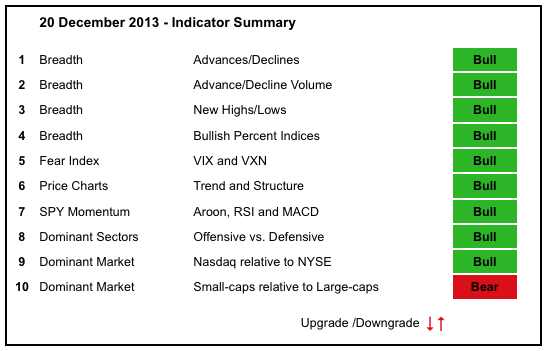

After correcting the first two weeks of December, stocks caught a big bid after the FOMC policy statement and the major index ETFs recouped their prior losses. SPY fell from 182 to 178 and then surged to 182 on Wednesday. These moves were enough to propel the Nasdaq AD Line and AD Volume Line to new highs. The NYSE AD Line and AD Volume Line, however, did not hit new highs and remain laggards. Relative weakness in small-caps is the other negative factor out there. Nevertheless, the bulk of the evidence remains bullish as the positives outweigh the negatives. The major index ETFs and the key offensive sectors are within a few percent of their 52-week highs and in clear uptrends.

- AD Lines: Bullish. The Nasdaq AD Line hit a new high at the end of November, pulled back in early December and bounced to form another higher low. The NYSE AD Line formed a small bearish divergence and weakened the last two months. The overall trend, however, remains up.

- AD Volume Lines: Bullish. The Nasdaq AD Volume Line hit a new high this week and remains in a long-term uptrend. The NYSE AD Volume Line is also a bit weak because it peaked in mid November. The big trend, however, remains up.

- Net New Highs: Bullish. NY Net New Highs and Nasdaq Net New Highs dipped into negative territory in early December and then bounced as the market surged over the last few days. The cumulative Net New Highs lines hit new highs.

- Bullish Percent Indices: Bullish. All nine sector Bullish Percent Indices are above 50%. $BPENER is the weakest at 56.82%.

- VIX/VXN: Bullish. The S&P 500 Volatility Index ($VIX) and the Nasdaq 100 Volatility Index ($VXN) moved higher from mid November to mid December and fell back a little this week. Overall levels remain low and low volatility creates a positive backdrop for the stock market.

- Trend-Structure: Bullish. DIA, SPY, MDY and IWM are all within 2% of their 52-week highs and remain in uptrends overall.

- SPY Momentum: Bullish. RSI got a bounce off the 40-50 support zone and remains in the bull zone (40-80). MACD(5,35,5) remains positive, but the Aroon Oscillator plunged below -50.

- Offensive Sector Performance: Bullish. XLI hit a new high this week and remains the strongest of the four. XLK, XLF and XLY are within a few percent of their highs.

- Nasdaq Performance: Bullish. The $COMPQ:$NYA ratio stalled from mid October to mid November and then surged to new highs over the last few weeks.

- Small-cap Performance: Bearish. The $RUT:$OEX ratio bounced in late November, but fell back sharply in December and remains in a downtrend since early October.

- Breadth charts (here) and intermarket charts (here) have been updated.

This table is designed to offer an objective look at current market conditions. It does not aim to pick tops or bottoms. Instead, it seeks to identify noticeable shifts in buying and selling pressure.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios