Archived News

Trading Places with Tom Bowley7mo ago

Recognize The New Leaders NOW!

We had a sneak preview of emerging leadership on the morning of July 12th. That was the morning the June Core CPI came in well below expectations Read More

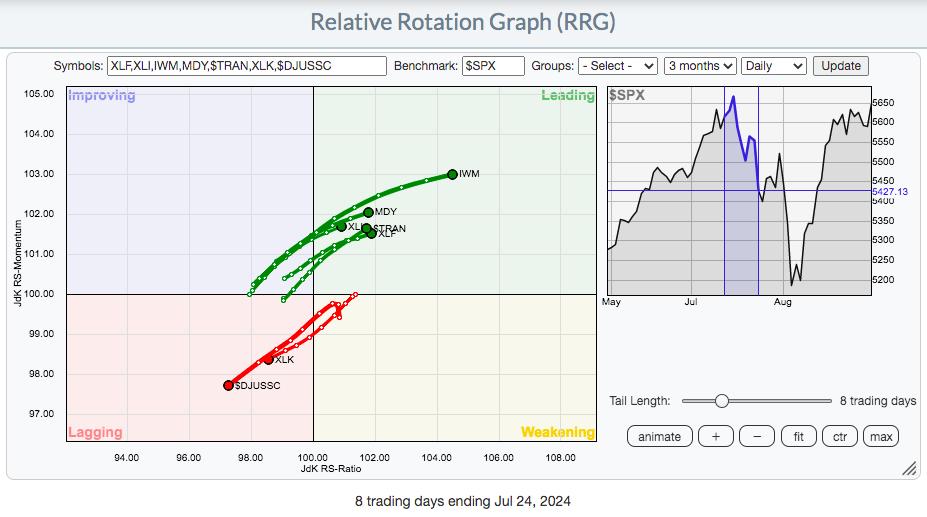

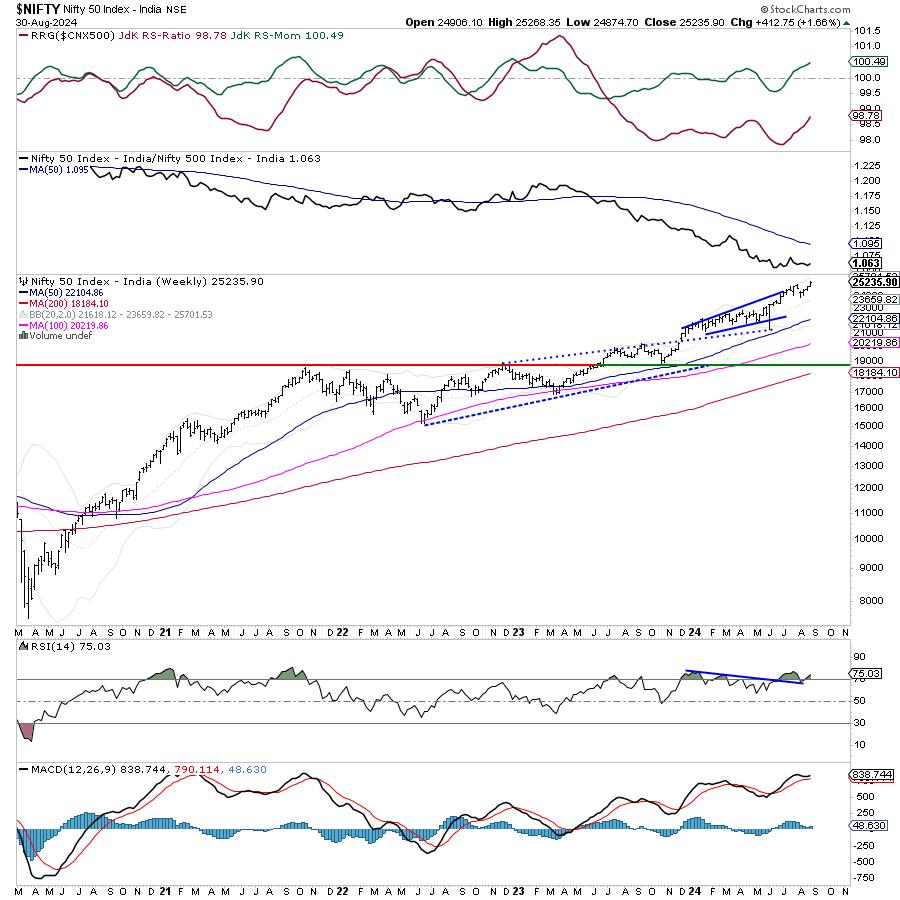

Analyzing India7mo ago

Week Ahead: Uptrend Stays Intact for NIFTY; RRG Shows Distinctly Defensive Setup

The past session for the markets stayed quite trending, as the headline index continued with its upward move. While extending its gains, the Nifty 50 Index ended the week on a very strong note Read More

The MEM Edge7mo ago

Should You Buy the Dip in NVDA?

