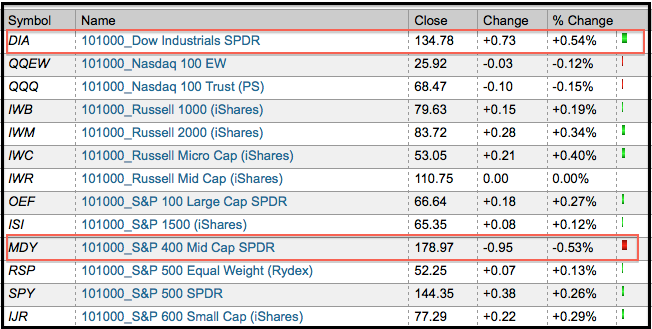

Monday was a strange day indeed. Stocks were truly mixed with the Dow Industrials SPDR (DIA) advancing around 1/2% and the S&P MidCap 400 SPDR (MDY) declining the same amount. It is definitely a strange day when two relatively broad indices move in opposite directions. There were splits elsewhere as well. The Russell 2000 ETF (IWM) edged higher on strength in the finance sector. Conversely, Apple and the technology sector weighed on the Nasdaq 100 ETF (QQQ).

Persistent weakness in semis remains a major concern for the market. The chart above shows the Semiconductor SPDR (XSD) hitting resistance at 48 and breaking wedge support with a sharp decline the last two weeks. Next support resides around 40-41. The price relative (XSD:SPY ratio) peaked in February and hit a new low on Monday. This is not a good sign for the technology sector, the Nasdaq or the market overall.

The S&P 500 SPDR (SPY) surged in early trading, but fell back as resistance in the 145.5 area ultimately held. This buying surge can probably be attributed to the first day of the month effect. Overall, the rise since last week looks like a potential bear flag. A break below flag support would signal a continuation lower and project a break below key support at 142.5. RSI is holding its support zone and chartists should look for a break below 40 to confirm a trend change in SPY.

**************************************************************************

The 20+ Year T-Bond Fund (TLT) surged and became overbought with the move above 124.50. The ETF consolidated the last few days to work off this overbought condition. A break above 125 would signal a continuation higher and be bearish for stocks. I am setting support just below the consolidation to allow for a buffer. A break below 123 would reverse the three week uptrend and be bullish for stocks. This is a big week for treasuries because of the key economic reports scheduled for release this week.

**************************************************************************

The US Dollar Fund (UUP) remains within a rising channel and could be nearing its make of break point. A surge above the upper trend line would signal an acceleration higher. I am, however, setting key resistance a little lower at 21.95. Chartists should also watch RSI for a breakout at 60 to confirm. Channel support remains at 21.72 and a break below this level would signal a continuation of the bigger downtrend.

**************************************************************************

No change. The US Oil Fund (USO) broke down last week. We can blame a firmer Dollar and weaker stock market, but oil moved disproportionately. USO got an oversold bounce late last week, but this is not enough to reverse the technical damage. Broken support turns first resistance in the 35-35.50 area. RSI resistance is set at 60.

**************************************************************************

No change. Even though the Dollar firmed and stocks softened, the Gold SPDR (GLD) held up quite well over the last two weeks. GLD plunged below 170, but quickly recovered and moved back near the top of its range. This recovery reinforces support in the 167-168 area. The trend is firmly bullish as long as this level holds. A break above 173 would signal another continuation higher for bullion. The QE debate from this week's Fed minutes release will likely affect gold.

**************************************************************************

Key Reports and Events:

Tue - Oct 02 - 14:00 - Auto/Truck Sales

Wed - Oct 03 - 07:00 - MBA Mortgage Index

Wed - Oct 03 - 08:15 - ADP Employment Change

Wed - Oct 03 - 10:00 - ISM Services Index

Wed - Oct 03 - 10:30 - Oil Inventories

Wed - Oct 03 - 14:00 - FOMC Minutes

Wed - Oct 03 – 20:00 – Presidential Debate

Thu - Oct 04 - 07:30 - Challenger Job Cuts

Thu - Oct 04 - 08:30 - Jobless Claims

Thu - Oct 04 - 10:00 - Factory Orders

Fri - Oct 05 - 08:30 - Employment Report

Mon - Oct 08 - 09:00 – EU Finance Ministers Meet

Tue - Oct 09 - 09:00 - EU Finance Ministers Meet

Thu – Oct 18 – 09:00 – EU Summit

Fri – Oct 19 – 09:00 – EU Summit

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.