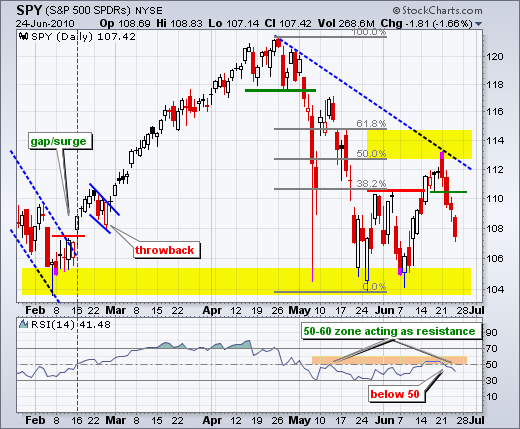

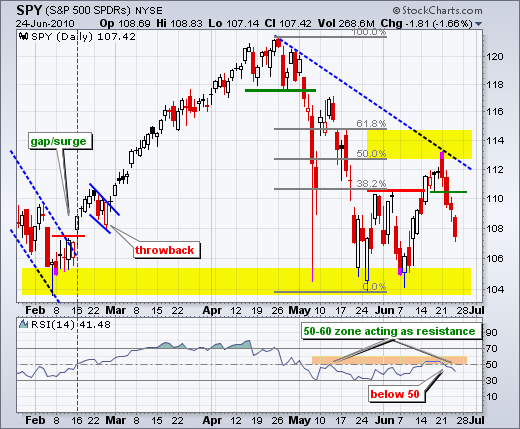

The daily chart is looking rather ugly. It all started with Monday's reversal day near the 50% retracement. Selling pressure continued on Tuesday with a move below the resistance breakout. A little uncertainty surrounding the Fed announcement made for indecisive trading on Wednesday, but no gains were to be had. Selling pressure continued on Thursday for the third long red candlestick this week. A test of the Feb-May lows appears to be in order. In fact, I think another test will result in a support break at 104. RSI is in bear mode after meeting resistance in the 50-60 zone and breaking back below 50 early this week.

On the 30-minute chart, SPY broke support at 110.5 and continued lower with two little bounces. The depth of the four day decline and strength of the selling pressure show considerable weakness. Wednesday's rising flag now marks a resistance zone around 108.7-109.5. RSI remains in bear mode after breaking below 40 on Tuesday and remaining largely below 40. The fact that this momentum oscillator cannot make it back above 40 reflects strong downside momentum.

Key Economic Reports:

Fri - Jun 25 - 08:30 - GDP Estimate

Fri - Jun 25 - 09:55 - U of Michigan Sentiment

Charts of Interest: CHRW, MAT, STJ

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More