In this StockCharts TV video, Mary Ellen reviews the broader markets, including NASDAQ weakness, and the outperformance in the equal-weighted S&P 500. She examines NVDA and shares how you should trade the stock depending on your investment horizon Read More

The Mindful Investor7mo ago

What Would a Top in Semiconductors Mean for the S&P 500?

After Nvidia (NVDA) dropped after earnings this week, investors are once again reminded of the importance of the semiconductor space Read More

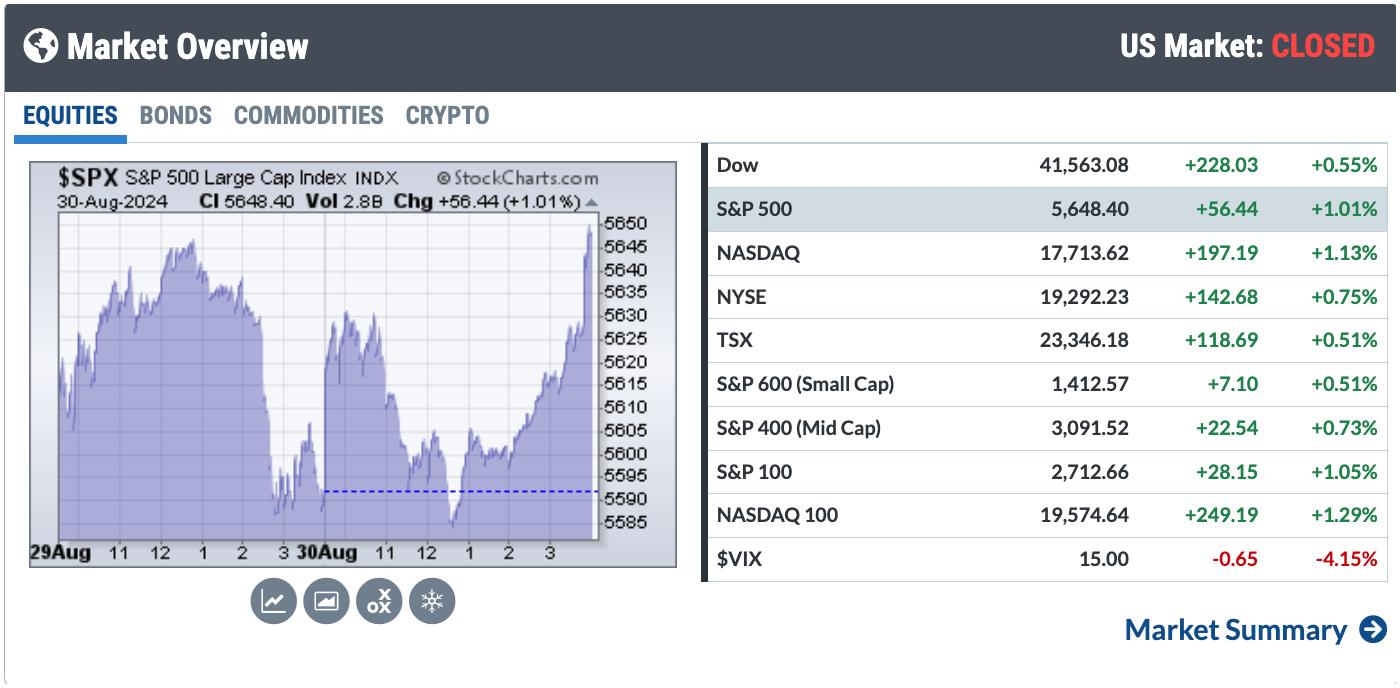

ChartWatchers7mo ago

Charting Forward: Opportunities You Can Seize in September

It's a quiet end to August, with the broader stock market indexes wavering higher and lower. The Market Overview panel on the StockCharts Dashboard shows equity indexes closing higher. And yes, the Dow Jones Industrial Average ($INDU) closed at a record high Read More

ChartWatchers7mo ago

New Highs, But Danger Looms—Is XLF Heading for a Big Fall?

