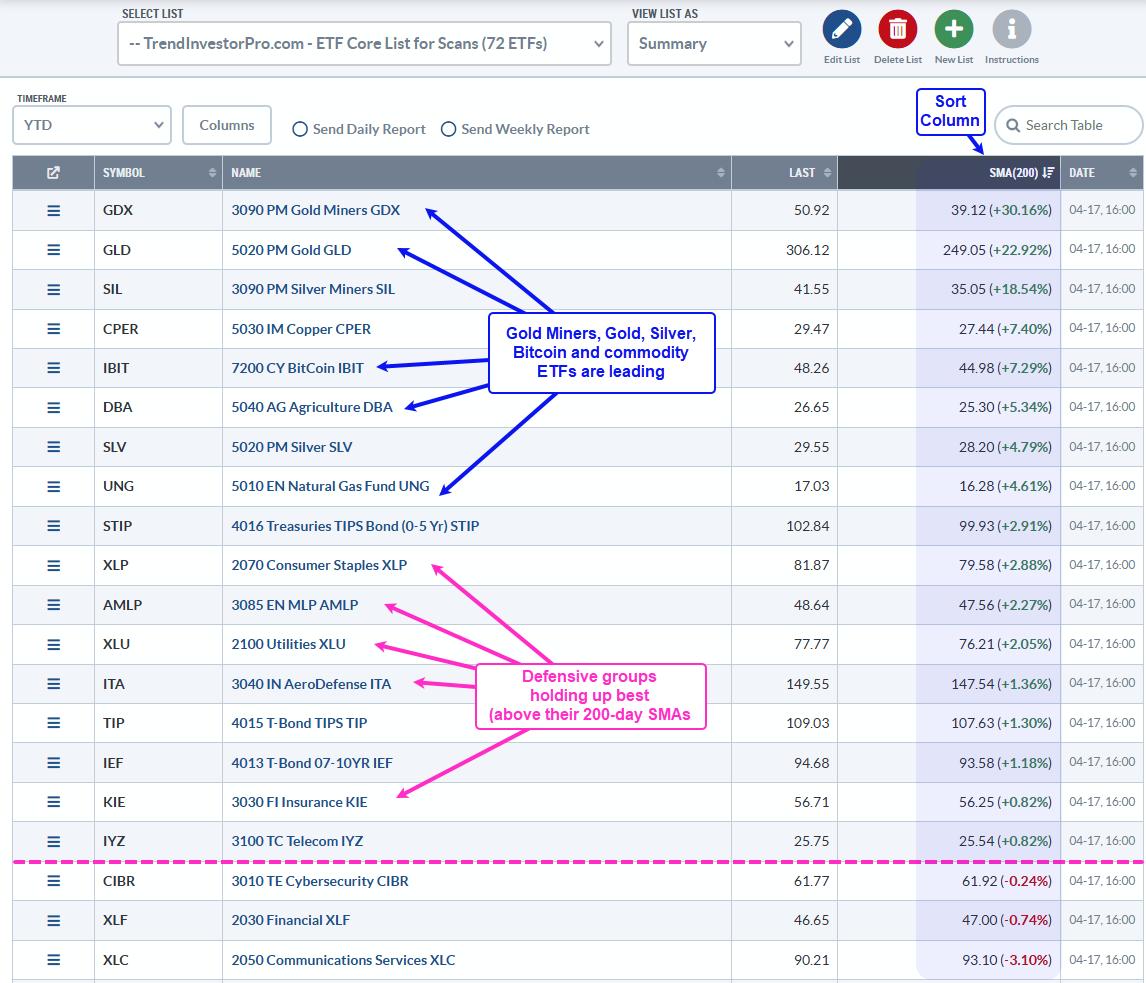

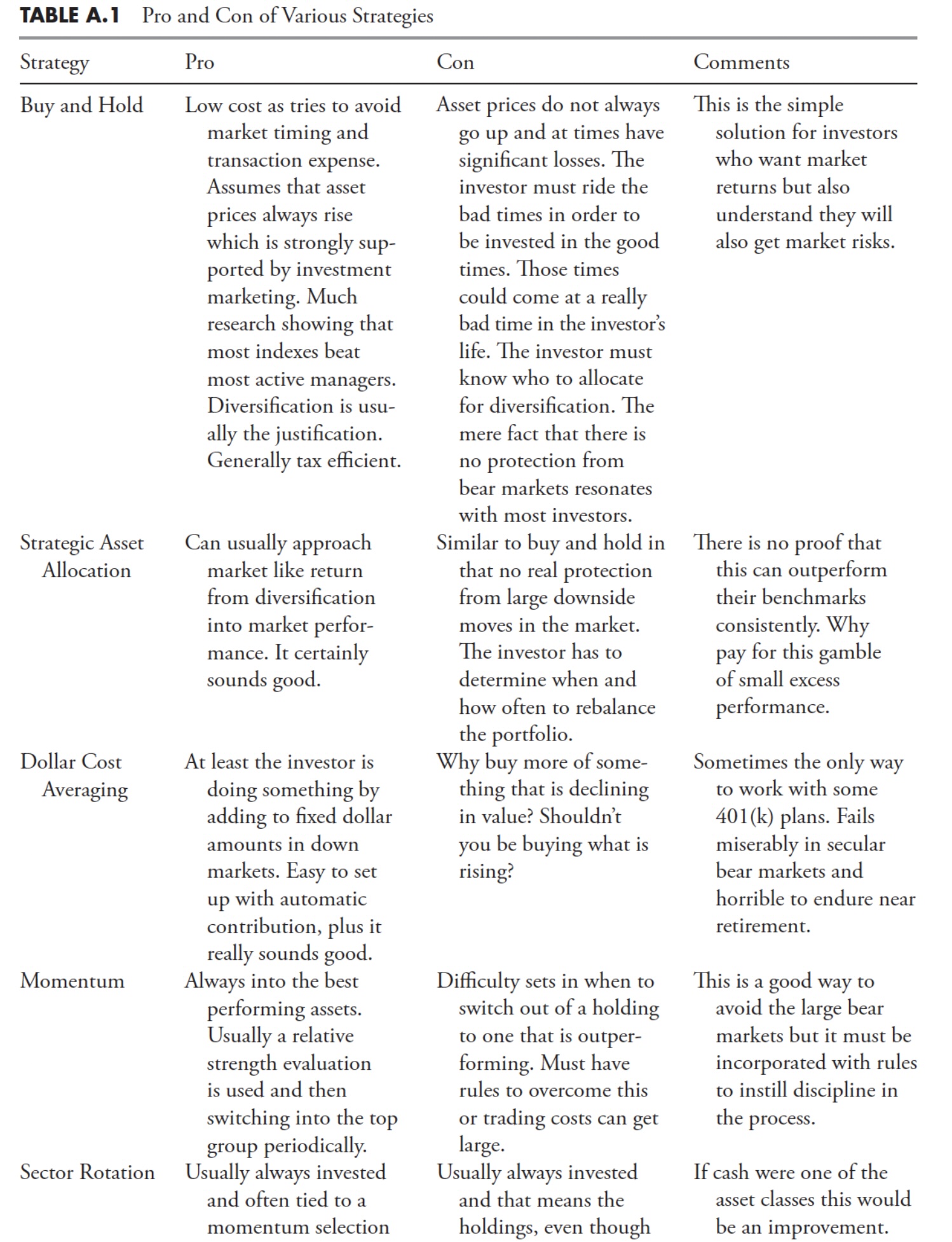

Dancing with the Trend10mo ago

Investing with the Trend: Appendix

Note to the reader: This is a set of appendices for a series of articles I'm publishing here, taken from my book, "Investing with the Trend." Hopefully, you will find this content useful Read More

Don't Ignore This Chart!10mo ago

Bitcoin, Politics, and Profits: What You Need to Know About CleanSpark and Riot Platforms

While money (the thing itself) knows no politics, its production and distribution are often soaked in it. While Bitcoin isn't a functioning currency, many consider it an antidote to "bad money." Perhaps that accounts for its 3.85% spike earlier in the week Read More

Members Only

Larry Williams Focus On Stocks10mo ago

Larry's LIVE "Family Gathering" Webinar Airs NEXT WEEK - Tuesday, June 18 at 2 PM EDT!

