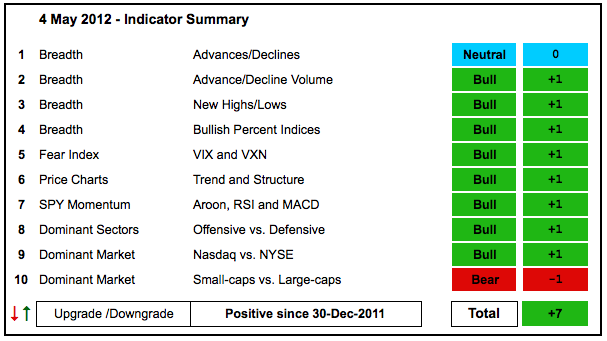

There are no changes in the indicator summary, but I am watching the AD Volume Lines quite closely. Even though both bounced over the last few weeks and essentially held support from the March lows, this bounce has not been that strong. Failure to reach the March high and a break below key support would turn these two breadth indicators bearish. For now, the bulk of the evidence remains bullish with NYSE net new highs and the NYSE AD Line showing the most strength. Small-caps continue to underperform though. The next week will be crucial. Either the major index ETFs extend on last week's breakouts or they fail and break support from the April lows. We have the employment report today, extended reaction to this week's economic onslaught next week and the reaction to Greek/French elections (Euro) next week.

- AD Lines: Neutral. The Nasdaq AD Line never fully recovered after the early April decline and remains weak. The NYSE AD Line it near its March highs already and established key support with the March-April lows.

- AD Volume Lines: Bullish. The Nasdaq AD Volume Line never fully recovered from the early April decline and is close to support from the March-April lows. The NYSE AD Volume Line fell well short of its March-April high, but has yet to break key support.

- Net New Highs: Bullish. Nasdaq Net New Highs surged last week and fell back to zero this week. I am watching support from the April lows on the cumulative line. NYSE Net New Highs remain strong and the cumulative line is well above its 10-day EMA.

- Bullish Percent Indices: Bullish. Eight of the nine sector BPIs remain above 50%. Only the Energy Bullish% Index ($BPENER) is below (39.53%).

- VIX/VXN: Bullish. The CBOE Volatility Index ($VIX) and the Nasdaq 100 Volatility Index ($VXN) hit resistance from their February highs in mid April and fell back as the stock market surged last week. It would take a break above the February-April highs to turn these indicators bearish.

- Trend-Structure: Bullish. IWM and MDY have been range bound for three months. DIA is near its March highs, but QQQ fell short of its March highs and continues to underperform. SPY is somewhere in the middle. Despite a range bounce situation overall, key supports are holding and the uptrends have yet to reverse.

- SPY Momentum: Bullish. 20-day RSI held the 40-50 zone during the November and April dips. A move below 40 would turn RSI bearish. MACD(5,35,5) hit the zero line with the April dip and then moved back into positive territory. Aroon moved into negative territory, but did not break below -50, which is the bearish threshold. Aroon moved back above 50 this week to turn bullish.

- Offensive Sector Performance: Bullish. XLY continues to lead the market, but XLI and XLF are lagging as they remain below their March highs. XLK is also lagging somewhat. Despite all this lagging, all remain above the April lows, which mark the first significant support level.

- Nasdaq Performance: Bullish. The $COMPQ:$NYA ratio took a hit in April and the Nasdaq has been relatively weak since early April. It is not enough relative weakness to turn bearish on this indicator, but Nasdaq performance should be watched closely.

- Small-cap Performance: Bearish. The $RUT:$OEX ratio peaked in early February, broke below its November low in April and remains in a downtrend. Relative weakness in small-caps is entering its fourth month and remains a concern overall.

- Breadth Charts (here) and Inter-market charts (here) have been updated.

This table is designed to offer an objective look at current market conditions. It does not aim to pick tops or bottoms. Instead, it seeks to identify noticeable shifts in buying and selling pressure. With 10 indicator groups, the medium-term evidence is unlikely to change drastically overnight.

Previous turns include:

Positive on 30-December-11

Negative on 16-December-11

Positive on 3-December-11

Negative on 23-November-11

Positive on 28-October-11

Negative on 5-August-11

Neutral on 29-Jul-11

Positive on 30-Jun-11

Negative on 17-Jun-11

Positive on 25-Mar-11

Negative on 18-Mar-11

Positive on 3-Sep-10

Negative on 13-Aug-10

Positive on 6-Aug-10

Negative on 24-Jun-10

Positive on 18-Jun-10

Negative on 11-Jun-10

Positive on 5-March-10

Negative on 5-Feb-10

Positive on 11-Sept-09