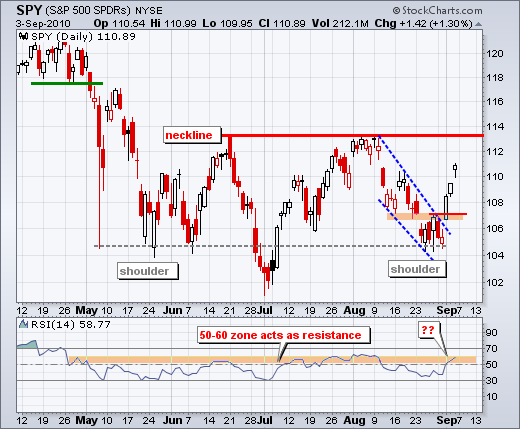

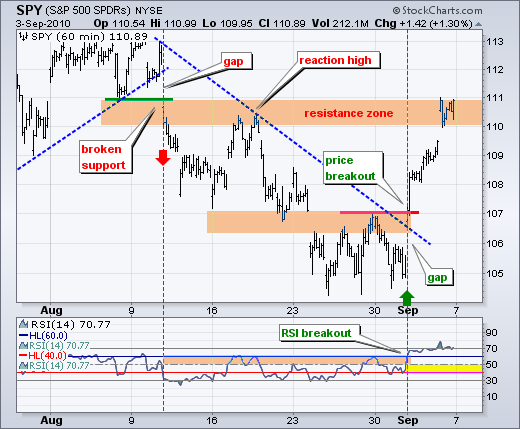

Last week's breakout and extended surge reversed the August downtrend. Also note that SPY formed a higher low in late August. With strong breadth and strong follow through on Thursday and Friday, this breakout looks like the start of an extended advance. However, SPY is already short-term overbought and closer to resistance than support. This increases the chances of a pullback or consolidation. Last week's sharp surge looks similar to the early July surge from 102 to 110 (~8%). There was a sharp pullback after this surge and then a continuation high. Even though the overall pattern looks like an inverse head-and-shoulders, SPY is much closer to resistance than support. In fact, SPY has been range bound since late May. Support resides around 104 and resistance around 113.

The economic docket is rather light this week. Bonds may be in focus with the 10-year and 30-year auctions on Wednesday and Thursday, respectively.

Key Economic Reports:

Wed - Sep 08 - 10:00 - 10 Year Note Auction

Wed - Sep 08 - 10:30 - Crude Inventories

Wed - Sep 08 - 14:00 - Fed's Beige Book

Wed - Sep 08 - 15:00 - Consumer Credit

Thu - Sep 09 - 08:30 - Initial Claims

Thu - Sep 09 - 10:00 - 30 Year Bond Auction

Charts of Interest: ANF, FDO, PLCM, TGT. Interesting charts are few and far between after last week's surge. There are lots of breakouts, which are bullish, but many stocks are already short-term overbought. Some are at resistance and we could see a pullback this week.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.