The Final Bar10mo ago

S&P 500 Above 5400: Economic Optimism or Irrational Exuberance?

In this edition of StockCharts TV's The Final Bar, Dave recaps the continued optimism for technology shares following this morning's bullish CPI data and the Fed's statements suggesting a Goldilocks scenario for risk assets Read More

Stock Talk with Joe Rabil10mo ago

5 Simple and Powerful Uses for Moving Averages

On this week's edition of Stock Talk with Joe Rabil, Joe shows the five ways to use the Moving Average lines to help with decision making. He discusses how these lines can help to define trend reversals and confirmed trends, when to be on the alert for a reversal Read More

RRG Charts10mo ago

Sector Rotation Model Flashes WARNING Signals

In this video from StockCharts TV, Julius examines the theoretical sector rotation model and aligns it with current state of sector rotation on Relative Rotation Graphs, and the phase of the economy Read More

The Final Bar10mo ago

Apple Blasts Through $200 On AI Optimism

In this edition of StockCharts TV's The Final Bar, Dave reviews key charts from a technical analysis perspective, including AAPL, FSLR, MSTR, and STT Read More

Members Only

Martin Pring's Market Roundup10mo ago

The Next Direction for Interest Rates Is...?

In most cycles, central banks around the world raise and lower short-term interest rates in a rough synchronization. Last week, the European and Canadian central banks began lowering their rates, and the British are expected to follow suit this week Read More

The Final Bar10mo ago

NVDA Stock Split Launches S&P 500 Higher

In this edition of StockCharts TV's The Final Bar, Dave recaps a bullish day for stocks, with 8 out of 11 S&P 500 sectors finishing higher. He breaks down the charts of NVDA, ENPH, FSLR, and AMD, and reviews a potential upside reversal in gold Read More

DecisionPoint10mo ago

DP Trading Room: Equal-Weight Losing Against Cap-Weight SPY

Did you know that the equally-weighted RSP is seriously underperforming the cap-weighted SPY? It is losing considerable ground against the SPY and that suggests that if mega-caps fail, so will go the market. Carl shows us charts to prove his point Read More

GoNoGo Charts10mo ago

Equities Hit New All-Time Highs as Communications Joins Leadership Party

Good morning and welcome to this week's Flight Path. Equities rebounded this week as we saw a string of strong blue "Go" bars and price hit a new higher high. Treasury bond prices returned to a "Go" trend with their own week of strong blue bars Read More

Analyzing India10mo ago

Week Ahead: Despite Pullback, Breadth Remains a Concern; Nifty Still Prone to Retracement

The markets had an incredibly eventful week as they reacted to the exit polls and general election results. All happened in the same week; the Nifty saw itself forming a fresh lifetime high, and also came off close to 8% from its peak Read More

Art's Charts10mo ago

Alibaba Returns to the Scene of the Crime

Chinese stocks wet on a tear from mid April to mid May with the China Large-Cap ETF (FXI) gaining some 40% and breaking its 200-day SMA. FXI then fell back over the last few weeks Read More

The Mindful Investor10mo ago

Tracking the Three Signs of the Bear

There is no denying that the primary trend for the S&P 500 remains bullish as we push to the end of Q2 2024 Read More

The MEM Edge10mo ago

META, AMZN and MSFT On The Move! Here's How to Pinpoint Entry

In this StockCharts TV video, Mary Ellen reviews what drove the markets to new highs. She highlights S&P 500 sectors, plus stocks that have reversed their downtrends, pointing out good entry points Read More

DecisionPoint10mo ago

NVIDIA's Stock Split and Potential Correction

When Nvidia (NVDA) opens on Monday, it will have experienced a 10:1 split, and we should remember that one of the purposes of stock splits is to facilitate distribution Read More