Financial sector stocks are at an all-time high, fueled partly by earnings beats, a favorable and higher interest rate environment, and sector sentiment. Investors are seeing value buying opportunities in many beaten-down financial stocks Read More

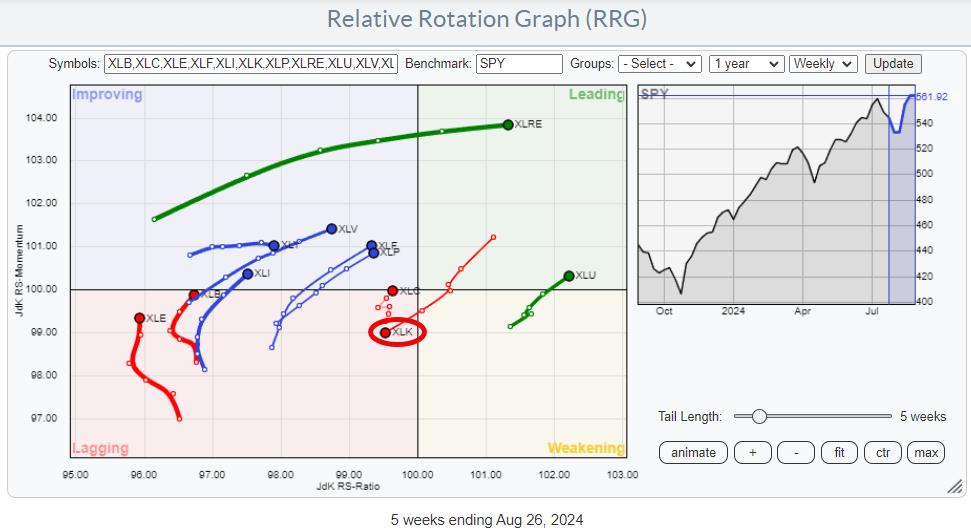

RRG Charts7mo ago

NVDA is Not the Only Semiconductor Stock Out There

It's All Still Relative The weekly Relative Rotation Graph, as it looks toward the close of this Friday (8/30) shows a clear picture -- out of Technology, into everything else Read More

