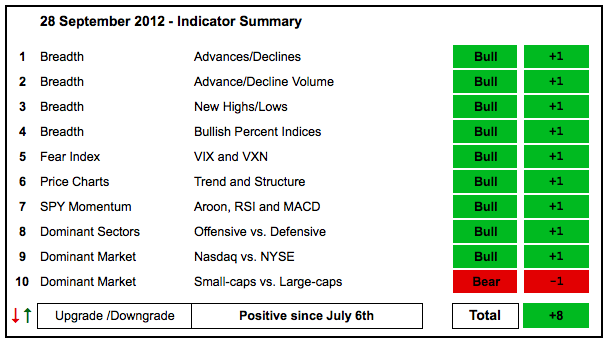

There is no change in the indicator summary, but the market is looking a bit tired and perhaps ripe for a correction or consolidation period. The Nasdaq AD Volume Line did not come close to its spring high and the NYSE AD Volume Line hit resistance from its spring high. The volatility indices hit extremes last week and surged this week. These extremes suggest complacency that could give way to a correction. Small-caps led the market in August, but the $RUT:$OEX ratio remains in a downtrend since February and turned back down the last two weeks. Stocks were overbought just two weeks ago so a correction period would be quite normal. Also note that the S&P 500 hit a 52-week high ahead of third quarter earnings and recent warnings do not support a 52-week high (see CAT, FDX, INTC, NSC).

- AD Lines: Bullish. The Nasdaq AD Line pulled back sharply the last two weeks, but remains in an uptrend since early June. The NYSE AD Line also pulled back, but this was after hitting a 52-week high earlier this month.

- AD Volume Lines: Bullish. The Nasdaq exceeded its spring high, but the AD Volume Line fell well short and turned down in mid September. A big bearish divergence is brewing, but the trend since early June is still up. The NYSE AD Volume Line reached its spring highs and then turned down, but remains in an uptrend since June.

- Net New Highs: Bullish. Nasdaq and NYSE Net New Highs contracted, but remain positive and bullish overall.

- Bullish Percent Indices: Bullish. Eight of the nine sector BPIs are above 70%. The Technology Bullish% Index ($BPINFO) is the "least strong" with a 68.35% reading. The Nasdaq BPI is also relatively low at 58.98%.

- VIX/VXN: Bullish. After moving below 15% in mid September, the S&P 500 Volatility Index ($VIX) and the Nasdaq 100 Volatility Index ($VXN) surged this week. However, the overall trends are down and a break above the early September high is needed to signal an uptrend in fear, which would coincide with increased selling pressure.

- Trend-Structure: Bullish. DIA, IWM, MDY, QQQ and SPY recorded 52-week highs earlier this month and pulled back over the last 1-2 weeks. So far, this is just a pullback within a bigger uptrend.

- SPY Momentum: Bullish. The Aroon Oscillator (20) has been positive since mid June. MACD(5,35,5) has been positive since late June. RSI remains above the 40-50 support zone.

- Offensive Sector Performance: Bullish. XLY and XLK recorded 52-week highs earlier this month and continue to show upside leadership. XLF and XLI hit resistance from their spring highs and are lagging somewhat.

- Nasdaq Performance: Bullish. The $COMPQ:$NYA ratio hit a new high in early September, but then declined back into the trading range six month trading range. A new high is bullish and it has yet to break down.

- Small-cap Performance: Bearish. The $RUT:$OEX surged from early August to mid September and then turned down the last two weeks. This move was not enough to reverse the downtrend that started in February.

- Breadth Charts (here) and Inter-market charts (here) have been updated.

Previous turns include:

Positive on 6-July-12

Negative on 18-May-12

Positive on 30-December-11

Negative on 16-December-11

Positive on 3-December-11

Negative on 23-November-11

Positive on 28-October-11

Negative on 5-August-11

Neutral on 29-Jul-11

Positive on 30-Jun-11

Negative on 17-Jun-11

Positive on 25-Mar-11

Negative on 18-Mar-11

Positive on 3-Sep-10

Negative on 13-Aug-10

Positive on 6-Aug-10

Negative on 24-Jun-10

Positive on 18-Jun-10

Negative on 11-Jun-10

Positive on 5-March-10

Negative on 5-Feb-10

Positive on 11-Sept-09