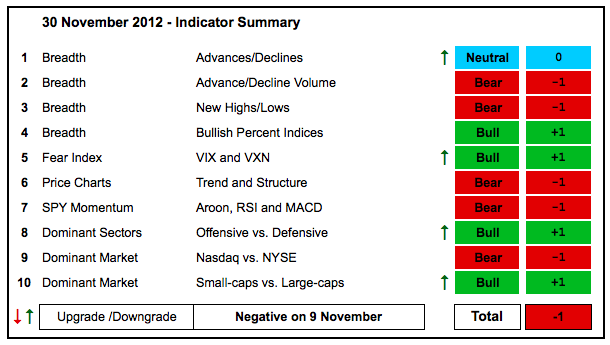

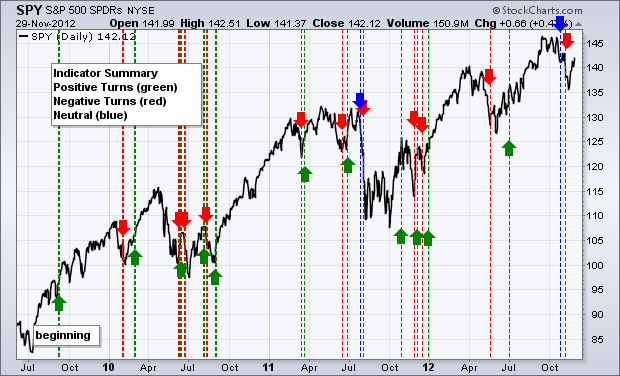

<div style="width: 600px;">With a sharp rally the last two weeks, several indicator groups were upgraded. Namely, the NYSE AD Line surged to its October-November highs and is close to a 52-week high. The cumulative line for NYSE Net New Highs hit a new high. The VIX and VXN are low and show little fear. The Consumer Discretionary SPDR (XLY) is the strongest sector and small-caps are starting to outperform. The overall picture, however, is still mixed because the two week surge has not fully negated the bearish signals from early November. Keep in mind that this table is NOT designed to call market tops or bottoms. It is an assessment of CURRENT market conditions. I use it to define my trading bias by looking for bullish setups when positive and bearish setups when negative.

- AD Lines: Neutral. The Nasdaq AD Line rebounded sharply the last two weeks and recovered most of the early November decline. A little more strength is needed to turn bullish though. The NYSE AD Line rebounded and surged to its Sep-Oct highs to earn an upgrade to bullish.

- AD Volume Lines: Bearish. The Nasdaq AD Volume Line surged to its mid October high, but remains in a downtrend overall since April. The NYSE AD Volume Line also surged but has yet to reverse the downtrend that started in mid September.

- Net New Highs: Neutral. Nasdaq Net New Highs turned positive, but the cumulative line has yet to break above the 10-day EMA. NYSE Net New Highs surged above 5% and the cumulative line hit a new high.

- Bullish Percent Indices: Bullish. All nine Bullish Percent Indices are above 50%. The Technology BPI ($BPINFO) even moved above 50% this week.

- VIX/VXN: Bullish. The Nasdaq 100 Volatility Index ($VXN) and the S&P 500 Volatility Index ($VIX) are well below 20. While that may seem complacent, it also suggests a lack of fear and this is positive for the stock market.

- Trend-Structure: Bearish. DIA, IWM, MDY, QQQ and SPY broke down in late October and early November. The two week surge is impressive, but the major index ETFs have yet to take out the early November highs.

- SPY Momentum: Bearish. RSI broke down in late October and then surged into its resistance zone (40-50) this week. MACD(5,35,5) turned positive. The Aroon oscillator remains at -50 and has yet to turn bullish.

- Offensive Sector Performance: Bullish. Three of the four offensive sectors are outperforming on the one and three month timeframes, but not the same three. The Consumer Discretionary SPDR (XLY) remains the strongest sector in the market and this is positive.

- Nasdaq Performance: Bearish. The $COMPQ:$NYA ratio flattened out the last 4-5 weeks as the Nasdaq performed in line with the NY Composite. I have yet to see an upturn and breakout though.

- Small-cap Performance: Bullish. The $RUT:$OEX ratio found support near the October lows and broke above its early November high this week. Small-caps are getting fiscal cliff fever and starting to outperform.

- Breadth Charts (here) and Inter-market charts (here) have been updated.

Previous turns include:

Negative on 9-November-12

Neutral on 26-October-12

Positive on 6-July-12

Negative on 18-May-12

Positive on 30-December-11

Negative on 16-December-11

Positive on 3-December-11

Negative on 23-November-11

Positive on 28-October-11

Negative on 5-August-11

Neutral on 29-Jul-11

Positive on 30-Jun-11

Negative on 17-Jun-11

Positive on 25-Mar-11

Negative on 18-Mar-11

Positive on 3-Sep-10

Negative on 13-Aug-10

Positive on 6-Aug-10

Negative on 24-Jun-10

Positive on 18-Jun-10

Negative on 11-Jun-10

Positive on 5-March-10

Negative on 5-Feb-10

Positive on 11-Sept-09

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More