Members Only

Larry Williams Focus On Stocks7mo ago

A Deeper Dive into the Dollar | Focus on Stocks: September 2024

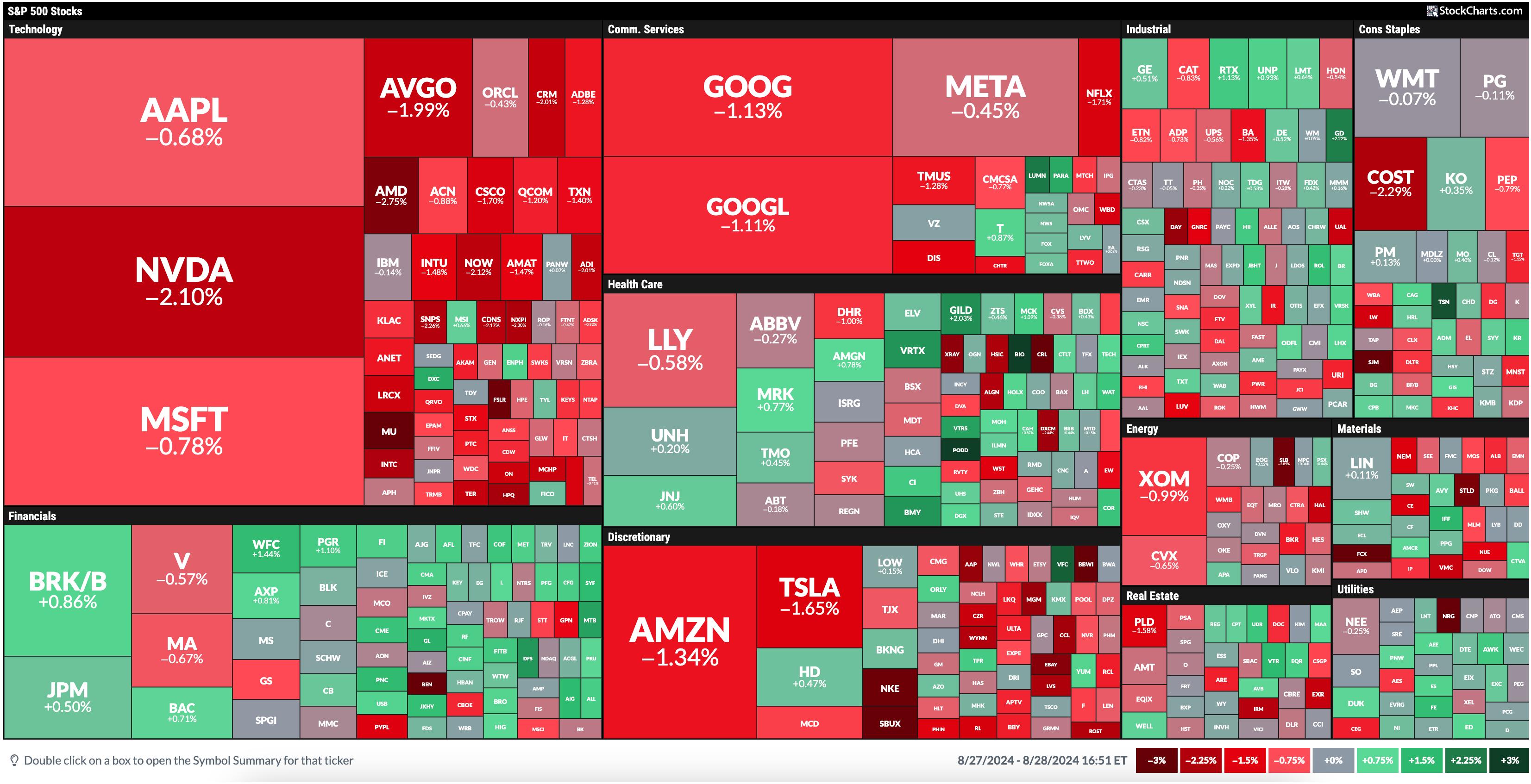

ChartWatchers7mo ago

MarketCarpet Report: Stock Market Remains Resilient With Dow Notching a Record Close

The thin trading ahead of Labor Day weekend is here. Despite that, on Thursday, the Dow Jones Industrial Average ($INDU) notched a record-high close. The S&P 500 ($SPX) was flat, and the Nasdaq Composite ($COMPQ) closed slightly lower Read More

The Final Bar7mo ago

NVDA Earnings Miss, Yet Dow Powers Higher

In this edition of StockCharts TV's The Final Bar, Dave breaks down key sector leadership themes and why growth stocks like Nvidia continue to take a back seat to value-oriented sectors. He speaks to the inverted yield curve, performance of the equal-weighted S&P 500 vs Read More

ChartWatchers7mo ago

Stock Market Today: NVDA Reports, Tech Lags, Financials Take the Lead

Today's MarketCarpet was a sea of red with just a few dabs of green. Financials took the lead, followed by Health Care and Utilities. The Technology sector, yesterday's leader, is at the bottom today Read More

The Final Bar7mo ago

Earnings Provide Another Nail in the Retail Coffin

In this edition of StockCharts TV's The Final Bar, Dave recaps a brutal day for retailers as ANF, FL, and BBWI drop on earnings misses Read More

Stock Talk with Joe Rabil7mo ago

4 MACD Patterns That Will Give You an Edge

In this exclusive StockCharts TV video, Joe shares four MACD patterns that he focuses on - Pinch, Reverse Divergence, Divergence, and Zero Line Reversal. These signals will help to improve the timing of your trades Read More

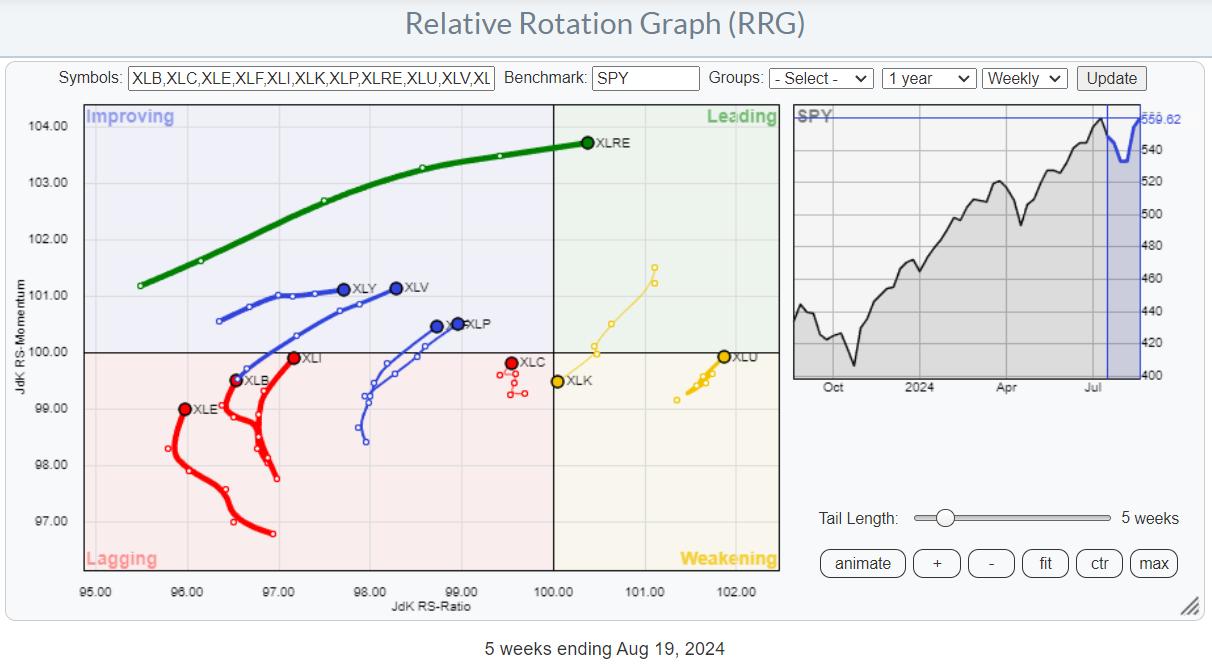

RRG Charts7mo ago

Weak September Rotation - What Does it Mean for Sectors?

In this video from StockCharts TV, Julius addresses the expected sector rotation for the upcoming month of September which is traditionally the weakest month of the year Read More

The Final Bar7mo ago

Three Technology Stocks in Make or Break Scenarios

In this edition of StockCharts TV's The Final Bar, Dave focuses in on three key charts to watch in the technology sector as investors anxiously await NVDA earnings and Friday's inflation data Read More

ChartWatchers7mo ago

Stock Market Today: Two Sectors That Can Make Sizable Moves

Have you ever been in a plane that keeps circling around, waiting to land? That's what the stock market feels like right now. Investors are rotating from one sector to another, waiting for direction from the control tower Read More

ChartWatchers7mo ago

An Investment Routine for Spotting Buy-The-Dip Opportunities

Buying the dip is a something of go-to strategy for many traders and investors. The trick here is to buy strength on the way down and to avoid a "falling knife" scenario (or at least plan for it in case it does happen) Read More

Members Only

Martin Pring's Market Roundup7mo ago

Is the Multi-Month Dollar Index Trading Range About to be Resolved?

Last June, I wrote an article whose title was more or less the same as this one. At the time, the Index was bumping up against the top of a major trading range, and it looked very much as if it was about to experience an upside breakout Read More

DecisionPoint7mo ago

DP Trading Room: NVDA Going Into Earnings - Hold or Sell?

It is a big week for earnings and NVIDIA (NVDA) is at the top of the list! Erin gives you her view on whether to hold into earnings based on the technicals of the chart. She also reviewed other stocks reporting on Wednesday: CRM, CRWD, HPQ and OKTA Read More

Add-on Subscribers

OptionsPlay with Tony Zhang7mo ago

PayPal Stock Price Breaks Out: How to Take Advantage of the Price Rise

Earlier this year, in April and June, I laid out a bullish thesis for PayPal Holdings, Inc. (PYPL)—the stock price was bottoming and had the potential to break out. Since then, PYPL has improved Read More

