On the daily chart, SPY failed to hold the breakout at 110.5 and remains below support from broken resistance. Is this just a pullback or the start of a bigger decline? Ideally, a pullback should be a little tamer. The sharp Monday-Tuesday reversal day is dominating the picture here. SPY opened around 113 on Monday and closed below 112 for an intraday reversal. Follow through on Tuesday created a short-term bearish situation that must now be rectified. A surge back above 110.5 would be the first thing to watch. RSI hit resistance in the 50-60 area and moved below 50. This is also bearish for momentum. If the bigger trend (2-4 months) is still down, then the 50-60 zone should act as resistance. If the mid June breakout signaled the start of an uptrend, then the 40-50 zone should act as support. As the chart shows, RSI is between a rock (50-60 resistance) and a hard place (40-50 support). 50 is the centerline that tilts the balance. The bears have the edge below 50 and the bulls have the edge above 50.

On the 30-minute chart, SPY broke support and consolidated around 109. This consolidation looks like a small rising flag. A break below the afternoon low (108.8) would signal a continuation lower and target further weakness towards the 106-107 area. Broken support at 110.5 turns into the first resistance level to watch for signs of a bullish revival. Momentum is currently bearish with RSI breaking below 40 on the 22nd.

Key Economic Reports:

Thu - Jun 24 - 08:30 - Durable Orders

Thu - Jun 24 - 08:30 - Initial Claims

Fri - Jun 25 - 08:30 - GDP Estimate

Fri - Jun 25 - 09:55 - U of Michigan Sentiment

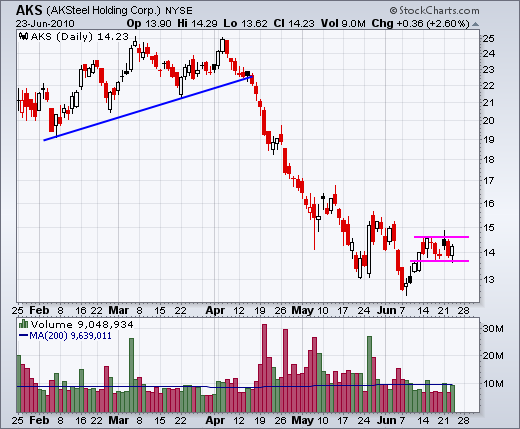

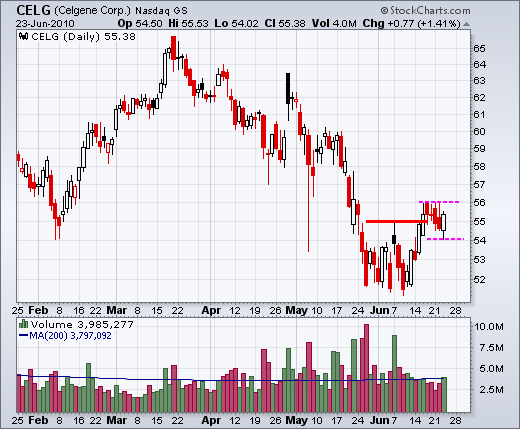

Charts of Interest: AKS, CELG, TSO, WMT

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More