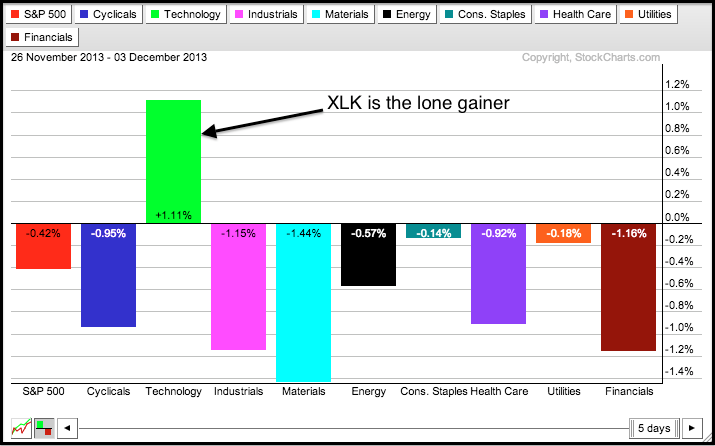

The major index ETFs corrected over the last two days, but this correction turned mixed as the tech sector held up relatively well on Tuesday. Also notice that the declines in the major index ETFs were modest and not that significant, especially considering the big gains from November. The PerfChart below shows performance for the S&P 500 and the nine sector SPDRs over the last five days. The S&P 500 and eight sectors are down with industrials, materials and finance leading the way lower. The tech sector is the only one showing a gain, and this gain is not too shabby for one week (+1.11%). Strength in Apple (+6.17%) and Microsoft (+2.57%) contributed significantly to the gains in XLK. As noted in Tuesday's market message, the Semiconductor SPDR (XSD) is also showing signs of life with a wedge breakout.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Wed - Dec 04 - 07:00 - MBA Mortgage Index

Wed - Dec 04 - 08:15 - ADP Employment Report

Wed - Dec 04 - 10:00 - New Home Sales-Sep

Wed - Dec 04 - 10:00 - New Home Sales-Oct

Wed - Dec 04 - 10:00 - ISM Services Index

Wed - Dec 04 - 10:30 - Crude Oil Inventories

Wed - Dec 04 - 14:00 - Fed Beige Book

Thu - Dec 05 - 07:30 - Challenger Job Report

Thu - Dec 05 - 08:30 - Initial Jobless Claims

Thu - Dec 05 - 08:30 - GDP

Thu - Dec 05 - 10:00 - Factory Orders

Thu - Dec 05 - 10:30 - Natural Gas Inventories

Fri - Dec 06 - 08:30 - Employment Report

Fri - Dec 06 - 08:30 - Personal Income & Spending

Fri - Dec 06 - 09:55 - Michigan Sentiment

Fri - Dec 13 - 23:59 - Congressional Budget Deadline

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.