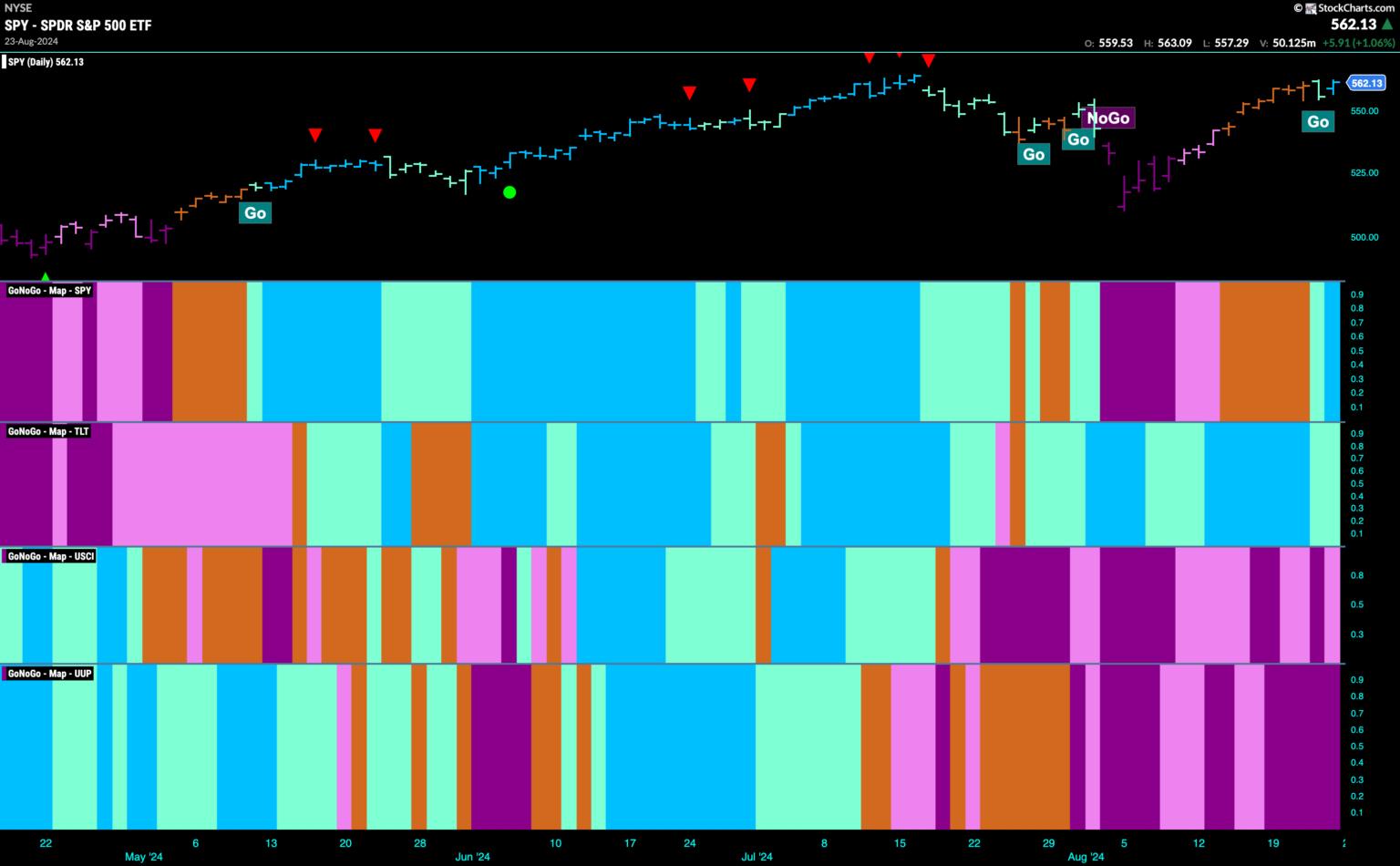

GoNoGo Charts7mo ago

Equities Continue Surge Amid "Healthy" Rotation

Good morning and welcome to this week's Flight Path. Equities continue their path out of the "NoGo" correction. The "Go" trend has returned for U.S. equities as we see first an aqua and then a blue "Go" bar. This came after a string of uncertain amber "Go Fish" bars Read More

Dancing with the Trend7mo ago

Investing with the Trend: A Review by Dr. Mark Holder

The following is a review of my book "Investing with the Trend" by Dr. Mark Holder. You can read the entire contents of the book on this blog, starting with this article. "History repeats itself." Never was a phrase (oft cited as a Churchill quote) more apt in describing a text Read More

Art's Charts8mo ago

This Housing-Related Stock Just Printed a 5 for the Trend Composite

The Home Construction ETF (ITB) is leading the market as it surged to a new closing high this week. While this high is certainly bullish and points to upside leadership, the real signal triggered back in early July as the Trend Composite turned bullish with an outsized move Read More

The MEM Edge8mo ago

Major Market Shift As Week Ends Strong!

