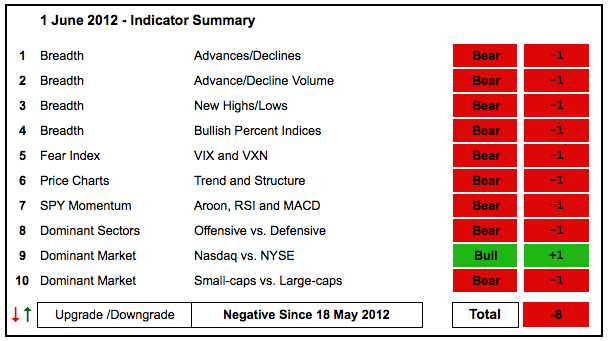

Despite a shallow bounce and some firmness the last two weeks, there is no change in the indicator summary. Current conditions remain bearish overall. The major index ETFs and the key sector SPDRs all broke down in May. The AD Volume Lines broke support from their March-April lows. Net New Highs turned negative and the cumulative Net New Highs lines turned lower in mid May. It will take strong and sustained buying pressure to reverse this bearish condition.

- AD Lines: Bearish. The Nasdaq AD Line broke to a 52-week low in May and is clearly in bear mode. The NYSE AD Line broke below its March-April lows in May to start a downtrend.

- AD Volume Lines: Bearish. The NYSE and Nasdaq AD Volume Lines formed head-and-shoulders patterns from February to April and broke support in May.

- Net New Highs: Bearish. Nasdaq Net New Highs are decidedly negative and the cumulative line broke down in mid May. NYSE Net New Highs dipped to their lowest level since October and the cumulative line turned down.

- Bullish Percent Indices: Bearish. We have a bit of a stalemate here. Four of the nine BPIs are below 50%, four are above 50% and one equals 50%. The Consumer Discretionary Bullish% Index ($BPDISC) is at 50% and holds the wild card here. I will leave the indicator at bearish because the BPIs for technology and industrials are well below 50%.

- VIX/VXN: Bearish. The S&P 500 Volatility Index ($VIX) and the Nasdaq 100 Volatility Index ($VXN) broke above resistance that extended from February to April. Notice that inverse head-and-shoulders patterns formed and both broke neckline resistance. Rising volatility signals rising fear and this increases the propensity to sell.

- Trend-Structure: Bearish. DIA, IWM, MDY and SPY all broke support levels and these support breaks are holding as they consolidate just below. QQQ has been trending lower since early April.

- SPY Momentum: Bearish. Selling pressure in May was strong enough to push RSI to its lowest reading since August and MACD(5,35,5) to its lowest reading since early October. The Aroon Oscillator moved below its bearish threshold (-50) in mid May.

- Offensive Sector Performance: Bearish. The four offensive sectors (XLF, XLY, XLI, XLK) broke support levels in May and these support breaks are holding. The three defensive sectors (XLU, XLP, XLV) held up the best in May.

- Nasdaq Performance: Bullish. The $COMPQ:$NYA ratio is holding up because the NY Composite ($NYA) is now leading the Nasdaq lower. $NYA can blame the industrials, finance and consumer discretionary sectors for relative weakness.

- Small-cap Performance: Bearish. The $RUT:$OEX ratio peaked in early February, broke below its November low in April and remains in a downtrend. Small-caps have been relatively weak for over four months now.

- Breadth Charts (here) and Inter-market charts (here) have been updated.

This table is designed to offer an objective look at current market conditions. It does not aim to pick tops or bottoms. Instead, it seeks to identify noticeable shifts in buying and selling pressure. With 10 indicator groups, the medium-term evidence is unlikely to change drastically overnight.

Previous turns include:

Negative on 18-May-11

Positive on 30-December-11

Negative on 16-December-11

Positive on 3-December-11

Negative on 23-November-11

Positive on 28-October-11

Negative on 5-August-11

Neutral on 29-Jul-11

Positive on 30-Jun-11

Negative on 17-Jun-11

Positive on 25-Mar-11

Negative on 18-Mar-11

Positive on 3-Sep-10

Negative on 13-Aug-10

Positive on 6-Aug-10

Negative on 24-Jun-10

Positive on 18-Jun-10

Negative on 11-Jun-10

Positive on 5-March-10

Negative on 5-Feb-10

Positive on 11-Sept-09