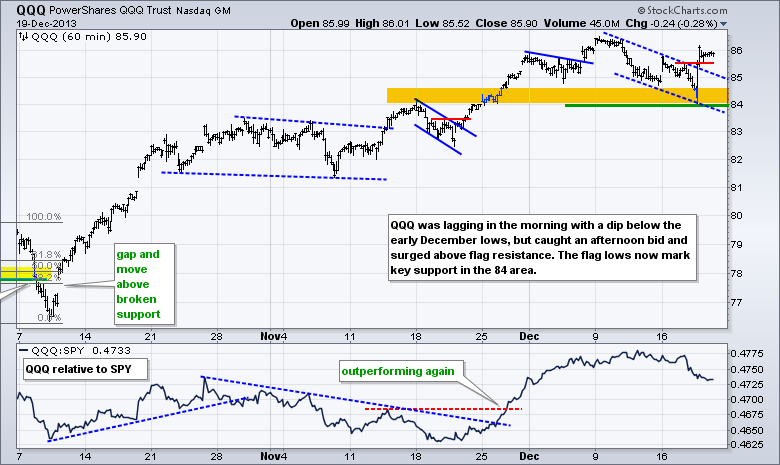

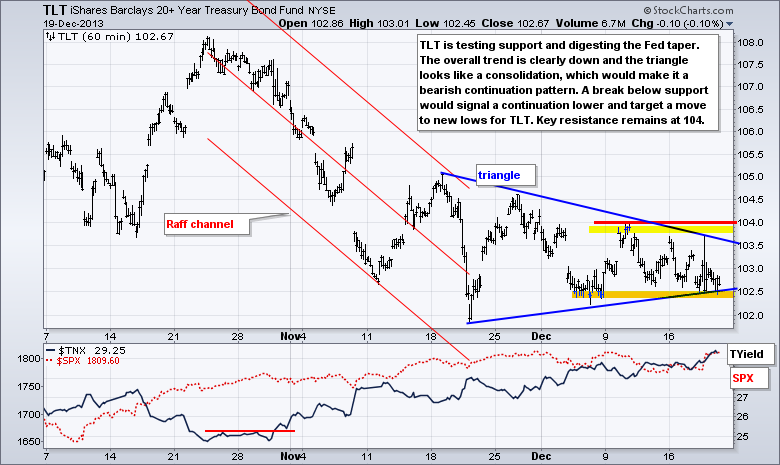

After big gains on Wednesday, stocks corrected a bit to digest these gains on Thursday. The Russell 2000 ETF (IWM) and the S&P MidCap 400 ETF (MDY) fell back with losses around .75% on the day. DIA edged higher with a fractional gain, while SPY edged lower. Eight of the nine sectors were mixed with fractional gains and losses. It seems that the Utilities SPDR (XLU) had a delayed reaction to tapering because it fell the most. Also note that the REIT iShares (IYR) was hit and the Home Construction SPDR (ITB) gave up some of its big gains. Precious metals provided the biggest moves as gold and silver fell over 2%. For the broader stock market, I am a bit concerned with the short-term performance of the Nasdaq and NYSE AD Lines. Even though stocks surged on Wednesday, the intraday AD Lines did not exceed Monday's high. Both AD Lines remain in downtrends this month and need to break this week's highs to reverse these downtrends.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Fri - Dec 20 - 08:30 - GDP - Third Estimate

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.