In this StockCharts TV video, Mary Ellen reviews the broader market's health while highlighting big shifts into newer areas, including banks, retail, and autos. Sharing one of the reasons Tech stocks were weak, she highlights which areas as seeing renewed strength Read More

The Final Bar8mo ago

Top Ten Charts for August: Two Bearish Turnaround Plays

In this edition of StockCharts TV's The Final Bar, Dave completes a five-part series covering ten charts to watch in August 2024, breaking down to stocks in established downtrends Read More

RRG Charts8mo ago

RRG-Velocity Jumping on XLF Tail

On the weekly Relative Rotation Graph, the rotation still favors almost every sector over Technology. I discussed the opposite rotations between weekly and daily RRGs in last week's video, which you can find here Read More

ChartWatchers8mo ago

The SCTR Report: Workday Rises on Strong Earnings Results and Rising Technical Strength

When a stock surges based on a strong earnings report, analyst upgrade, or other fundamental factors, it's tempting to jump into the stock Read More

Don't Ignore This Chart!8mo ago

Is Peloton Stock the Next Big Turnaround? What You Need to Know Before It's Too Late

Peloton's (PTON) stock soared over 38% on Thursday after the company posted positive free cash flow for the second quarter in a row—a first since 2021. Is the turnaround working? Maybe. But investors aren't waiting around—they're hopping on Read More

Trading Places with Tom Bowley8mo ago

Jackson Hole Jay Doesn't See His Shadow, Worst Market Weather Behind Us

It's been nearly two years since Jackson Hole Jay saw his shadow and we all endured 6 more weeks of harsh market weather Read More

Members Only

Larry Williams Focus On Stocks8mo ago

A New Way of Forecasting Crude Oil | Larry's "Family Gathering" August 22, 2024 Recording

The Final Bar8mo ago

Top Ten Charts for August: Best Healthcare Stocks for August 2024

In this edition of StockCharts TV's The Final Bar, Dave continues a five-part series covering ten charts to watch in August 2024, honing in on two Health Care stocks showing renewed signs of strength Read More

DecisionPoint8mo ago

Gold Miners' Performance vs. Gold -- Does It Say Sell Gold?

In Monday's DecisionPoint Trading Room video, we were asked why we cover Gold Miners (GDX) as well as Gold (GLD) Read More

Stock Talk with Joe Rabil8mo ago

Looking for the Next Entry Point in SPY? USE RSI!

In this exclusive StockCharts TV video, Joe shows how to use RSI in multiple timeframes to identify the next buying opportunity in the SPY. He explains why he thinks this rally is important and uses the ADX on the daily to distinguish between the strength in different indices Read More

The Final Bar8mo ago

Top Ten Charts for August: Two Key Defensive Plays

In this edition of StockCharts TV's The Final Bar, Dave continues a five-part series covering ten charts to watch in August 2024, with a focus today on Utilities and Real Estate Read More

Don't Ignore This Chart!8mo ago

Disney Bust or Bargain? Here are the Levels to Watch!

The House of Mouse has taken a serious nosedive over the last three years, having gone from a high of about $201 down to $89 and change—a 55% drop that feels like one of its roller coaster rides. Not exactly the thrill Disney shareholders were hoping for Read More

The Final Bar8mo ago

Top Ten Charts for August: Two Tempting Consumer Staples Names

In this edition of StockCharts TV's The Final Bar, Dave continues a five-part series covering ten charts to watch in August 2024, focusing on potential ideas in the Consumer Staples sector Read More

RRG Charts8mo ago

What Does This Mean for the S&P 500 Rally?

In this video from StockCharts TV, Julius looks at the conflicting rotations in both asset classes and equity sectors. The weekly rotations differ significantly from their daily counterparts Read More

The Final Bar8mo ago

Top Ten Charts for August: Two Magnificent 7 Stocks Worth Watching

In this edition of StockCharts TV's The Final Bar, Dave kicks off a five-part series covering ten charts to watch in August 2024, starting with two mega-cap growth stocks testing key resistance levels Read More

Members Only

Martin Pring's Market Roundup8mo ago

This Market is On Track for a 45-Year Breakout

It's not very often that any market experiences a 10-year breakout, let alone a 45-year one. That, however, is what Chart 1 says is about to materialize for the inflation-adjusted gold price Read More